Spearheaded by the UK Financial Conduct Authority (FCA), the UK Sustainable Disclosure Regulation (SDR) targets issuers of bonds and shares listed on a UK-regulated market, as well as UK-based investment managers. Its primary objective is to furnish investors with comprehensive, consistent, and comparable sustainability data from both issuers and investment managers. By doing so, it aims to empower investors with the knowledge they need to make informed decisions regarding sustainable finance products and investments.

What is the UK SDR and how can you prepare for it?

We outline what the SDR is, which organizations are covered by it, and how you can prepare.

How does the UK SDR relate to the EU SFDR?

Led by the European Commission, the EU SFDR imposes sustainability-related disclosure requirements on a wide spectrum of financial market participants, including investment firms, insurance companies, and reinsurance companies. Unlike the UK SDR, the SFDR encompasses entities established within the EU and extends its reach to products marketed in the EU, irrespective of the entity's location. Its overarching goal is to instill trust and integrity in sustainable financial instruments by combating greenwashing, the practice of exaggerating or misrepresenting the environmental credentials of financial products. Furthermore, it seeks to augment transparency and disclosure standards in sustainable finance, thereby providing investors with a richer trove of information to facilitate well-informed investment decisions.

Both the SDR and the SFDR are not only pivotal in the fight against greenwashing but also act as essential tools to promote sustainable investment practices. By enhancing transparency and imposing rigorous disclosure standards, both the UK SDR and EU SFDR are pivotal in building investor trust and advancing sustainable finance principles. Consequently, they contribute to the broader global effort of aligning financial systems with sustainability goals and ensuring that investments drive positive environmental and social impacts.

What are the main differences between SDR and SFDR?

Although the SDR is generally considered to be the UK’s answer to the EU’s SFDR, the two regimes are far from being aligned. Below, we outline some of the major differences.

1. Sustainable investment classification and labels

The objective here is to address greenwashing. The FCA is clamping down on “exaggerated, misleading, or unsubstantiated claims” regarding sustainable investment products.

Consumer-facing disclosures are meant to help investors understand the key sustainability-related features of an investment product.

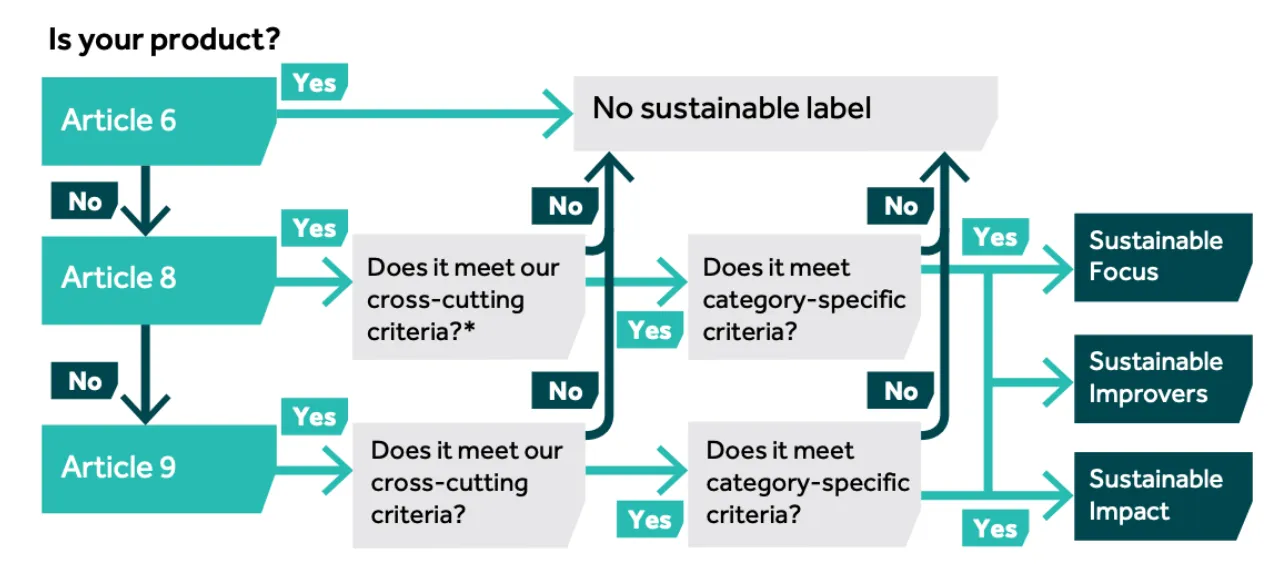

🔍The UK SDR proposed three labels (focus, impact, improve) and these do not correspond to the three categories in SFDR (Article 6, ,8 and 9).

SDR

Under SDR, financial products will be labelled based on intentionality and on the level of sustainable investments. SDR offers more clarity to funds in determining their appropriate label and potentially will offer investors more certainty in selecting funds that reflect their preferences.

The three labels are designed to not have a hierarchy and instead reflect the desires of different consumer preferences, as outlined below:

-

Sustainable Focus – Assets that mainly have an environmentally or socially sustainable focus.

This label suggests that the fund maintains a high standard of sustainability in the profile of the assets (It should invest at least 70% in sustainable assets, as suggested in the consultation paper).

-

Sustainable Improvers – Assets that may not be sustainable now, but are aiming to have a positive environmental or social impact in the future.

This label is the most novel and brings the idea of “stewardship” on the part of the asset manager to make a “measurable” improvement in underlying ESG performance.

-

Sustainable Impact – Assets that invest in real-world problems and are achieving real-world measurable contributions to environmentally or socially sustainable outcomes.

This label includes products with a specific sustainable outcome as an objective, with no minimum sustainable investment required.

SFDR

According to the SFDR’s classification system, a fund will either be classified as an article 6,8, or 9 fund – depending on their characteristics and level of sustainability. The SFDR categories are not labels and instead represent levels of disclosures that the fund will make.

-

Article 6: Funds without a sustainability scope

-

Article 8: Funds that promote environmental or social characteristics

-

Article 9: Funds that have sustainable investment as their objective

|

SFDR Classification |

Description |

Alignment with SDR |

|

Article 6 |

Funds that don’t integrate sustainability into their investment process. |

Doesn’t meet the criteria to achieve a label. |

|

Article 8 |

Funds that promote sustainable investment, but it is not a primary objective. |

Sustainable Focus and Sustainable Improver funds would exceed the criteria for Article 8. |

|

Article 9 |

Funds that have sustainable investment as a primary objective. |

Sustainable Impact funds would exceed the criteria for Article 9. |

The FCA labels cover different investment objectives, whereas the three SFDR categories do suggest a hierarchy of sustainability. There’s a minimum set of criteria for each SDR label (unlike SFDR): e.g. for a “focus” fund, they must commit to invest at least 70% in sustainable assets.

The FCA, acknowledging that firms may already have implemented SFDR, shows how one can map to the other in its consultation paper.

Source: FCA Consultation Paper

As you seen it’s not that obvious! A firm could have an investment product that’s categorized as Article 8 or 9 under the SFDR but does not meet the qualifying criteria for the investment labels within the SDR. This could cause confusion in the market where a product is seen as sustainable according to one regime but not to another.

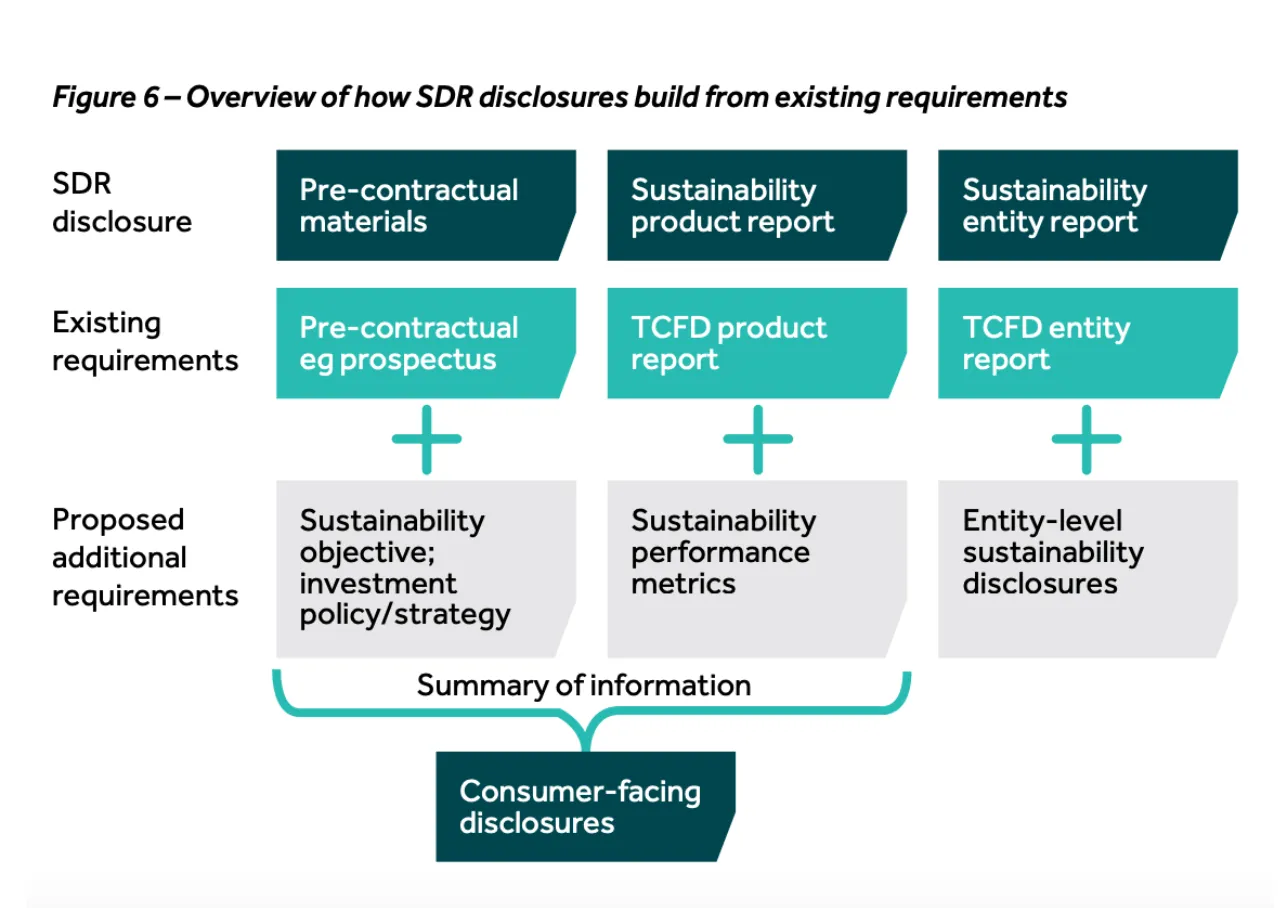

Sustainability Disclosures

The UK proposal differs from SFDR on determining whether investments are sustainable or not:

-

The SDR doesn’t contain a “do no significant harm” test. This may be introduced at a later stage, but for now the FCA views it as too restrictive.

-

The SDR also doesn’t include any reference to Taxonomy alignment. We expect this to change when the UK Taxonomy is developed.

-

The SDR doesn’t have any reference to the reporting of Principal Adverse Impact indicators (PAIs).

🔍 FCA will look to develop quantitative KPI disclosures based on, amongst other things, TCFD and ISSB standards.

Source: FCA Consultation Paper

The key differences in a nutshell

|

Firms making SFDR product‐level disclosures will be considering… |

Is this required under SDR proposals? |

|

Sustainable investment objective; E or S characteristics of the product |

Yes – Principle 1: sustainability objective |

|

Monitoring sustainability objective; E or S characteristics (sustainability indicators) |

Yes – Principle 3: KPIs |

|

DNSH |

No |

|

Principal adverse impacts |

No |

|

Investment strategy |

Yes – Principle 2: investment policy and strategy |

|

Asset allocation/proportion of investments that promote E or S characteristics (including use of derivatives) |

Yes – Principle 2: investment policy and strategy |

|

Taxonomy-alignment |

No |

|

Methodologies, data sources and processing, limitations to methodologies and data |

Yes – Part B sustainability product report |

|

Due diligence |

Yes – Principle 4: governance and resources |

|

Engagement policies (where part of strategy) |

Yes – Principle 5: stewardship |

|

Reference benchmarks |

Yes – Principle 2: investment policy and strategy |

|

Extent to which E or S characteristics/sustainable investment objective were met (performance of sustainability indicators) |

Yes – Principle 3: KPIs |

|

Proportions of investments (eg top investments; those that attained E or S characteristics/met the objective; those in different economic sectors and sub-sectors; Taxonomy-aligned) |

No |

|

Performance against designated reference benchmark |

Yes – Principle 3: KPIs (eg where a benchmark has been designated as a performance indicator) |

|

Historical comparison |

Yes – Part B sustainability product report |

|

Information on underlying investment options |

No |

SDR – Key dates

The final FCA policy statement is expected in Q4 2023, and the SDR will come into effect twelve months after the publication of the final rules, along with clarifications on greenwashing in the form of a policy statement.

However, the clarification on greenwashing will come into effect immediately. Funds that currently make sustainability or ESG claims may wish to review their marketing messaging prior to June to ensure that it is clear, fair and not misleading.

From July 2024 onwards, SDR will initially start with requirements for labelling, marketing, pre-contractual disclosures and customer facing disclosures. Following this will be a staggered rollout of additional reporting requirements, starting with the largest firms.

The investment classification and labelling rules would come into effect provisionally from 30 June 2024 for in-scope firms (other than portfolio managers) and 30 December 2024 for portfolio managers that satisfy the 90% test: where 90% or more of the value of the constituent products qualify for a label.

Notably, the use of labels is optional even for funds targeting retail investors, and may be used for funds targeting institutional investors.

What can you do to prepare for the SDR?

To prepare for SDR implementation, businesses can take three crucial steps:

Assess and adapt: Evaluate current practices against expected SDR requirements. Identify necessary changes, especially in governance and data processes. Find the right software provider to help you effectively track and measure your ESG data – including tracking data gaps.

Comply with existing standards: Align with the existing ISSB standards. This early adoption eases future SDR compliance, promotes standardized reporting, and enhances access to sustainable finance. Leverage existing practices for efficient implementation.

Seize transformation opportunities: View SDR compliance as a catalyst for holistic business transformation. Reevaluate strategy, risk management, data handling, and value chain coordination. Embrace a value-centric mindset and capitalize on sustainability-driven opportunities.

Learn how Sweep can help you comply with regulations and meet your climate targets.

Sweep can help

Sweep is a carbon and ESG management platform that empowers businesses to meet their sustainability goals.

Using our platform, you can:

- Conduct a thorough assessment of your carbon footprint.

- Get a real-time overview of your supply chain and ensure that your suppliers meet your sustainability targets.

- Reach full compliance with the CSRD and other key ESG legislation in a matter of weeks.

- Ensure your sustainability information is reliable by having it verified by a third party before going public.