The SFDR (Sustainable Finance Disclosure Regulation) is an European Union regulation designed to enhance transparency and promote sustainable investment practices. It requires financial market participants and advisors to disclose their sustainability policies, ESG (Environmental, Social, and Governance) integration, and the potential adverse impacts of investments on sustainability.

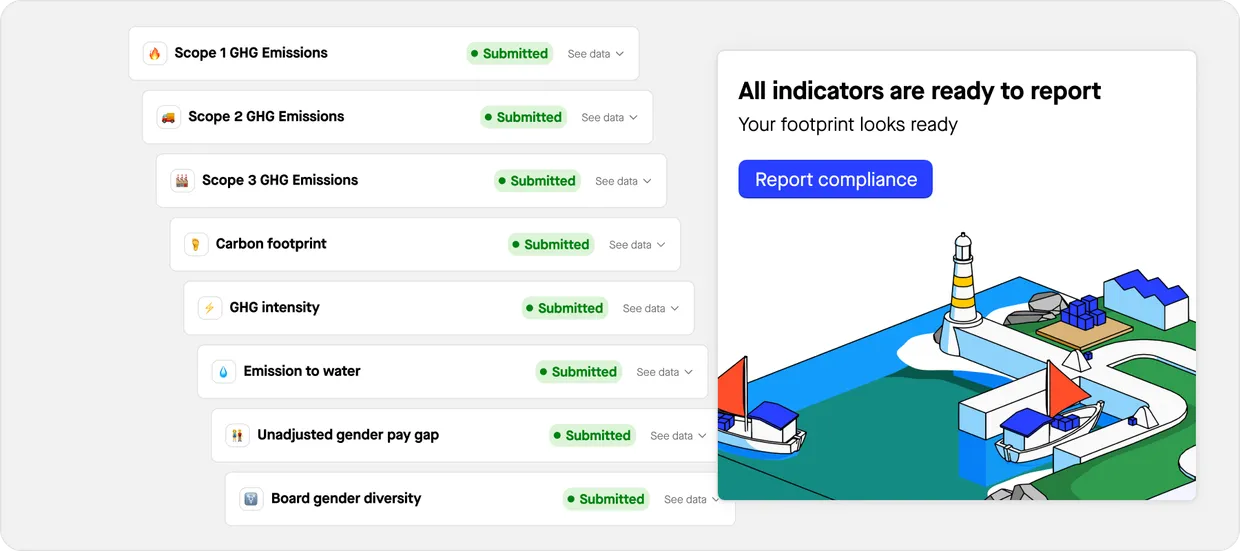

- Level 1: Disclosures on ESG factors, including how sustainability risks are integrated into investment decisions, the adverse impacts of investments, and alignment with sustainability goals.

- Level 2: Detailed rules on implementing these disclosures, including content, methodology, and presentation.

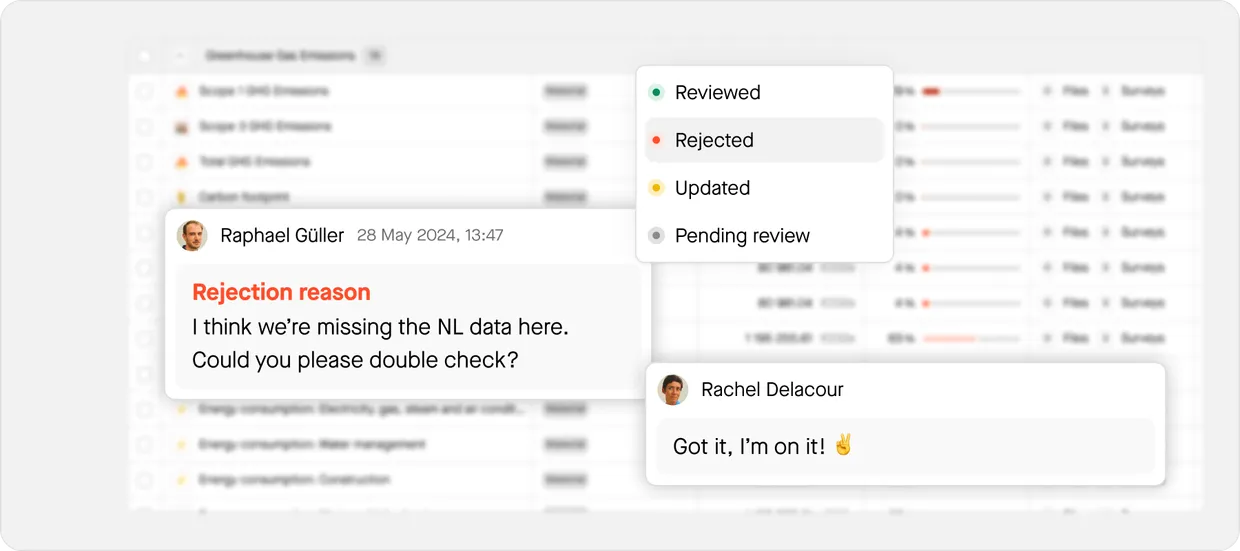

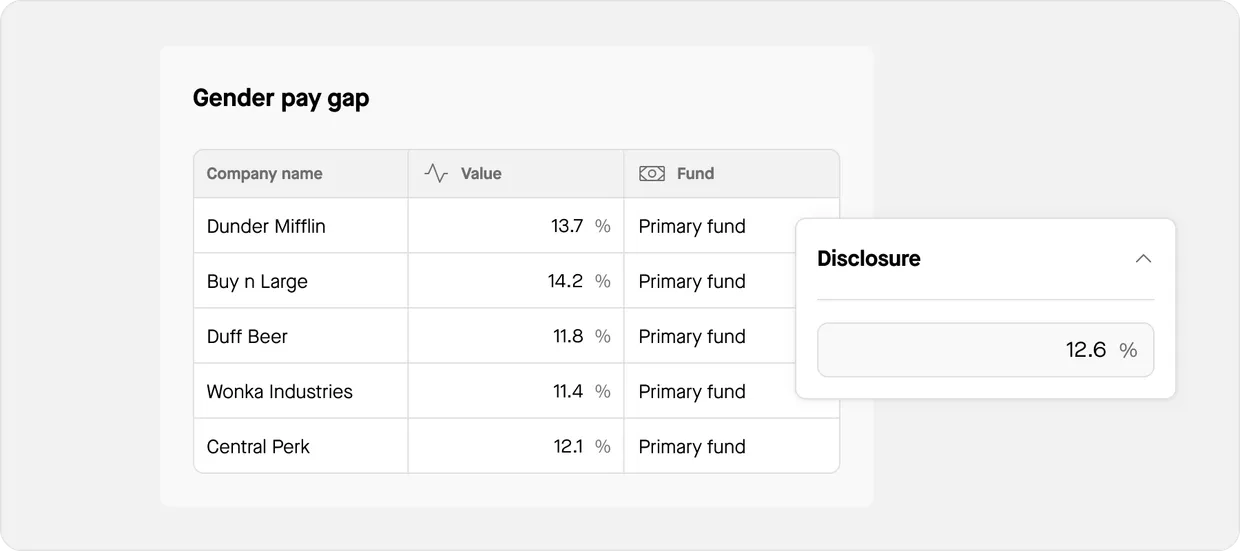

Principal Adverse Impacts (PAIs)

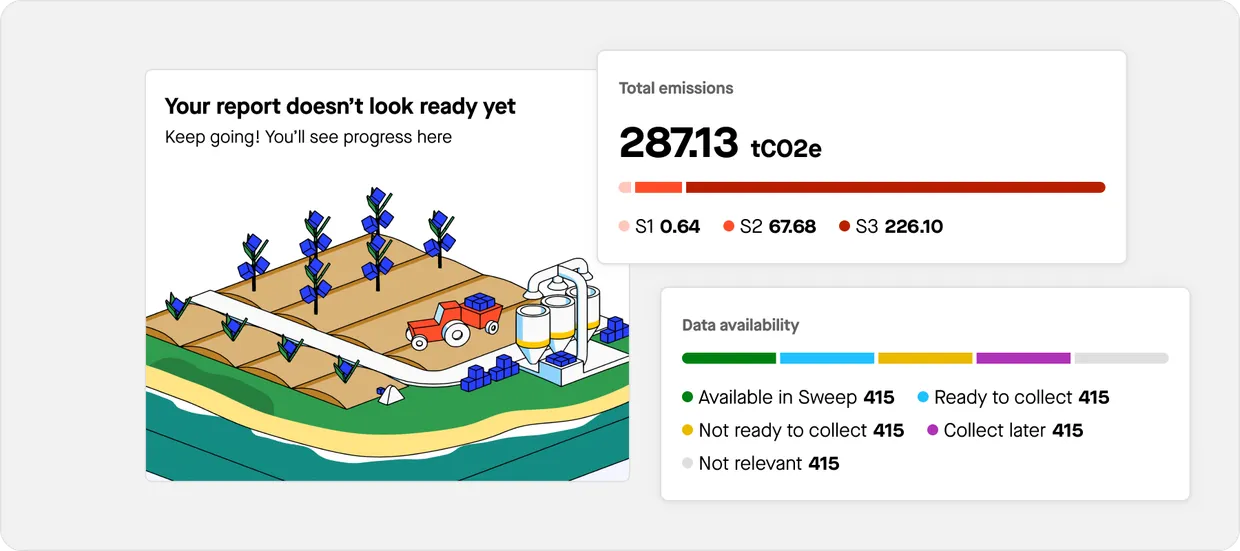

PAIs refer to significant negative effects an investment may have on sustainability factors, such as environmental damage (e.g., greenhouse gas emissions) or social issues (e.g., human rights violations). Financial market participants must disclose their methods for assessing and managing these impacts, ensuring sustainability risks are part of the investment decision-making process.