1. Mitigate risks and uncertainties of fast-evolving global markets

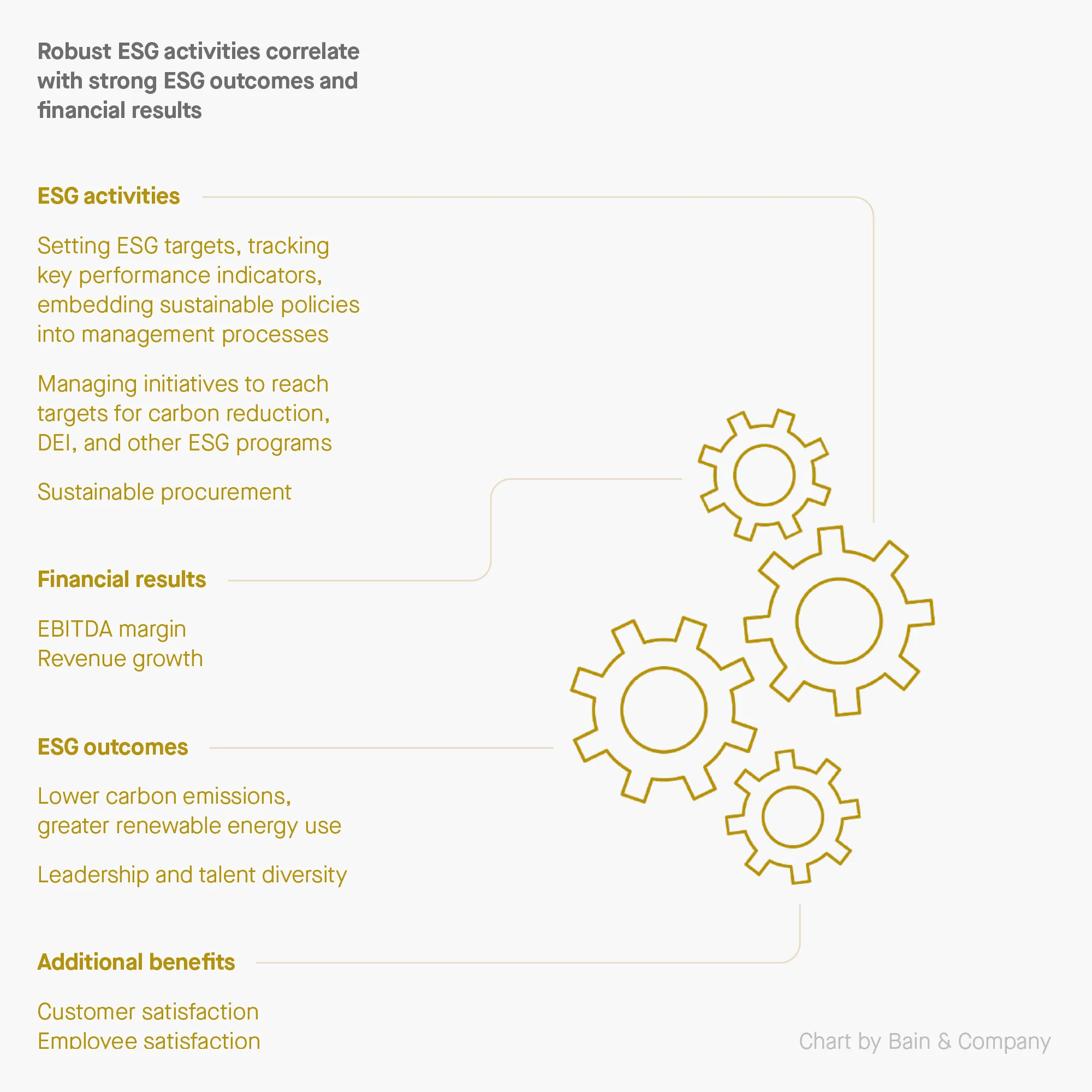

Companies that focus on ESG tracking can better manage risks and build stronger foundations for their businesses – making them more sustainable in the long run. Companies that track Environmental, Social, and Governance (ESG) factors are better equipped to handle global crises.

The COVID-19 pandemic has highlighted the significance of integrating ESG factors into business strategies to ensure resilience during times of crisis. A 2020 study of 1,204 European firms revealed that organizations that track ESG were more equipped to face the crisis compared to other firms. These firms were able to better manage the risk-return trade-off and maintain stock market liquidity. They also had higher levels of cash holdings and liquid assets before the pandemic hit, which helped the absorb the externalities of COVID-19 more effectively than others.

The same is true for mitigating climate risks. Severe weather events such as hurricanes, wildfires, and water scarcity can be devastating for several industries, including manufacturing, healthcare, and agriculture. In 2022, Hurricane Ian left a lasting impact on Florida's key industries, damaging up to 2,800 manufacturing firms and 7,000 healthcare producers, among others. The projected losses were estimated at around $20B.

As weather events are projected to be more frequent and severe in the coming years, businesses must take a proactive approach to managing risks and identifying opportunities for growth. That’s where a thorough tracking of ESG metrics is necessary.

By embracing ESG practices, businesses can enhance their resilience and better weather projected and unforeseen consequences of the global market and climate changes.

New frontiers: Re-thinking investment strategies

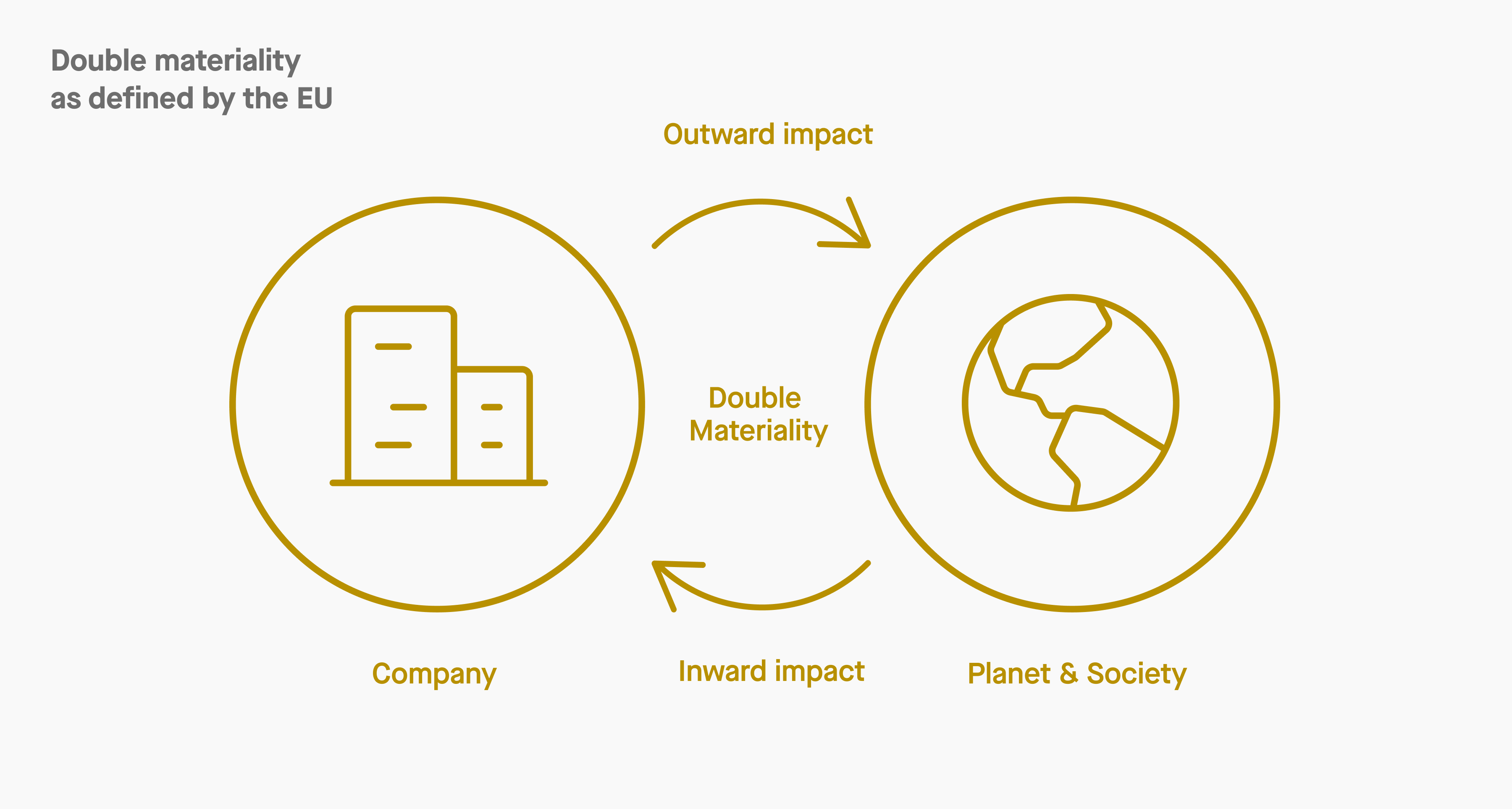

We’ve built a world where financial return is king. This money-driven approach is limiting, as health crises and extreme weather events also impact companies’ bottom lines. By taking into account non-financial indicators, such as climate risks or employee well-being, investors will better anticipate the fast-evolving economic environment and build more resilient portfolios.

Among the alternative approaches, Kate Raworth, author of Doughnut Economics, proposes a new way of thinking about economics based on the needs of all people and within the means of the living planet.

Her theory has evolved into a global community Doughnut Economics Action Lab, offering workshops, case studies, and tools, to help companies integrate non-financial indicators into their business strategy.