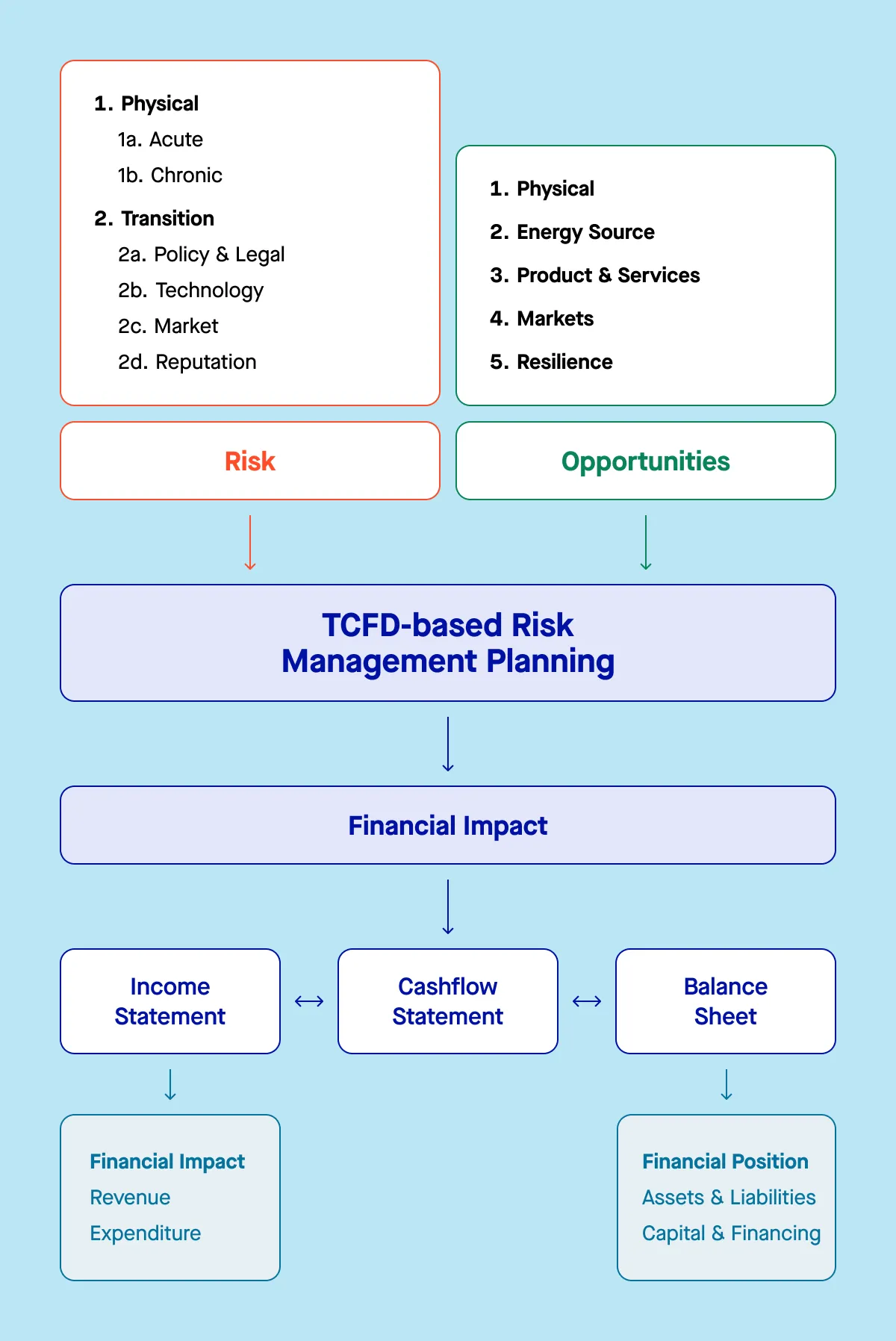

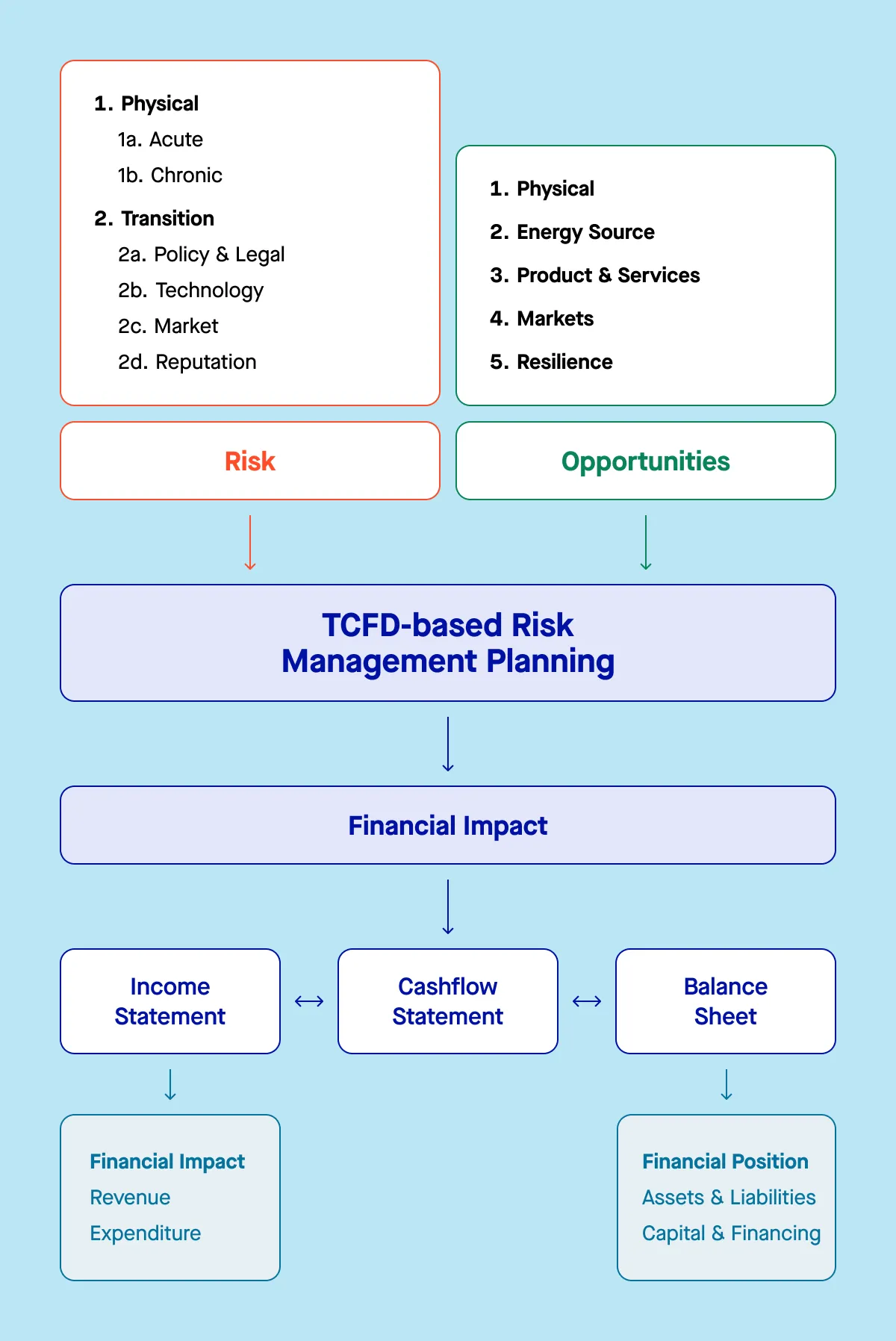

According to the Task Force, climate-related risks refer to the risks that arise from climate change – most notably the risks presented by rising temperatures. These can be physical risks, such as damage to infrastructure and property due to extreme weather events, or they can be transitional, such as policy and legal changes, shifts in technology, and market fluctuations that result from efforts to mitigate or adapt to the changing climate.

These risks can impact businesses and financial institutions in a variety of ways, including through changes in consumer behavior, supply chain disruptions, and regulatory developments.

What are the TCFD’s recommendations?

The TCFD developed a set of recommendations to support companies with climate risk disclosure, highlighting the opportunities presented by adopting sustainable practices. These recommendations are structured under four pillars:

Governance

Disclosing the organization’s governance around climate-related risks and opportunities.

Strategy

Disclosing the actual and potential impacts of climate-related risks and opportunities on the organization’s business, strategy, and financial planning, including the financial implications. Companies are expected to take responsibility for carbon emissions reporting and actively participate in TCFD-related activities to meet the growing anticipation from regulators, the market, and investors.

Risk Management

Disclosing how the organization effectively manages climate-related risks by prioritizing climate considerations and integrating them into business strategies. The financial system plays a crucial role in analyzing risks and opportunities through enhanced climate scenario analyses, referencing frameworks like the Network for Greening the Financial System (NGFS) to model transition risks and opportunities associated with both low-carbon and high-carbon scenarios in the global economy.

Metrics and Targets

Disclosing the metrics and targets used to assess and manage relevant climate-related risks and opportunities. Tracking and reporting interim targets is crucial as part of overall strategies to achieve net zero. This includes the company’s transition plan outlining actions to achieve net-zero emissions by 2050, covering all three emissions scopes. The adoption of ISSB standards as a new global reporting baseline for climate issues is also highlighted.

What are the TCFD’s 11 Disclosures?

To operationalize the four pillars, the TCFD developed 11 recommended disclosures. These guide organizations in addressing key climate-related issues across governance, strategy, risk management, and metrics and targets.

Governance

- Describe the board’s oversight of climate-related risks and opportunities.

- Describe management’s role in assessing and managing climate-related risks.

Strategy

- Identify the climate-related risks and opportunities over the short, medium, and long term.

- Describe the potential impact of these risks and opportunities on your business, strategy, and financial planning. It is crucial to understand these climate-related risks to inform strategies and conduct scenario analyses.

- Assess the resilience of the organization’s strategy under different climate-related scenarios, including a scenario aligned to a 2°C or lower future.

Risk Management

- Describe how your organization identifies, assesses and manages climate-related risks. The identified risks are determined through a comprehensive analysis that recognizes significant threats to the business.

- Describe your processes for managing these risks. The implications of these identified risks are then factored into the organization’s overall strategy and reporting, ensuring proactive measures are taken to address climate-related threats.

- Explain how climate-related risk processes are integrated into overall management of risk.

Metrics and Targets

- Disclose the metrics used to assess climate-related risks and opportunities. Industry associations play a key role in promoting the adoption of climate-related financial disclosures.

- Disclose Scope 1, Scope 2, and, if appropriate, Scope 3 greenhouse gas (GHG) emissions, along with the associated risks.

- Describe the targets set to manage risks and opportunities and report progress against these targets.

Although all pillars are important, the TCFD emphasized that the Metrics and Targets pillar is crucial, as it forms the link between assessing risks and tracking actual progress.

Where should you file your disclosures?

The TCFD does not prescribe a specific location for companies to file their climate-related disclosures. Filing practices can depend on jurisdiction and company requirements. However, the CDP (formerly the Carbon Disclosure Project), a leading non-profit that runs a global environmental disclosure system, has closely aligned its questionnaires with the TCFD framework and is often used for reporting.

In the UK, for example, listed companies are required to file TCFD-aligned disclosures annually, usually as part of their strategic or directors’ reports in their annual filings, alongside SECR (Streamlined Energy and Carbon Reporting) requirements.

Which frameworks has the TCFD influenced?

Even though the TCFD Task Force itself has been disbanded, its influence on climate related policy is stronger than ever. The Swiss Federal Council and the Federal Office for the Environment (FOEN) have worked in close cooperation to develop legislation that aims to make the TCFD recommendations binding. Several major global sustainability and reporting standards have directly incorporated the TCFD framework or have built upon its principles, including:

IFRS Sustainability Disclosure Standards

The International Sustainability Standards Board (ISSB), created by the IFRS Foundation, has based its IFRS S1 and S2 standards largely on the TCFD structure, particularly for climate-related disclosures. The TCFD Knowledge Hub serves as a key online resource designed to support organizations in implementing the Task Force on Climate-Related Financial Disclosures recommendations. The ISSB aims to create a global baseline for corporate sustainability reporting that is consistent across sectors and regions.

The TCFD’s focus on enhancing the reporting and transparency of organizations’ impacts on the global climate is crucial for promoting consistent climate-related financial disclosures and addressing relevant climate related risks .

The IFRS S1 standard addresses general sustainability disclosures, including governance, strategy, risk management, and metrics, aligning directly with TCFD’s four pillars. The IFRS S2 focuses specifically on climate-related disclosures, expanding on TCFD’s guidance with enhanced requirements for companies to disclose their climate-related risks, opportunities, and strategies. The TCFD’s focus on enhancing the consistency and comparability of climate-related disclosures among organizations is crucial in providing a framework for businesses to assess and integrate climate-related risks and opportunities into their decision-making processes.

By incorporating the TCFD framework, the ISSB seeks to provide companies with clear and consistent guidelines that improve comparability and transparency in sustainability reporting. This global effort ensures that investors and stakeholders can access relevant and comparable information across a wide range of industries and regions.

European Sustainability Reporting Standards (ESRS)

The ESRS, which support the EU’s Corporate Sustainability Reporting Directive (CSRD), align closely with the TCFD recommendations, especially around governance, strategy, risk management, and metrics.

Other voluntary and national frameworks

Several other frameworks, including those issued by the UK, Singapore, Japan, and New Zealand regulators, have integrated TCFD recommendations into their mandatory or voluntary disclosures.

The TCFD has effectively become the backbone for how climate risks and climate related financial information is integrated into corporate reporting globally.