California Climate Laws – essential tools for businesses

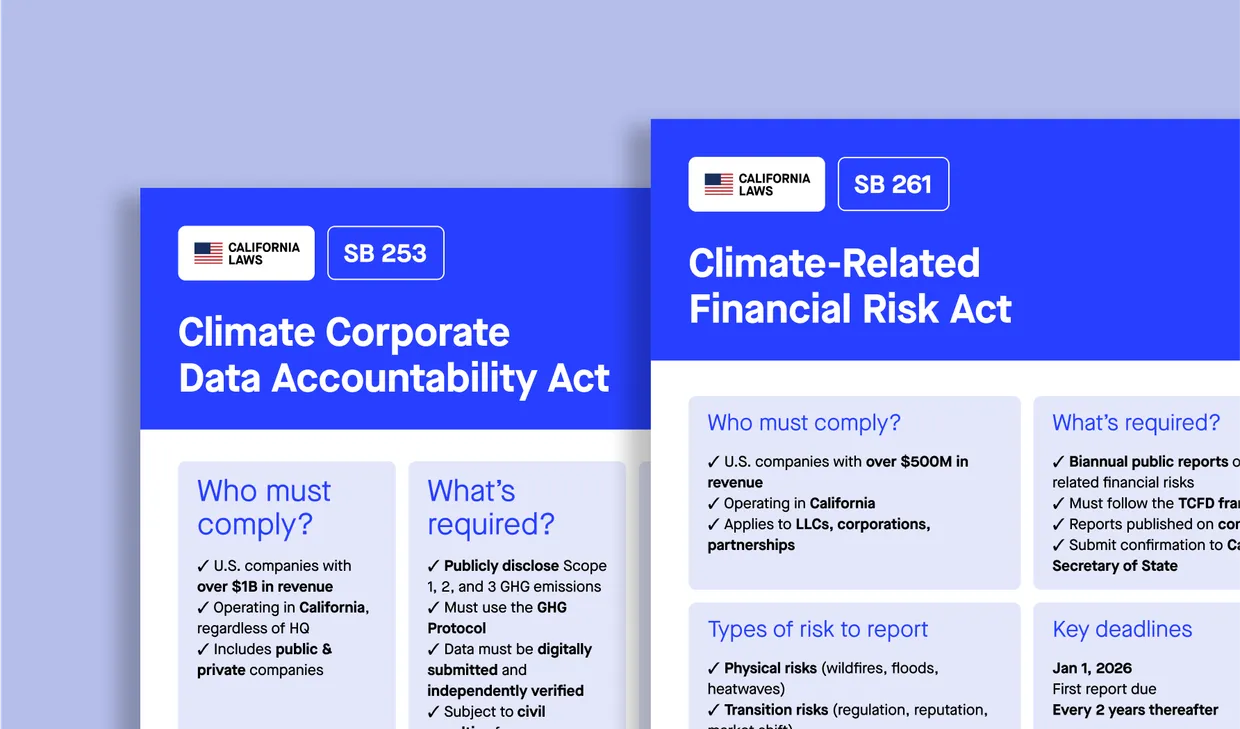

One platform – Two important regulations

Who it applies to

Companies with $1B+ revenue doing business in California

What it requires

Public disclosure of full Scope 1, 2, and 3 emissions

Who it applies to

Companies with $500M+ revenue doing business in California

What it requires

Disclosure of climate-related financial risk & mitigation strategy (aligned with TCFD)

Turn regulation into a strategic advantage

– Unified platform to collect Scope 1, 2, and 3 data

– AI-assisted data mapping and automated workflows

– Data structured per GHG Protocol

– Traceable, verifiable carbon footprint

– Supplier collaboration built-in

– Simplifies Scope 3 reporting at scale

– Sweep evolves with CARB updates

– Regular updates aligned to SB 253 deadlines

Download our guide to preparing for SB 253 and SB 261

The power of Sweep

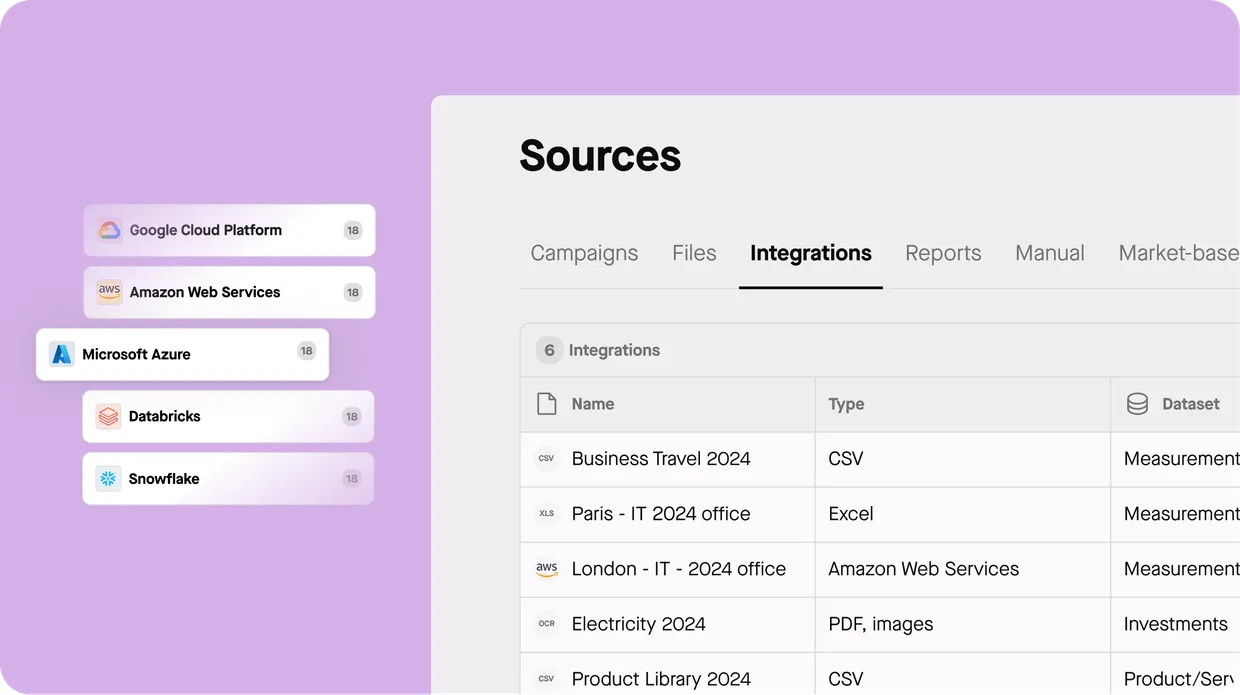

Centralise Sustainability data from across your value chain

Collect and transform

Sweep makes it easy to bring together emissions, ESG, and operational data from across your organisation, suppliers, and partners. Whether through built-in integrations, manual inputs, file uploads, or API connections, you can build a single, trusted source of truth.

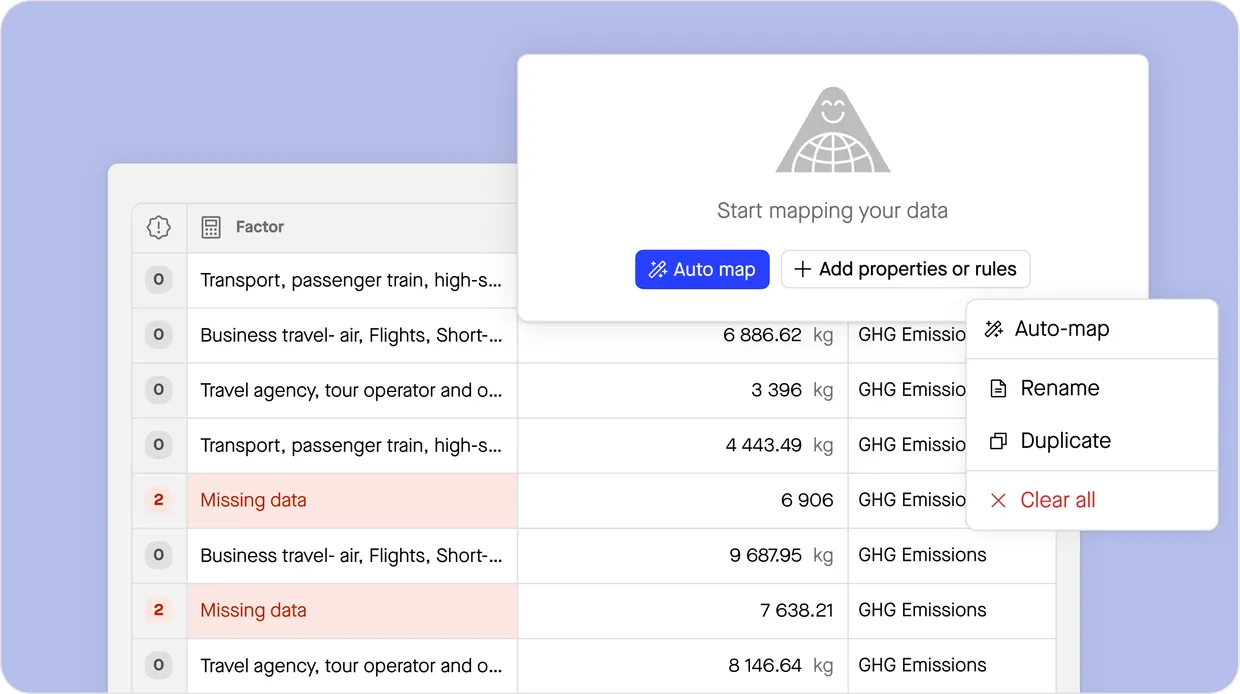

Validate and structure it with built-in indicators and AI assistance

Validate and map

Our AI engine automatically maps emissions data, detects anomalies, and suggests improvements. Built-in data controls and custom workflows ensure your data is clean, complete, and ready for disclosure.

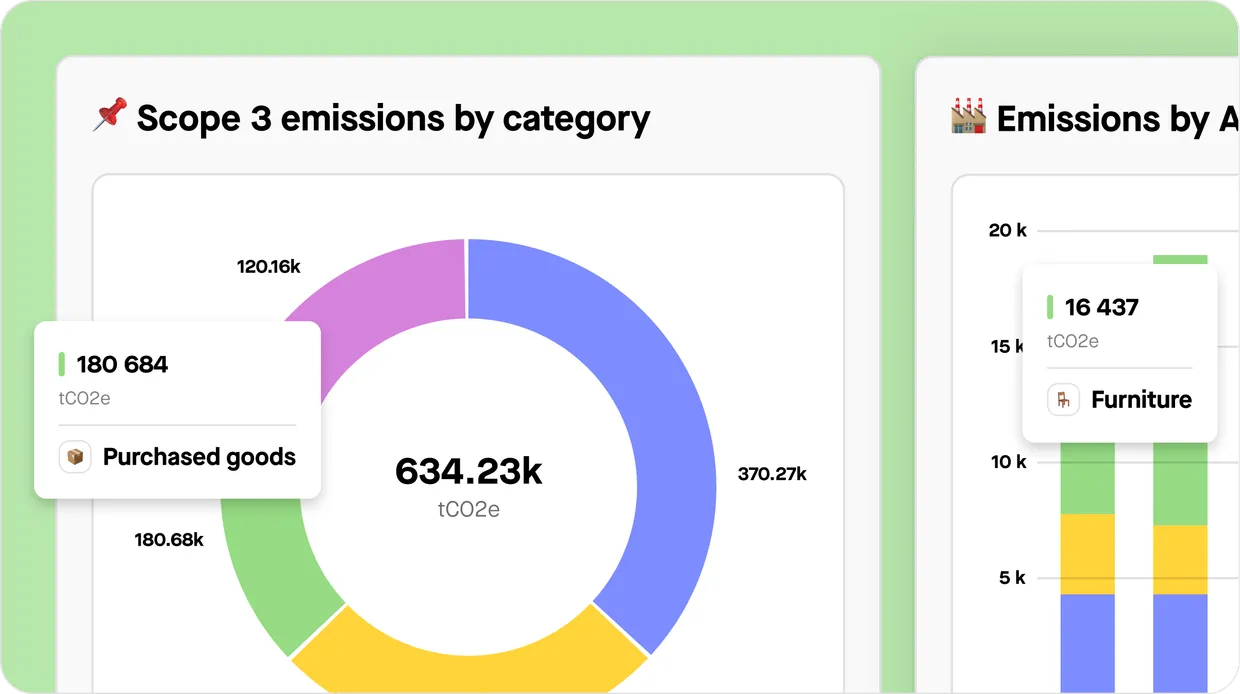

Monitor compliance with dashboards that flag gaps and risks

Keep track

Sweep’s real-time dashboards surface gaps, risk areas, and reporting progress as you go. You’ll always know what’s complete, what needs attention, and how ready you are for the SB 253 and SB 261 disclosure requirements.

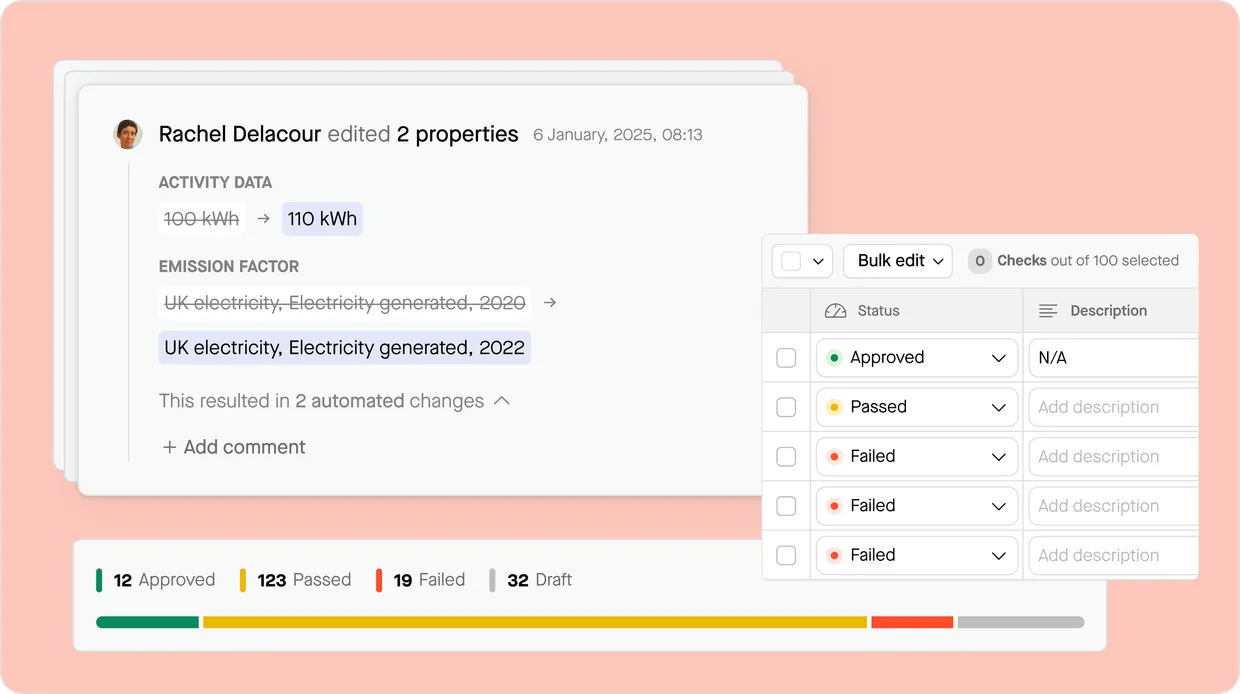

Run audits and export reports aligned to SB 253, SB 261 and more

Run audits

Export audit-ready, standardised or custom reports aligned with the latest regulatory frameworks. Granular permissions and a full data trail make it easy to run internal checks or prepare for third-party audits.

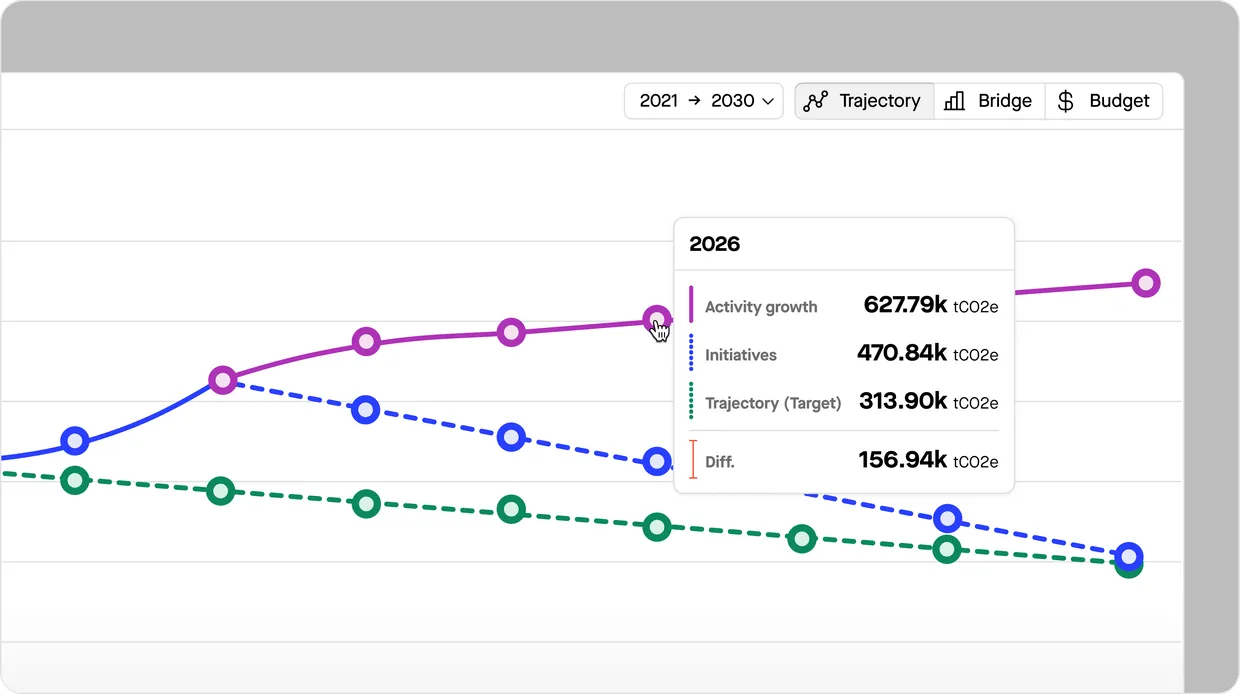

Identify and track initiatives to reduce risk or drive impactful change

Drive change

Go beyond disclosure. Use Sweep to plan and simulate decarbonization strategies, set science-based targets, and track progress on your climate risk mitigation efforts.

See how Sweep can help your company comply to California Laws

Built-in compliance

Sweep is built to meet the leading ESG standards and regulations: CSRD, GHG Protocol, ISSB, TCFD, SB 253, SB 261 and more.

Industry validation

Sweep has been recognized as a top carbon and ESG reporting platform by independent analysts worldwide.

Leading companies trust Sweep

Get started today

California ESG regulations are coming fast. Don’t just keep up: get ahead!

FAQ

What is the Climate Corporate Data Accountability Act (SB 253)?

Which companies must comply with the SB 253?

Companies with over $1 billion in annual revenue that do business in California. This includes corporations, partnerships, and LLCs, whether public or private.

What are the consequences of non-compliance with the SB 253?

Non-compliance with California SB 253 can result in administrative penalties of up to $500,000 per year, public disclosure of violations by the California Air Resources Board (CARB), and reputational damage from failing to meet mandatory climate reporting requirements.

What is the Climate-Related Financial Risk Act (SB 261)?

The Climate-Related Financial Risk Act (SB 261) requires companies with over $500 million in annual revenue doing business in California to prepare and publicly disclose a climate-related financial risk report every two years. These reports must describe the company’s climate-related financial risks and the strategies in place to mitigate or adapt to those risks, following frameworks such as the Task Force on Climate-related Financial Disclosures (TCFD). The law is enforced by the California Air Resources Board (CARB), which can impose administrative penalties for non-compliance.

What are the consequences of non-compliance with the SB 261?

Non-compliance could result in fines of up to $50,000, with third-party entities monitoring adherence under California’s climate investment framework and TCFD guidelines.

Which companies must comply with SB 261?

Companies with over $500M in revenue ︎operating in California. It also applies to LLCs, corporations and partnerships.

What is the Climate-Related Financial Risk Act (SB 261)?

The Climate-Related Financial Risk Act (SB 261) requires companies with over $500 million in annual revenue doing business in California to prepare and publicly disclose a climate-related financial risk report every two years. These reports must describe the company’s climate-related financial risks and the strategies in place to mitigate or adapt to those risks, following frameworks such as the Task Force on Climate-related Financial Disclosures (TCFD). The law is enforced by the California Air Resources Board (CARB), which can impose administrative penalties for non-compliance.

What are the timescales for compliance?

For SB 253, reporting entities must begin to annually disclose greenhouse gas emissions in 2026, based on data collected during the 2025 reporting year.

For SB 261, climate related financial disclosures must begin in 2026, with updates required every two years thereafter.

How can your business prepare for the California Climate Laws?

- Assess and adapt: Review past reporting practices and identify compliance gaps, including assessing physical and transition risks.

- Form a sustainability committee: Ensure climate risks are integrated at the executive level.

- Invest in climate software : Select a provider to collect consistent and accurate emissions data and evaluate climate risks across your value chain.