CSRD reporting

made simple

driving data automation and collaboration

to ensure compliance.

CSRD reporting can be costly and time-consuming

estimated cost of non-compliance

average cost of assurance

data points to measure and report on

Sweep's CSRD Readiness Checklist

Take our 5-min test to assess your organization's CSRD preparedness

Here’s how CSRD compliance works with Sweep

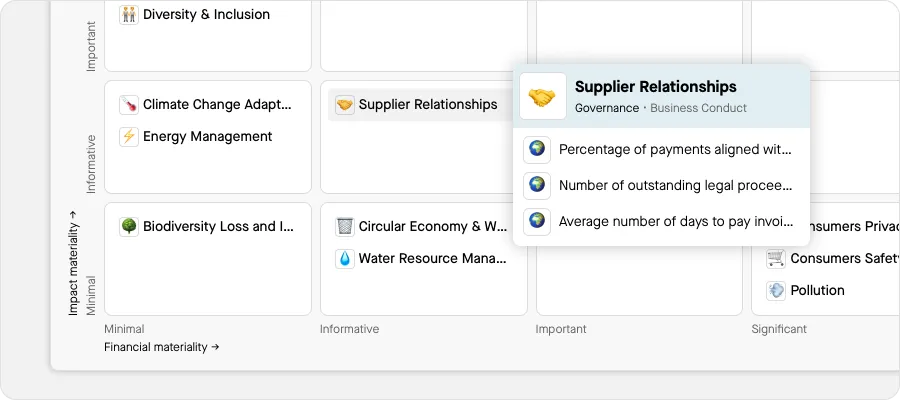

Step 1

Perform materiality assessment

Conduct your double materiality assessment based on your industry sector.

Then, refine your financial impact and impact threshold limits, focusing your efforts on critical sustainability topics.

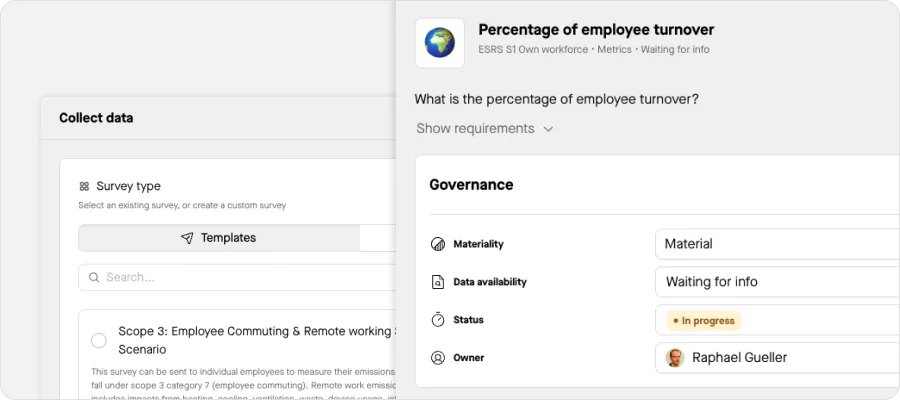

Step 2

Identify gaps and collect data

Check data availability and potential gaps, and streamline stakeholder engagement with surveys and file imports.

Improve governance by defining clear roles and responsibilities.

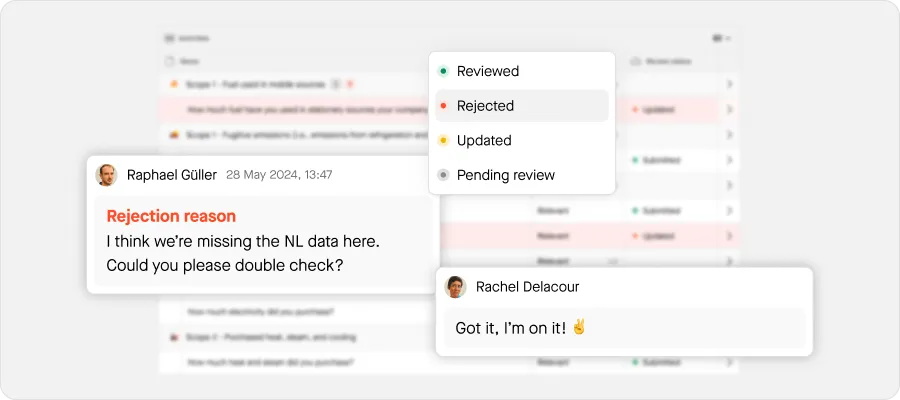

Step 3

Check and approve data points

Use an advanced validation workflow to accept or reject an entire survey or individual responses.

Include comments and documents to support answers and provide explanations.

Step 4

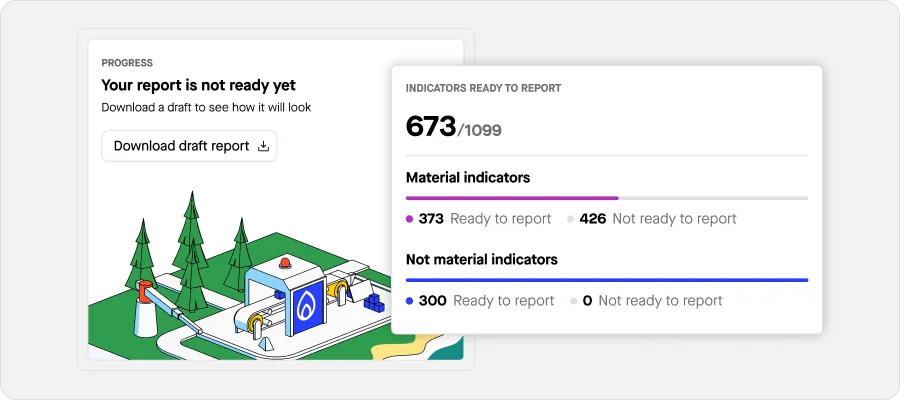

Monitor campaign progress

Keep track of your data collection and find any missing information.

Check each indicator’s status and take action. Send reminders to complete reporting campaigns.

Step 5

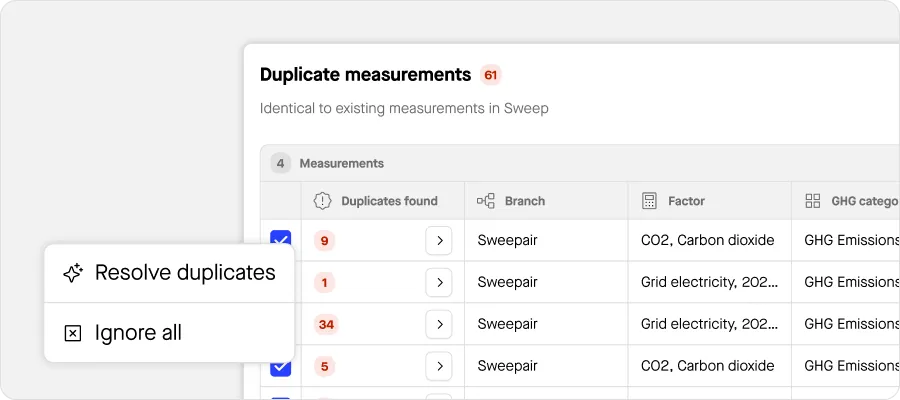

Run internal controls and audits

Identify and correct any errors, duplicates, and irregularities in your dataset.

Track all changes across the platform, make comments and add supporting documents.

Step 6

Submit CSRD report to authorities

Compile, export, and review your material indicators in the required reporting format.

Tag your indicators for machine-readable format suited for the ESAP platform.

“With the growing number of sustainability regulations (such as the CSRD) and stakeholder demands for transparency, companies are under pressure to accurately communicate their impact. By working with tech partners like Sweep, large organizations can streamline the collection, monitoring, and reporting of their data in one single place.”

The Sweep difference

- Dozens of spreadsheets

- Painful team collaboration

- Poor data quality

- Complex ESRS questions

- No campaign progress visibility

- Automated data collection

- Streamlined team collaboration

- Investor-grade data

- GenAI-based answer suggestions

- Real-time progress tracker

From reporting compliance to performance improvement

Sweep sets you up for success in your long-term sustainability journey.

Organizations like yours are taking action today