What topics does GRI reporting cover?

GRI spans a broad spectrum of material topics segmented into economic, environmental, and social performance, addressing a wide range of sustainability issues:

- Economic: Revenues, anti-corruption, indirect economic impacts

- Environmental: Emissions, water, waste, biodiversity

- Social: Labour practices, human rights, diversity, training, with a focus on social performance as a key reporting area

GRI standards require organizations to report on core indicators and sustainability indicators that measure economic, environmental, and social performance. These indicators provide structured, comparable data to monitor and assess progress on sustainability issues.

Modular topic coverage

An organisation can choose only relevant standards, based on sector and topic standards, allowing them to tailor their reporting to address the unique sustainability challenges of specific sectors. For example:

- Waste and emissions policies – use GRI 306 and GRI 305

- Employee benefits and workforce diversity – use GRI 401 and GRI 405

- Human rights and procurement – use GRI 408 and GRI 414

GRI sector standards are designed for high-impact industries such as oil, gas, and agriculture, providing sector-specific disclosures to improve transparency and comparability. Using the GRI Standards enables organizations to address sector-specific sustainability challenges and improve compliance with regulatory requirements.

This flexibility ensures efficient reporting while remaining comprehensive.

How does GRI compare to UK SRS, CSRD and ISSB?

| Framework |

Materiality |

Audience |

Coverage |

Mandatory |

| GRI |

Double (impacts both ways) |

Stakeholders (all) |

Full ESG (econ, env, soc) |

Voluntary* |

| CSRD |

Double |

Regulators & investors |

Full ESG + double audit |

Mandatory (EU) |

| UK SRS |

Double (UK/IFRS-based) |

Regulators, investors |

ESG with UK specificity |

Mandatory soon |

| ISSB |

Financial only |

Investors |

Climate → broader ESG |

Baseline* |

*Unless mandated via CSRD, SECR or UK SRS integration

All these frameworks can be aligned: GRI can serve as the core framework for impact disclosures, supplemented with UK SRS or ISSB fields for financial and investor-centric reporting.

How can UK companies prepare for GRI reporting?

Preparing for GRI reporting can seem daunting, but by breaking it into clear steps and aligning with best practices, UK companies can build a robust, repeatable ESG disclosure process. Here’s how to get started:

1. Understand the GRI framework

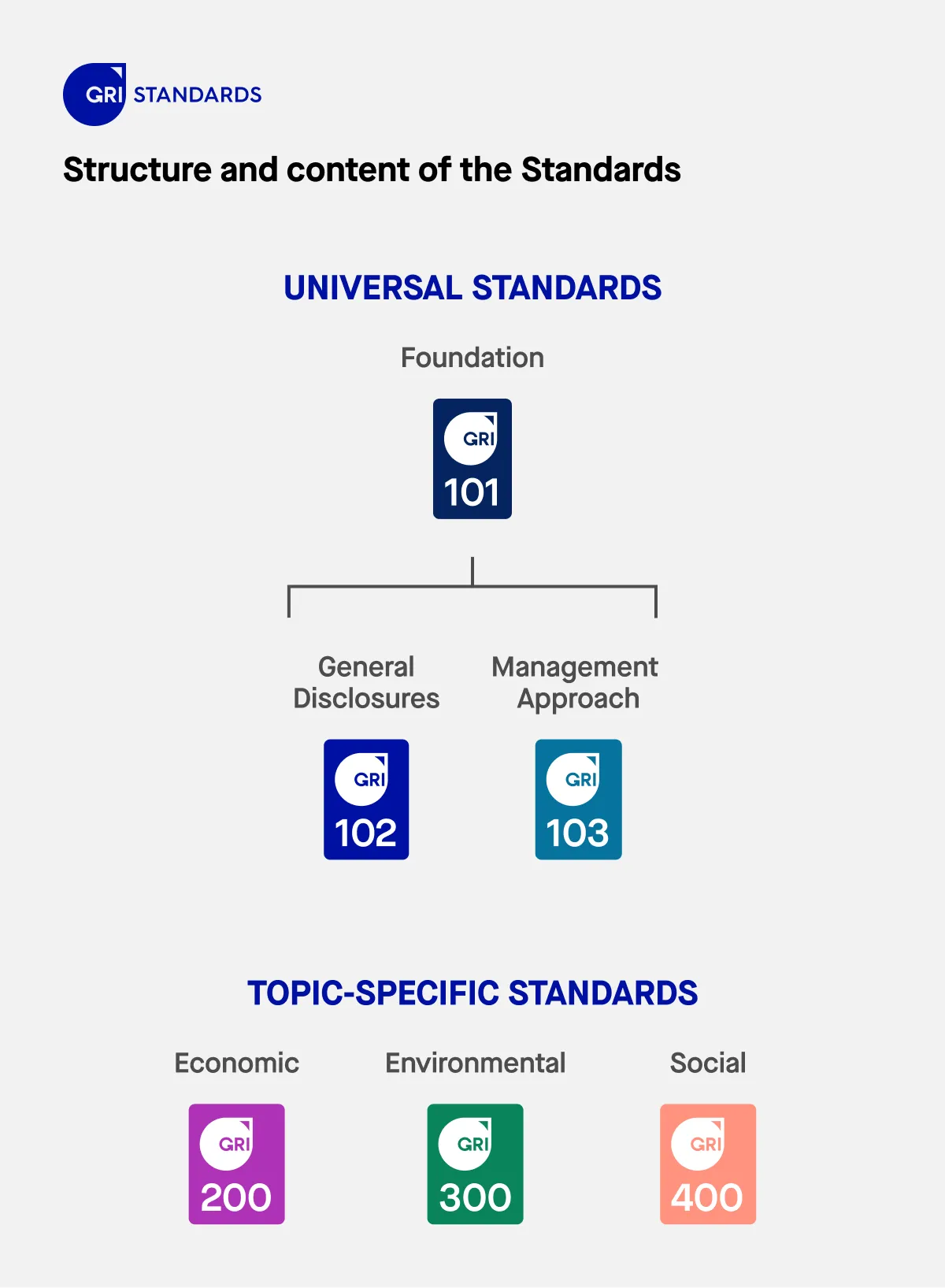

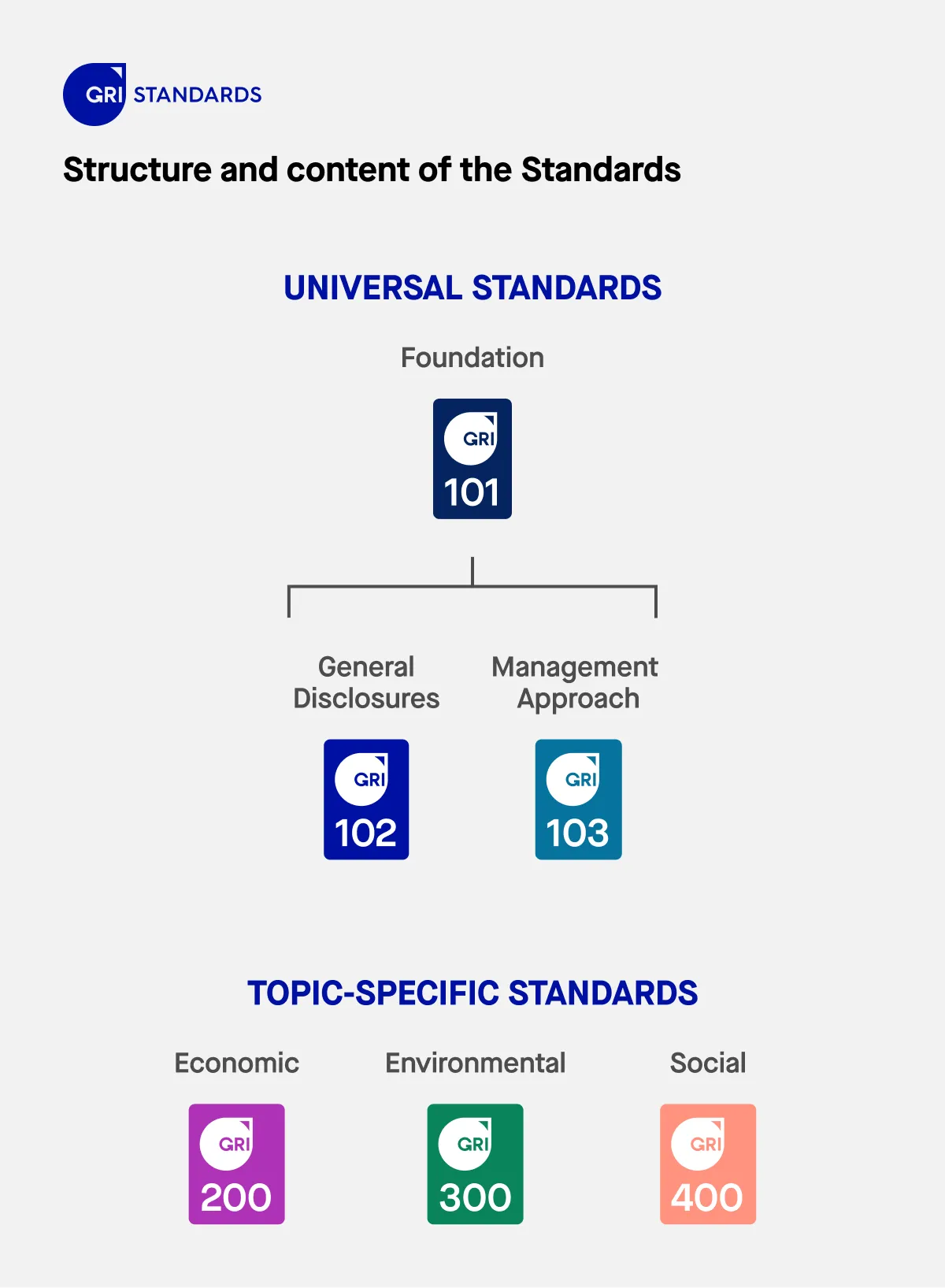

Before anything else, ensure your team understands how the GRI Standards are structured. The GRI Standard is organized as a modular system, guided by GRI principles and specific reporting criteria that help organizations ensure transparency and stakeholder engagement in their sustainability reports:

- GRI Universal Standards: These apply to all reporters (e.g. GRI 1: Foundation, GRI 2: General Disclosures, GRI 3: Material Topics).

- Topic-Specific Standards: These cover particular topics like energy (GRI 302), water (GRI 303), and diversity (GRI 405).

- Sector Standards: For companies in high-impact sectors (e.g. Oil & Gas, Agriculture), GRI offers additional sector-specific guidance.

The Global Sustainability Standards Board (GSSB) is the independent body created by GRI to oversee the development and review of the GRI Standards, ensuring their relevance and effectiveness. The GSSB is supported by various governance bodies, such as the board of directors, stakeholder council, and advisory committees, which help maintain the quality and credibility of the global sustainability reporting framework.

Find out more about GRI Standards in our dedicated blog post.

2. Conduct a materiality assessment

GRI reporting is materiality-driven. This means you need to identify the sustainability topics that matter most to your stakeholders and your business.

Steps to follow:

- Map stakeholders: Include investors, employees, suppliers, regulators, NGOs, and local communities. Engage diverse stakeholder groups to ensure inclusive participation.

- Engage stakeholders: Use surveys, interviews, workshops, or focus groups to collect insights on their ESG concerns.

- Assess business impact: Combine stakeholder input with internal analysis (e.g. risks to operations, supply chains, reputation). Conduct a risk assessment to identify the most significant impacts on the environment, economy, and people.

- Prioritize topics: Plot topics on a materiality matrix (impact vs. importance). GRI 3 provides a structure for identifying and describing material topics.

The materiality assessment process helps organizations identify and prioritize their most significant impacts for reporting, ensuring that significant impacts relevant to diverse stakeholders and stakeholder groups are addressed.

👉 Tip: Materiality under GRI is broader than under ISSB or TCFD—it includes social and environmental impacts beyond just financial materiality.

Find out more about conducting a materiality assessment in our latest blog post.

3. Identify relevant GRI disclosures

Once you’ve identified your material topics, select the GRI Topic Standards that correspond. Using the GRI Standards helps organizations select core indicators and sustainability indicators relevant to their material topics, ensuring comprehensive and transparent reporting. For example:

- Climate change: GRI 305 (Emissions), GRI 302 (Energy)

- Diversity and inclusion: GRI 405 (Diversity), GRI 406 (Non-discrimination)

- Waste management: GRI 306

- Human rights in supply chains: GRI 414 (Supplier Social Assessment), GRI 408 (Child Labor)

Each standard specifies what to disclose, including management approach, metrics, and performance over time.

4. Map existing data sources

Before collecting new data, conduct a data inventory. Ask:

- What ESG data are we already collecting (e.g. for SECR, TCFD, ESOS)?

- Where is it stored? (e.g. spreadsheets, HRIS, finance systems)

- Who owns it? (e.g. HR, facilities, finance)

- Is it reliable and auditable?

- Do these data sources meet GRI’s reporting criteria?

You’ll likely find that many data points needed for GRI reporting already exist across departments—you just need to consolidate and structure them.

5. Fill in data gaps

Where gaps exist, determine:

- What new data must be collected? e.g. Supplier labor practices, product lifecycle emissions

- Who will collect it? Assign departmental roles, or partner with consultants.

- How often? Annual, quarterly, or real-time updates depending on the topic.

- What tools are needed? Use ESG software or manual processes as appropriate.

Some data may need to be collected from external stakeholders such as suppliers or community partners to ensure comprehensive and transparent reporting.

Don’t forget qualitative disclosures—GRI also asks for context around governance, policies, and practices (e.g. “Describe the organization’s policy on water withdrawal”).

6. Draft the report

Follow the structure set out in the GRI Universal Standards:

- GRI 2: General Disclosures: Includes company structure, values, governance, policies, stakeholder engagement, and a detailed description of the organization’s governance structure, such as the board of directors, stakeholder council, and advisory committees that oversee standards development and organizational operations. This section also highlights the importance of transparent reporting, ensuring stakeholders receive clear and comprehensive information about the organization’s sustainability practices and management approach.

- GRI 3: Material Topics: For each, describe:

- Why the topic is material

- How it is managed

- What metrics and results you’re reporting

- Topic-specific disclosures: Add metrics from the chosen standards (e.g. tonnes of CO₂e, % women in leadership).

👉 Tip: Include year-on-year trends, and link to relevant corporate strategy goals where possible.

7. Review and validate data

- Internal review: Ensure each department signs off on its data.

- Third-party assurance (optional): While not required by GRI, it adds credibility—especially for investors.

- Check for alignment: If you’re also reporting under CSRD or ISSB, ensure disclosures are consistent across reports.

8. Publish and communicate

- Format: Publish your GRI report as a standalone PDF or integrate it into your annual report.

- Access: Make the report publicly available on your corporate website. Companies can also publish their sustainability reports on the GRI website to enhance visibility and comparability within their sector.

- Communication: Use infographics, case studies, and short-form content to share insights with stakeholders across channels.

Don’t forget to submit your report to the GRI Disclosure Database, which improves visibility and benchmarking.

Implementing the GRI Standards can be resource-intensive—especially for companies with complex operations or supply chains. ESG data management tools help streamline and strengthen every step of the reporting process, from data collection to final disclosure. These tools enable organizations to monitor and improve their environmental performance, including tracking energy efficiency and reducing reliance on fossil fuels, which supports the transition to environmentally responsible economies.

1. Centralizing data across departments

GRI reporting requires input from multiple teams, including finance, HR, operations, procurement, and sustainability. ESG platforms:

- Act as a single source of truth for carbon, energy, social, and governance data

- Replace disconnected spreadsheets with a unified reporting environment

- Facilitate collaboration across teams and business units

This structure ensures consistency, transparency, and audit-readiness throughout the reporting process.

2. Automating data collection and calculations

Many ESG tools integrate directly with systems such as ERP, HRIS, and utility platforms to pull in real-time data. This supports:

- Automated emissions calculations (e.g. Scope 1–3 for GRI 305)

- Standardized data inputs for GRI 302 (Energy), GRI 403 (Occupational Health), and more

- Conversion of operational metrics into GRI-aligned disclosures using approved methodologies

Automation reduces errors and speeds up reporting timelines—critical as GRI and other frameworks grow more rigorous.

3. Managing GRI-aligned disclosures

Advanced ESG platforms often include built-in GRI mapping, helping users:

- Align disclosures with specific GRI standards and metrics

- Track which disclosures are complete, in progress, or missing

- Generate structured content and evidence for each material topic

Some tools even allow for custom tagging of disclosures that overlap with CSRD, ISSB, or TCFD—supporting integrated reporting strategies.

4. Enabling stakeholder engagement

The GRI Standards emphasize stakeholder inclusion. ESG platforms support this by:

- Sending custom surveys to suppliers, employees, and partners

- Collecting qualitative and quantitative data from across the value chain

- Capturing stakeholder feedback to support your materiality assessments

This not only strengthens reporting—it also enhances ESG governance and transparency.

GRI isn’t just about publishing one report—it’s about improving ESG performance year on year. ESG tools support:

- Dashboard views of key metrics by topic, product, or location

- Alerts for data anomalies or missed targets

- Scenario modelling to support decision-making and reduction planning

Having access to historical and real-time data helps businesses set credible sustainability goals and track progress over time.

6. Preparing for assurance and audits

Many companies are voluntarily seeking assurance for GRI disclosures. ESG tools simplify this by:

- Maintaining audit trails for all reported figures

- Storing documentation and methodology in one place

- Providing third-party auditors with controlled access to relevant datasets

This not only improves credibility but also prepares companies for potential regulatory alignment (e.g. CSRD assurance requirements).

Why GRI reporting matters for UK businesses

With sustainability reporting rising up the agenda, UK companies are under growing pressure to disclose their environmental and social impacts. The Global Reporting Initiative (GRI) Standards provide a globally recognized framework for doing just that—enabling organizations to report on sustainability performance in a way that is transparent, comparable, and aligned with stakeholder expectations. Developed with support from the United Nations Environment Programme and other non profit organizations, GRI aims to drive positive change in corporate sustainability reporting.

Adopting GRI reporting can help UK businesses:

- Improve ESG data quality and decision-making

- Meet investor and regulatory expectations (including CSRD and UK SRS)

- Enhance corporate accountability and public trust

- Benchmark performance against international peers

- Contribute to positive change and align with initiatives led by the United Nations Environment

Whether you’re just getting started or evolving your reporting strategy, the GRI Standards offer a flexible, materiality-led structure to track progress and communicate it with clarity. For UK companies aiming to lead on sustainability, GRI is a powerful tool to support long-term business resilience and credibility.