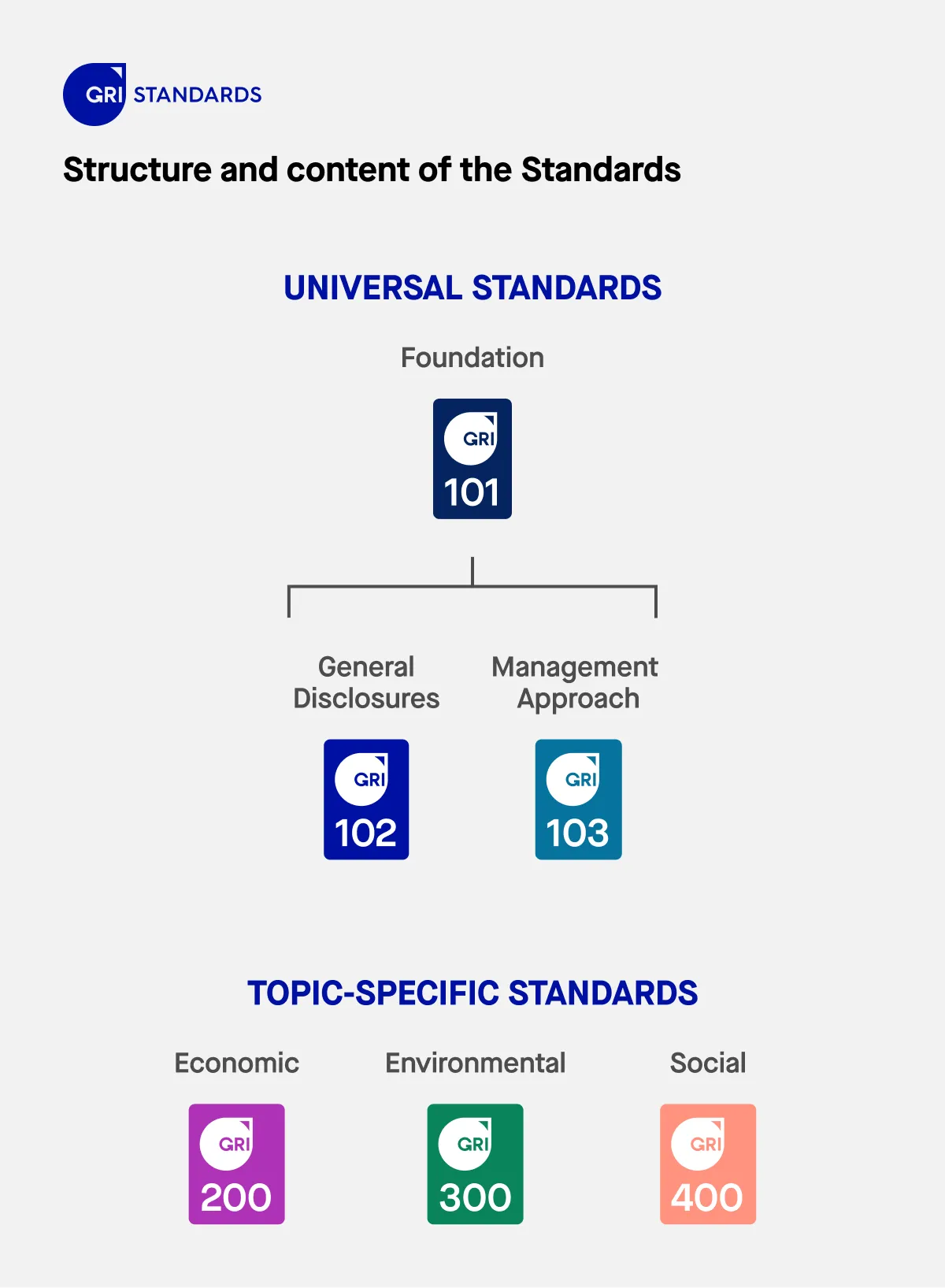

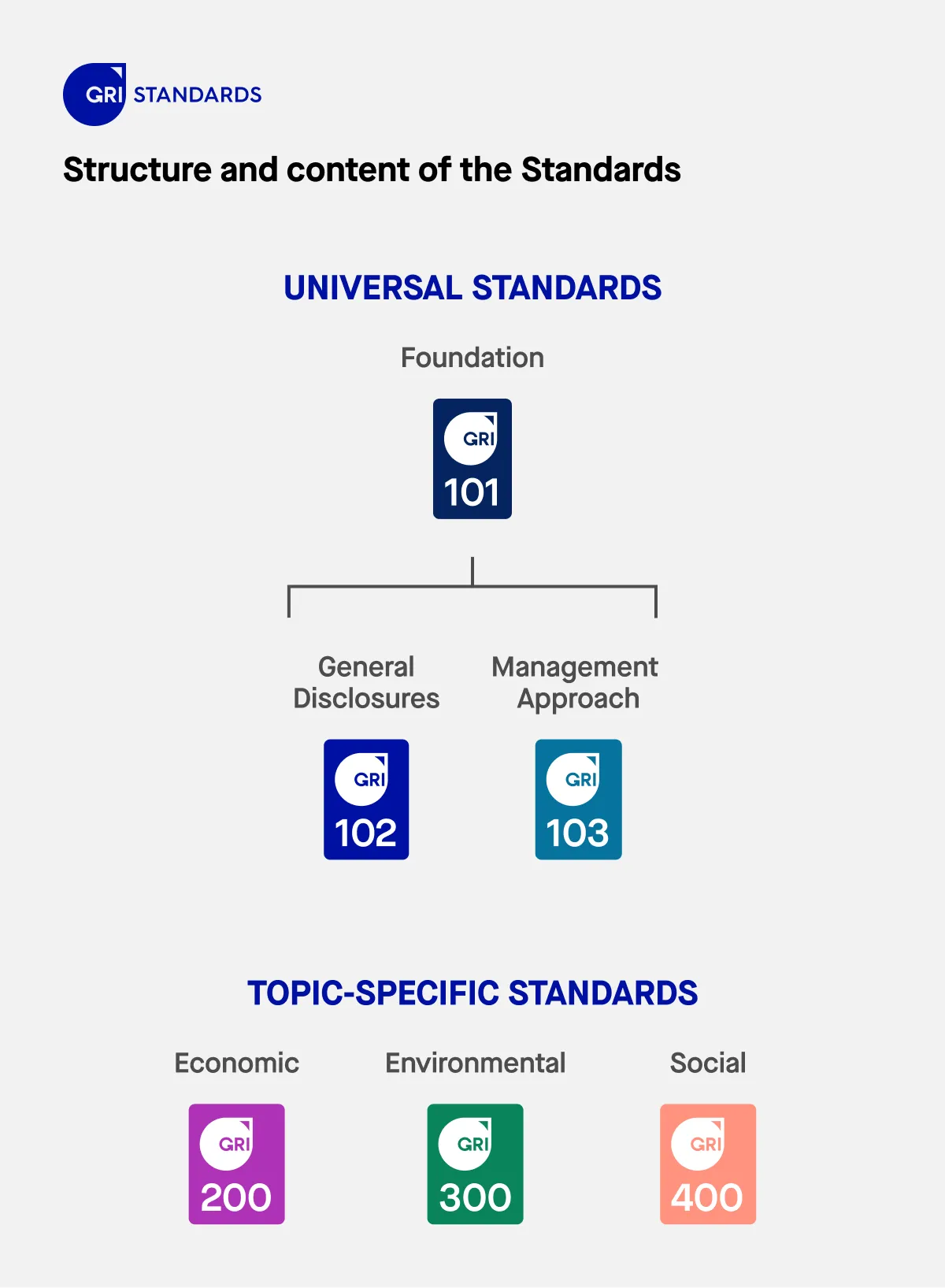

What are the core components of a GRI report?

At its core, a GRI report is built on two types of disclosures: General Disclosures and Topic-Specific Disclosures.

General disclosures

These provide essential context about the organization, such as:

- Organizational details: Name, activities, brands, and location

- Governance and structure: Board composition, oversight of ESG issues, and the role of governance bodies such as the board of directors and stakeholder councils in guiding and maintaining sustainability reporting standards

- Strategy and policies: Mission, values, sustainability commitments

- Stakeholder engagement: How the company identifies and responds to stakeholder concerns, noting that external stakeholders—including investors, regulators, and policymakers—rely on GRI reports for decision-making

- Reporting practices: GRI version used, restatements, external assurance (if applicable)

Topic-specific disclosures

These relate to specific material issues identified by the organization. Each disclosure includes: Topic standards provide detailed guidance on disclosures for specific sustainability issues.

- Management approach: How the issue is managed and monitored

- Quantitative indicators: Metrics such as GHG emissions, energy use, energy consumption, energy efficiency, water withdrawal, or injury rates. These indicators help track progress on climate change.

- Qualitative information: Narrative descriptions, strategy, and outcomes

These disclosures are selected based on a materiality assessment, a process used to identify ESG topics that have the most significant impact on the business and its stakeholders. Organizations should also disclose any negative impacts identified through their materiality assessment.

How should companies identify their material topics?

Materiality is the foundation of GRI reporting. According to the latest GRI 2021 Universal Standards, companies must disclose topics that reflect:

- The organization’s most significant sustainability impacts, including economic impacts, social impacts, and associated risks, on the economy, environment, and people

- The topics that influence stakeholder decisions

The materiality assessment process typically involves:

- Identifying relevant ESG topics based on industry, stakeholder feedback, regulations, and peer practices

- Engaging stakeholders to gather input on topic relevance

- Assessing the significance of each impact across the value chain

- Prioritizing issues to focus reporting on high-impact areas

Public companies are often subject to stricter materiality and disclosure requirements, and non compliance with these requirements can result in regulatory penalties.

For example, a retail company might prioritize emissions from its supply chain (Scope 3), while a financial institution may highlight social equity in lending practices.

What are examples of common GRI topics?

The GRI framework includes a wide range of topics that companies can report on, depending on their industry and materiality assessment outcomes. GRI is one of the leading sustainability reporting standards, and organizations use these standards to produce comprehensive sustainability reports that enhance transparency and accountability. These are grouped under the following categories:

Environmental topics

- GRI 302: Energy

- GRI 303: Water and effluents

- GRI 305: Emissions (Scope 1, 2, and 3)

- GRI 306: Waste

- GRI 307: Environmental compliance

- Environmental protection: A key focus of environmental disclosures under GRI is environmental protection, highlighting how organizations align their sustainability initiatives with international standards and demonstrate their commitment to protecting the environment.

Social topics

Social performance and social impacts are key areas covered by GRI social topics, which include:

- GRI 401: Employment practices

- GRI 403: Occupational health and safety

- GRI 404: Training and education

- GRI 405: Diversity and equal opportunity

- GRI 408: Child labor

- Human rights

- Customer privacy

Governance topics

- GRI 205: Anti-corruption

- GRI 206: Anti-competitive behavior

- GRI 419: Socioeconomic compliance

These governance topics are often addressed by the GRI in collaboration with other organizations to ensure best practices and broad stakeholder engagement.

These disclosures must include both narrative and quantitative data where available. Companies are encouraged to report with clarity, transparency, and consistency to enable comparability.

How can companies ensure data quality in GRI reporting?

High-quality data is critical to credible reporting. According to Deloitte, the biggest challenges for companies reporting under GRI include data availability, accuracy, and system integration.

To enhance data quality:

- Centralize ESG data from different departments

- Use consistent methodologies aligned with GRI indicators

- Engage internal audit or third-party assurance to review disclosures

- Document data sources and assumptions to ensure traceability

Many companies also adopt software platforms to automate data collection, apply emission factors, and reduce manual errors. This is particularly useful when gathering Scope 3 data from suppliers.

How should companies structure and present their report?

There is no mandatory format, but best practices include:

- An executive summary: Overview of the company’s ESG performance and highlights

- A clear table of contents: Helps readers find relevant information easily

- A GRI content index: Lists all GRI standards used and where they appear in the report

- Integrated visuals: Charts, graphs, and infographics to improve clarity

- Case studies: Real-world examples of sustainability initiatives

- Transparent reporting: Ensure disclosures are clear, comprehensive, and stakeholder-oriented to enhance trust.

KPMG’s 2022 Survey of Sustainability Reporting found that over 90% of the world’s largest companies now use GRI, and the majority integrate sustainability goals with financial reporting to demonstrate long-term value creation.

How often should a GRI report be published?

Most companies issue a GRI-aligned report annually. Consistency allows stakeholders to track progress over time. If significant changes occur during the year (such as acquisitions or major environmental incidents), companies should update disclosures or issue a supplement.

Companies should also clearly indicate the reporting period, and explain any changes in scope or methodology since the previous report.

What are the benefits of using GRI standards?

Using GRI helps companies:

- Align with international best practices

- Meet stakeholder and investor expectations

- Enhance transparency and trust

- Support compliance with emerging regulations (such as the EU’s CSRD and the UK SRS)

- Improve internal sustainability governance and data management

- Contribute to a more sustainable world by promoting transparency and accountability in sustainability initiatives

According to Capgemini, businesses that integrate ESG data into strategic decision-making experience improved risk management, stronger stakeholder relationships, and better financial performance.

Technology plays a key role in making GRI reporting more efficient and accurate. ESG tools like Sweep enable organizations to:

- Centralize carbon and ESG data across operations

- Engage suppliers with user-friendly surveys to collect Scope 3 data

- Automate calculations using integrated emissions factors

- Generate GRI-aligned reports and dashboards

- Prepare for current and future regulations like the CSRD, UK SRS, California laws and more