AASB S1 |

AASB S2 |

|

Scope & Focus |

All sustainability risks and opportunities, focusing on broad environment, social and governance factors | Climate-related risks and opportunities, focusing on financial impact and business resilience |

Requirement |

Voluntary (except climate-related topics) | Mandatory under Australian climate reporting law |

Topic |

Biodiversity, social impact, water use, supply chain | Climate impact on business model, cash flows, and financing |

Turn AASB reporting into a strategic advantage

One framework. Infinite reporting potential.

Built to create a global baseline for sustainability disclosure, the Australian Accounting Standards are designed to help companies provide decision-useful, investor-focused sustainability information—clearly, consistently, and comparably.

Master your AASB reporting

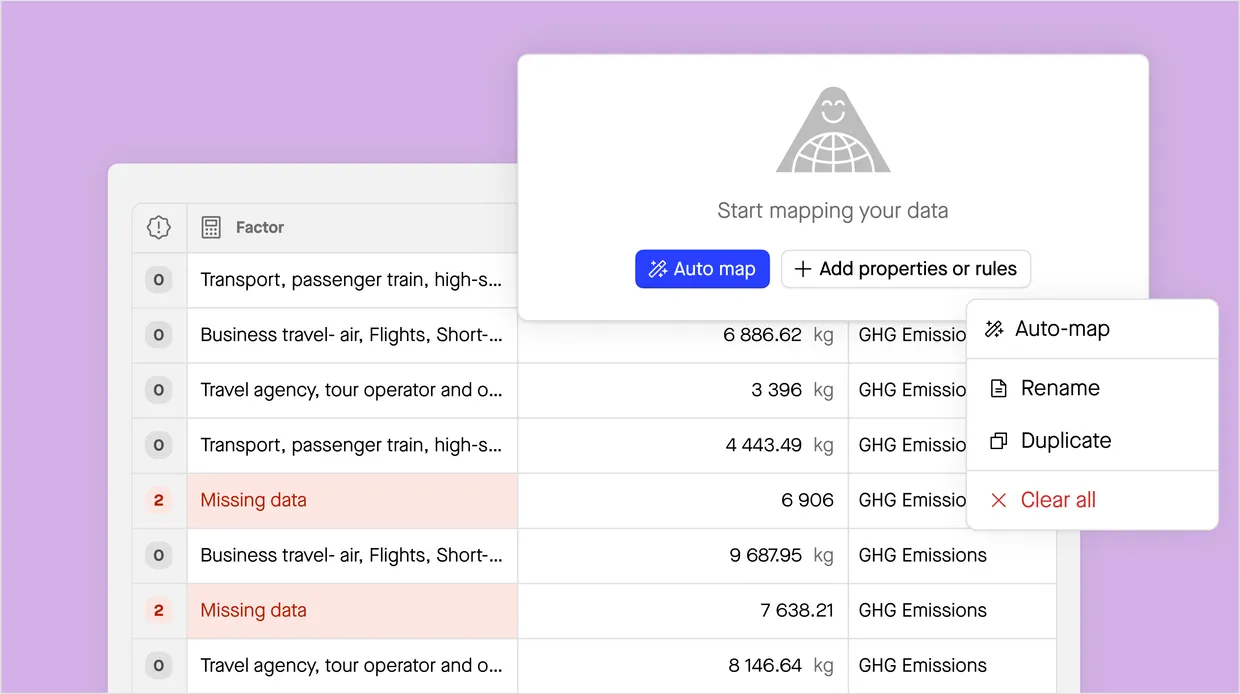

Sustainability is a data and a network problem. At Sweep, we streamline and automate data collection in even the most complex organizations to help you measure and manage your scope 1, 2 and 3 emissions.

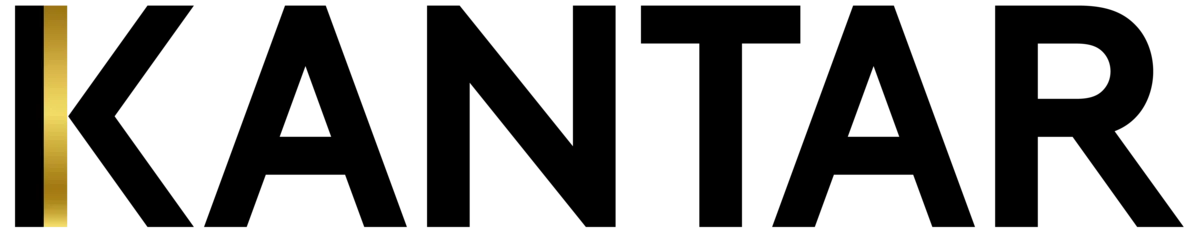

Full AASB (IFRS S1/S2) and SASB coverage: 250+ indicators

Pre-configured reporting templates, aligned to IFRS taxonomy

Efficient data collection via API, files, surveys, and integrations

use everywhere

Use the same data across your other disclosures: CSRD, SEC, SB 253, GRI and beyond

Reach your sustainability goals

Built for global standards

We help you report across AASB (IFRS S1/S2), GRI, CSRD, and other major standards — all from one ESG data platform.

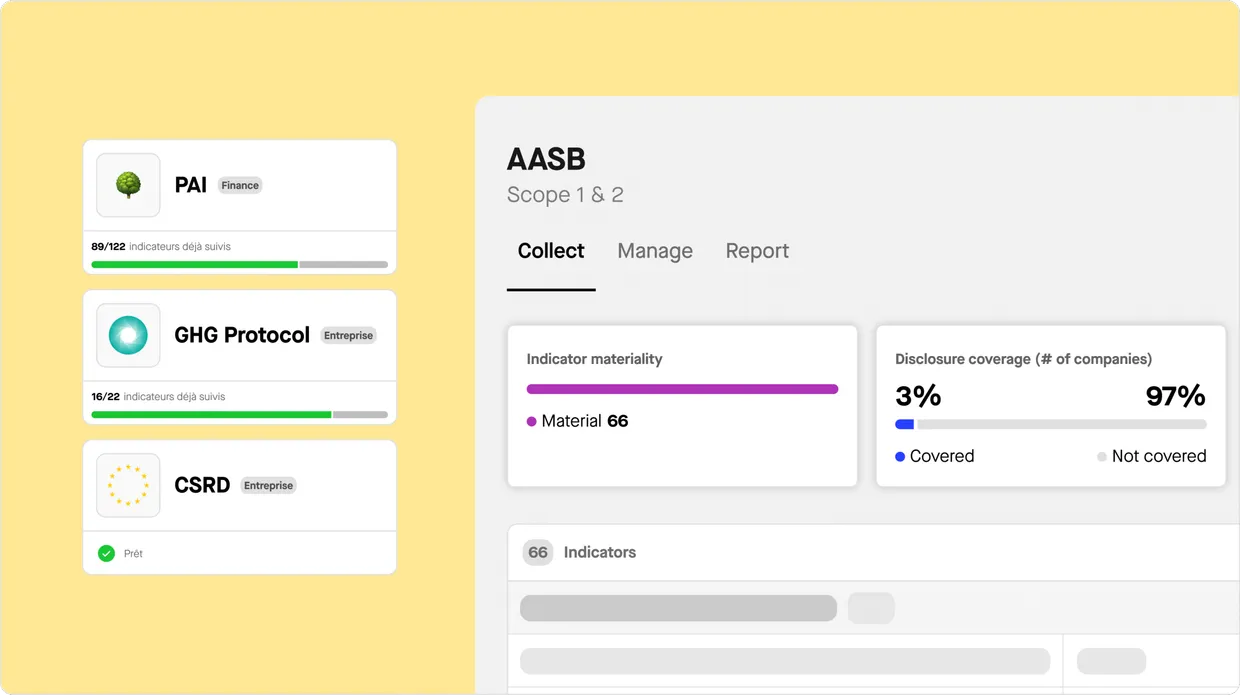

AI-powered disclosure support

Map indicators, validate data, and generate reporting drafts with the help of intelligent automation.

Pre-configured AASB modules

Use pre-built AASB disclosure libraries and guidance to ensure accurate, complete reports.

Built for audits

Keep track of your data and who can access it, so everything is clear, secure, and easy to check when needed.

See how Sweep can help your company comply to the AASB.

Built-in compliance

Sweep supports the most important ESG frameworks — now and into the future.

🎯 Use your data once, and apply it everywhere.

A world-class solution with global recognition

Sweep has been recognized as a top carbon and ESG reporting platform by independent analysts worldwide.

We believe Sweep is the top ESG data solution. Our customers think so too.

Book a demo

Discover how Sweep can support your business in a 30-minute demo.

FAQ

What is the AASB?

The Australian Accounting Standards Board (AASB) is the government body responsible for developing, issuing and maintaining financial reporting standards in Australia. The AASB’s role extends to both private and public sector entities, with a focus on promoting consistency, transparency and comparability across financial and sustainability reporting. The Assurance Standards Board (AUASB) works alongside the AASB to set assurance requirements for sustainability and climate disclosures.

What is the AASB S1?

AASB S1 is a voluntary standard that outlines the general principles and overarching requirements for disclosing sustainability-related financial information. It aligns closely with the International Sustainability Standards Board’s IFRS S1 and serves as the foundation for entities wanting to provide comprehensive general sustainability disclosures beyond climate.

What is the AASB S2?

AASB S2 is the mandatory standard that focuses specifically on climate-related disclosures. Based on IFRS S2, AASB S2 requires entities to report on governance, strategy, risk management, and metrics and targets related to climate change.

AASB S2 requires each entity to disclose information about climate related risks and opportunities that could reasonably be expected to affect the entity’s cash flows, access to finance, or cost of capital over the short, medium or long term.

How ESG software can help comply AASB?

A well-chosen platform can help reduce administrative burden, improve accuracy, and ensure your disclosures meet regulatory expectations with features such as:

– Data integration: Centralising emissions, energy, and climate risk data from across your business

– Scenario analysis tools: Running climate models aligned with required standards

– Workflow automation: Simplifying the preparation of sustainability reports

– Audit readiness: Creating traceable records and audit trails

– Stakeholder engagement: Providing dashboards and reports for investors, regulators, and internal teams