In the face of the accelerating climate crisis, carbon accounting has become a critical task for businesses worldwide. As regulatory requirements and regulatory frameworks like the Corporate Sustainability Reporting Directive (CSRD) intensify and stakeholder expectations rise, companies must meticulously measure and manage their carbon emissions.

Carbon accounting software helps businesses measure their carbon footprint accurately, comply with climate disclosure requirements, and monitor progress toward sustainability goals. This comprehensive effort, once limited to Scope 1 and 2 emissions, now extends to the intricate realm of Scope 3 emissions, encompassing a wide array of indirect emissions. To navigate this complexity, many organizations are turning to advanced carbon management solutions.

With numerous platforms available, selecting the right one can be daunting. Here, we highlight the 7 best carbon accounting software platforms in 2025, designed to streamline your sustainability management and enhance your climate strategy.

What does carbon accounting involve?

Carbon accounting (or more broadly, greenhouse gas accounting) encompasses the systematic process to calculate emissions, record, and report the greenhouse gases (GHGs) emitted or sequestered by an organization. The Greenhouse Gas Protocol serves as the foundational framework guiding these practices.

The primary goal is to identify all sources of both direct and indirect emissions and quantify them, enabling businesses to measure their emissions using these methods to support effective emission reduction strategies. Establishing a robust carbon accounting framework is crucial for monitoring progress, achieving reduction targets, and showcasing commitment to net zero and environmental goals.

High data quality is essential for accurate carbon emissions calculations and to generate actionable insights that drive sustainability efforts.

What is a business carbon footprint?

A business carbon footprint refers to the total amount of GHG emissions, typically measured in carbon dioxide equivalents (CO2e), generated directly and indirectly by an organization over a specific period. This metric, following GHG Protocol guidelines, spans emissions from energy consumption, transportation, production, and the supply chain, with fossil fuels being a primary source of these emissions.

Calculating a business carbon footprint using a structured carbon management solution allows companies to understand their unavoidable emissions, mitigate climate risk, and track sustainability performance.

What are the three scopes?

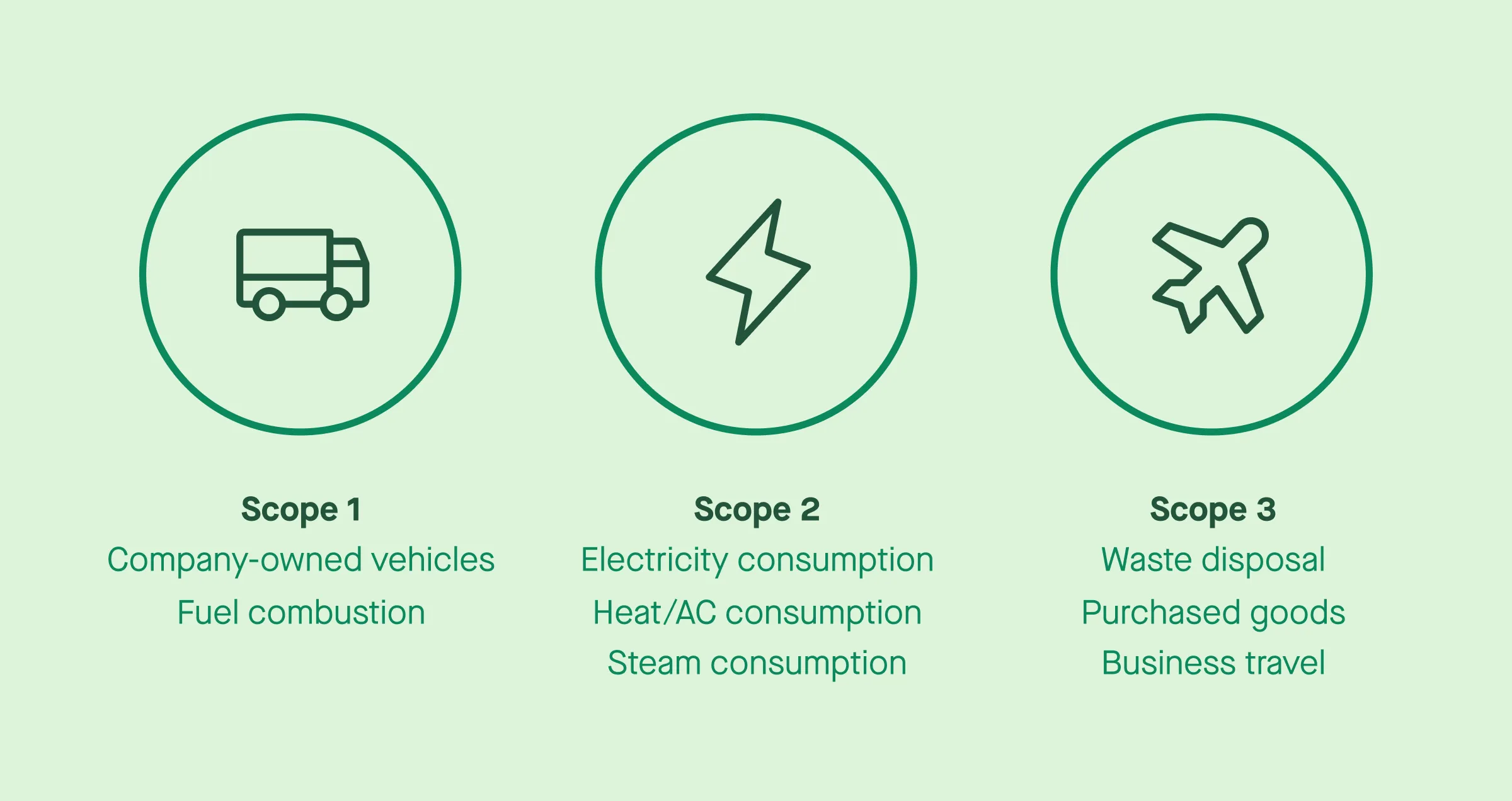

The GHG Protocol outlines three scopes to ensure comprehensive carbon reporting:

- Scope 1: Direct emissions from owned or controlled sources, like company vehicles or onsite fuel use.

- Scope 2: Indirect emissions from the consumption of purchased electricity, steam, heating, and cooling.

- Scope 3: All other indirect emissions, including those related to business travel, supply chains, and product lifecycle activities.

Covering all three scopes provides a full picture of an organization’s carbon emissions and supports informed sustainability decisions.