The SFDR doesn’t have to be complicated

of financial market participants (FMPs) face difficulties in obtaining good quality data to comply with the SFDR

of FMPs don’t feel sufficiently prepared to report under the SFDR

of FMPs are unsure how to approach materiality in the context of PAI indicators

Your guide to SFDR Compliance

Gain the tools and knowledge to master SFDR compliance, from requirements to reporting.

How SFDR Compliance works with Sweep?

Step 1

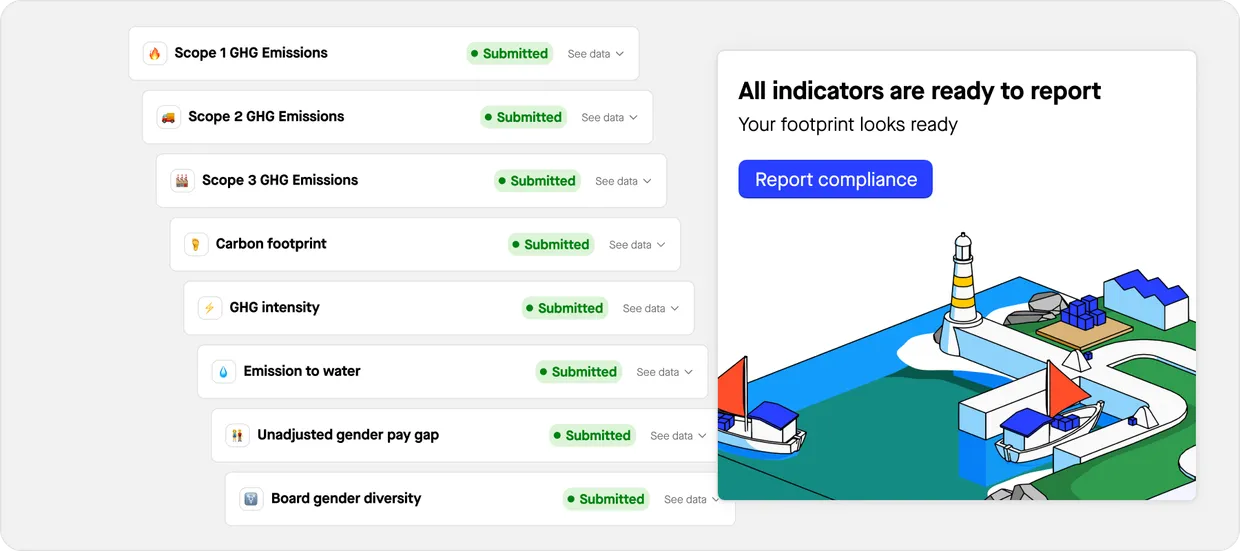

Accelerate your compliance with PAIs

Ensure full compliance with SFDR’s mandatory PAI reporting in a matter of weeks.

Step 2

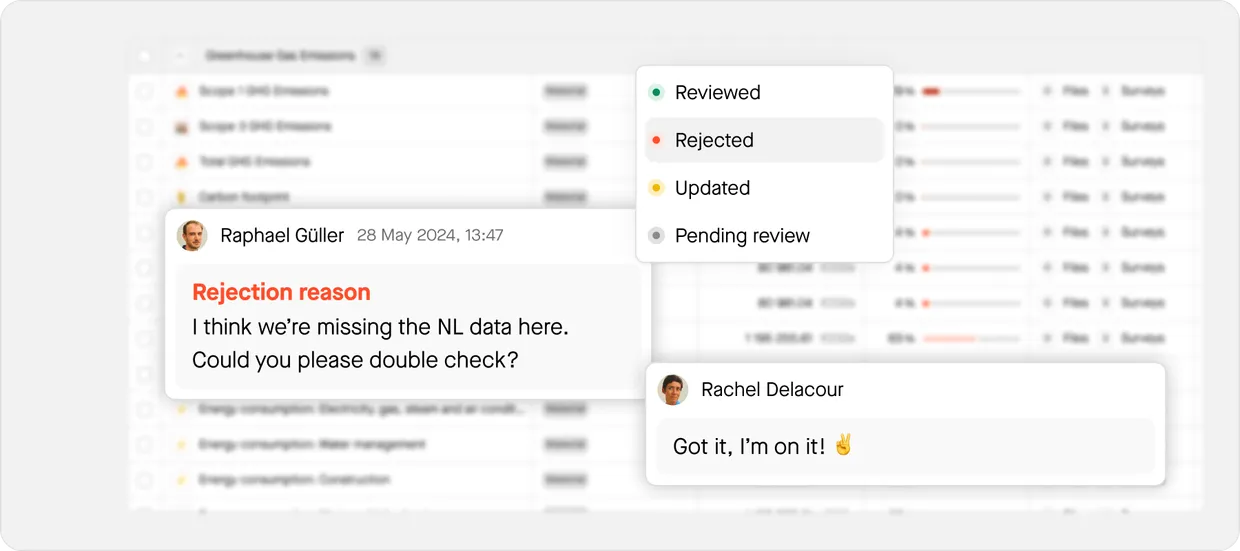

Engage with your portfolio

Collect data from your investees with surveys or file imports.

Step 3

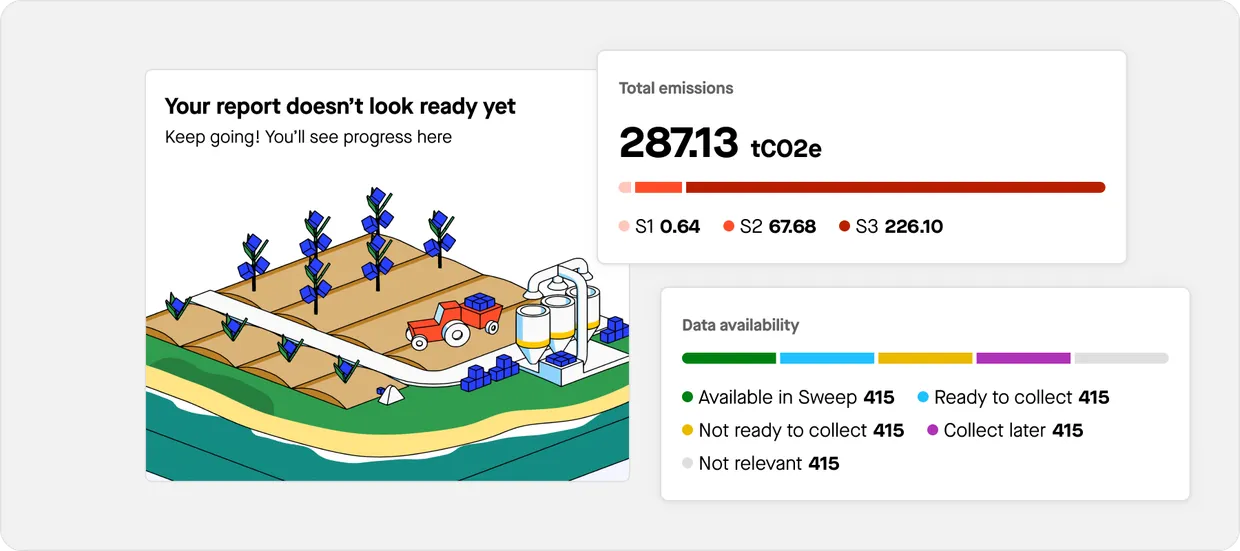

Track progress in real-time.

Get a live overview of your SFDR compliance progress with the mandatory metrics

Step 4

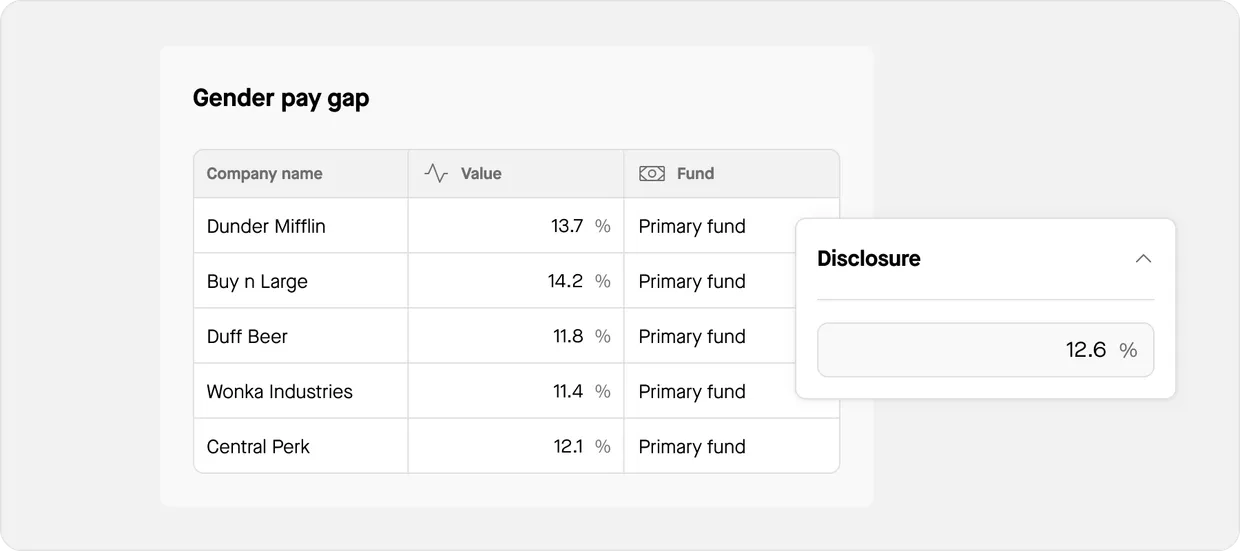

Calculate mandatory indicators

Automatically consolidate and convert portfolio companies input into PAI indicator results.

Step 5

Generate PAI report in a click

Use your results to create a PAI statement ready to share with the authorities.

“Sweep’s emission monitoring dashboards make it easy for asset managers to communicate and answer questions from our investors about financed emissions, carbon intensity, and data quality.”

The Sweep difference

- Dozens of spreadsheets

- Painful portfolio collaboration

- Poor data quality

- Complex PAIs calculations

- No campaign progress visibility

- Automated data collection

- Streamlined portfolio collaboration

- Investor-grade data

- Automatic aggregation and calculation

- Real-time progress tracker

Organizations like yours are taking action today

Balderton engages portfolio companies on ESG measurement with Sweep

Let’s make a difference together

What's SFDR?

The Sustainable Finance Disclosure Regulation (SFDR) is a European Union regulation that requires financial market participants and advisers to disclose how they integrate environmental, social, and governance (ESG) factors into their investment decisions. SFDR aims to increase transparency, prevent greenwashing, and help investors compare the sustainability of financial products across the EU.

What are the Principal Adverse Impacts (PAIs)?

Principle Adverse Impacts refer to the significant negative effects that an organization’s activities, products, or services can have on ESG factors. Note that under the SFDR, financial actors are expected to consider PAIs in their investment or insurance advice.

Who does the SFDR apply to?

The SFDR applies to EU-based financial market participants and financial advisers, including banks, asset managers, fund managers, pension funds, insurance companies, institutional investors, venture capital funds, alternative investment funds, and credit institutions offering portfolio management. It also covers financial advisors providing investment or insurance advice on insurance-based investment products (IBIPs). The regulation applies to these entities if they have over 500 employees, and also includes investment managers and advisers operating in the EU, even if headquartered elsewhere.

What are the SFDR requirements?

The SFDR sets out disclosure requirements for financial market participants at both the entity and product levels:

Entity-level disclosures (Level 1):

– Sustainability risk policy: Explain how sustainability risks are integrated into investment decisions.

– Principal adverse impacts (PAIs): Report on how investments affect key ESG factors, covering 14 mandatory indicators (including 6 on greenhouse gas emissions).

– Remuneration policy: Disclose how sustainability risks are factored into remuneration policies, or clearly state and explain if they are not considered.

Product-level disclosures (Level 2):

– Mainstream products: Describe how principal adverse impacts are considered for all products, regardless of sustainability goals.

– Article 8 products: Provide details on how products promoting environmental or social characteristics meet these criteria.

– Article 9 products: Explain how products with a sustainable investment objective achieve this, including alignment with the EU Taxonomy and relevant sustainability indicators.