Australian businesses are facing increasing expectations to disclose their climate-related risks and opportunities. In response to this shift, the Australian Accounting Standards Board (AASB) has issued a new mandatory standard—AASB S2, which is crucial for the transparency and consistency of Australian securities regulations.

The AASB S2 standard aims to align local reporting with global frameworks while addressing Australia’s specific regulatory and legal context. Below, we outline its key objectives, coverage, timeline for implementation and more.

What is the objective of AASB S2?

The objective of AASB S2 is to provide consistent, decision-useful climate-related disclosures for investors and other users of financial statements in accordance with AASB standards. The standard aims to enhance transparency regarding how climate-related risks and opportunities affect a company’s financial position, performance and cash flows.

Regulatory bodies such as the Australian Accounting Standards Board (AASB) and the Australian Securities and Investments Commission (ASIC) are responsible for overseeing compliance with the standards.

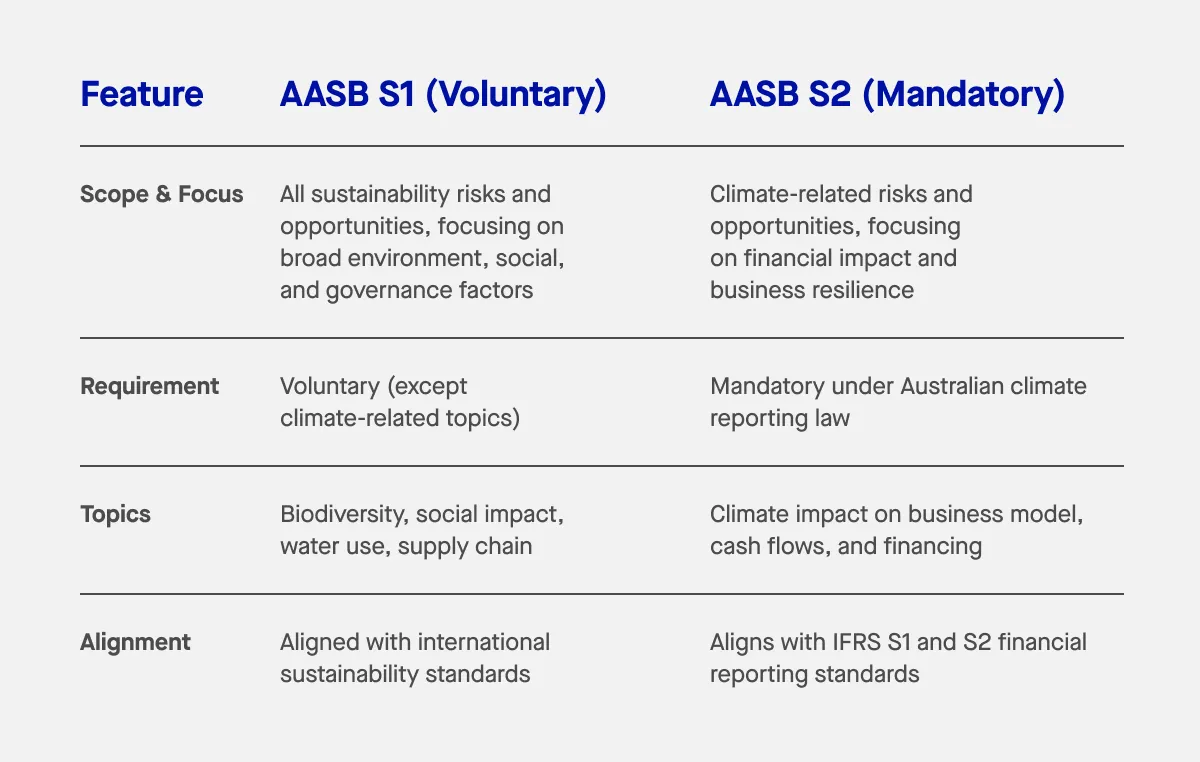

What is the difference between AASB S1 and S2?

AASB S1 and AASB S2 are both part of the Australian Sustainability Reporting Standards (ASRS), but while AASB S1 is voluntary, AASB S2 is mandatory.

AASB S1 – General sustainability disclosures (voluntary for now):

- Provides a broad framework for reporting on all sustainability-related risks and opportunities (not just climate), including those relevant to not-for-profit entities

- Currently voluntary for topics other than climate-related matters

- Covers issues like biodiversity, social impacts, water use, supply chain, human capital, and more

- Also aligned with international standards to promote consistency across jurisdictions

- Encourages entities to consider how wider sustainability factors may affect long-term performance and financial position

AASB S2 – Climate-related disclosures (mandatory):

- Focuses specifically on climate-related risks and opportunities

- Mandatory for entities captured by Australia’s climate reporting legislation

- Integrates IFRS S1 and S2 to align with international financial reporting standards

- Requires companies to disclose information that could affect cash flows, access to finance, or cost of capital in the short, medium or long term

- Targets how climate change may impact an entity’s business model, resilience and strategic planning

- Recognizes lease liability under AASB 16, requiring entities to measure and disclose lease liabilities on the balance sheet, including interest accrual and repayment adjustments over the lease term

In summary, AASB S2 is focused and mandatory, dealing only with climate risks. AASB S1 is broader and currently voluntary, intended to support future reporting on a full range of sustainability issues. Both standards aim to improve transparency, support investor decision-making, and strengthen the alignment between sustainability and financial reporting.

Who does the AASB S2 standard cover?

Entities that fall under the Corporations Act 2001 and meet certain size or activity thresholds, including for-profit entities required to report under AASB S2, will be required to report in line with AASB S2. This includes:

- Large proprietary companies

- Listed entities meeting the size thresholds

- NGER reporters

- Superannuation entities or managed investment schemes with $5B+ in assets

- Financial institutions

Public sector entities are also included in the reporting requirements.

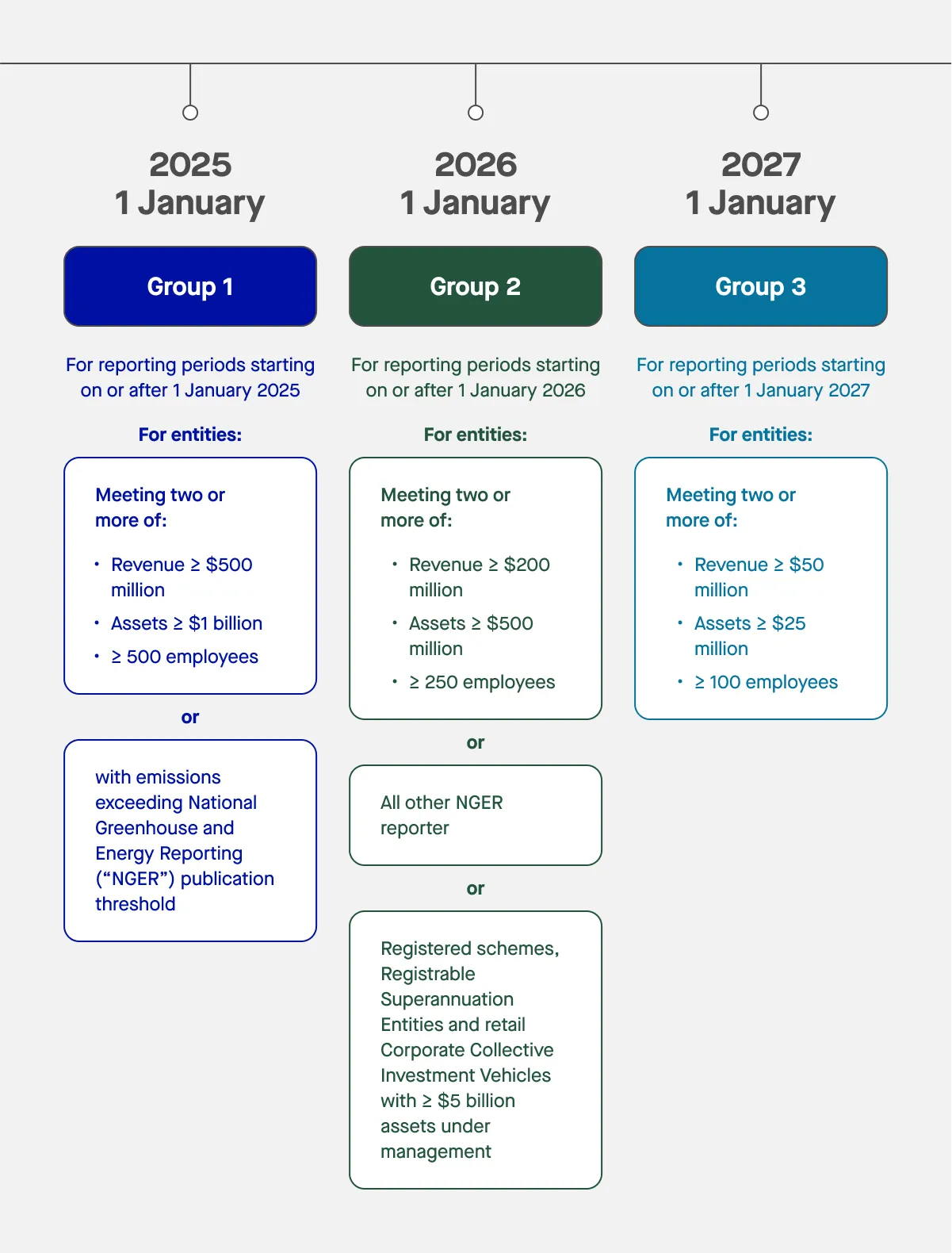

Entities are split into three groups with phased implementation based on size and emissions profile. Smaller businesses (typically SMEs) are excluded for now but may be included in the future.

Contracts play a crucial role in defining the obligations that entities must fulfill to comply with AASB S2.

What is the timeline for implementation?

Mandatory reporting begins in phases for annual reporting periods beginning:

- Group 1: First full reporting period on or after 1 January 2025

- Group 2: First full reporting period on or after 1 July 2026

- Group 3: First full reporting period on or after 1 July 2027

These annual reporting periods are crucial for regulatory compliance, as they align with various Australian Accounting Standards (AASB) that apply to financial reporting, including new sustainability reporting requirements.

Reporting must align with the organisation’s financial year and the preparation of the financial report. For example, if your financial year runs from July to June, Group 1 entities will report from FY26 (1 July 2025 – 30 June 2026).

A one-year grace period applies for reporting Scope 3 emissions, meaning these disclosures become mandatory from the second reporting period. It is essential to start assessing compliance with the new requirements during this grace period to ensure a smooth transition.

What are the similarities with IFRS?

AASB S2 is built on IFRS S2, developed by the International Sustainability Standards Board (ISSB), and aligns with international financial reporting standards to ensure global consistency. While the core framework is retained, AASB S2 includes Australian-specific adjustments to align with local legal and institutional settings. Key similarities include:

- Use of climate-related risk and opportunity concepts from IFRS S2

- Scenario analysis, governance, risk management and target-setting requirements

- Cross-compatibility with IFRS-aligned systems, making it easier for global entities to comply

- General requirements for disclosure of sustainability-related financial information, as outlined in IFRS S1, provide a foundational framework for AASB S2

The AASB has also included relevant IFRS S1 provisions in an appendix, allowing AASB S2 to function as a standalone mandatory standard, without requiring AASB S1 to be adopted. Amendments to AASB S2 ensure alignment with international standards, particularly in the assurance requirements for sustainability reporting and the phasing in of these requirements. These new standards, as part of the Australian Sustainability Reporting Standards (ASRS), aim to enhance transparency and consistency in sustainability reporting, especially for organizations that will need to comply by specific deadlines.

How can companies prepare?

Organisations should view AASB S2 compliance not only as a regulatory obligation but also as an opportunity to align climate strategy with long-term value creation. Below are key steps to take:

Understand your timeline

Determine which reporting group your organisation falls into under AASB S2 and confirm your first reporting period. Different groups have staggered start dates, so identifying your classification early allows time to plan and allocate resources accordingly.

Train your teams

Equip leadership and key personnel with the knowledge needed to understand and implement climate-related financial disclosures. AASB S2 introduces concepts and requirements that may be unfamiliar to some functions, such as scenario analysis and emissions tracking. Internal training should address the objectives of AASB S2, explain why it matters, and outline what teams need to do.

Common questions about reporting boundaries, scope of emissions, and financial materiality should be addressed clearly and early. Additionally, providing an action alert system for timely notifications about important meetings and decisions made by the Australian Accounting Standards Board (AASB) can keep stakeholders informed about updates as they happen.

Update materiality assessments

Reassess how climate change affects your business model and what risks and opportunities are now considered material. AASB S2 requires companies to disclose information based on climate risks that could reasonably be expected to influence investor decisions. Companies should revisit their risk registers and ESG priorities to ensure they reflect current and emerging climate-related issues. The AASB expects a dynamic approach to materiality that evolves with your strategy and operating context.

Begin scenario analysis

Start modelling how different climate futures could impact your organisation’s strategy, performance, and resilience. AASB S2 requires large listed and private companies to assess and disclose the resilience of their business model under a range of plausible climate scenarios as part of their mandatory sustainability reporting requirements. Scenario analysis can be complex and may require cross-functional collaboration, expert input, and new modelling capabilities. Early action in this area allows time to refine assumptions and build confidence in your projections.

Get GHG-ready

Greenhouse gas emissions data will be central to AASB S2 disclosures. Establish systems to track and measure Scope 1, Scope 2, and Scope 3 emissions, and ensure that your data collection processes are governed by robust internal controls. This is particularly important given the growing scrutiny on emissions reporting and the connection between emissions profiles and business risk. Strong GHG reporting practices will also support alignment with future legislation, including mandatory climate reporting within the framework of Australian standards, and voluntary ESG commitments.

Review strategy

Evaluate how climate-related risks and opportunities are embedded within your strategic planning and risk management frameworks. AASB S2 encourages businesses to show how climate considerations influence decision-making and capital allocation. Aligning your sustainability objectives with your core business model demonstrates long-term resilience and provides stakeholders with insight into how your company is managing transition and physical risks.

Boards should play an active role in overseeing these strategic responses, ensuring that non-financial assets are accurately represented in financial statements according to the new accounting standards. This includes accounting for right-of-use assets similar to other non-financial assets, which is crucial for the recognition and measurement of grants related to the construction or acquisition of such assets.

Prepare additional disclosures

In addition to the climate-specific requirements, AASB S2 may require companies to disclose new types of information within their financial reports. This could include changes to asset valuations, liability recognition, or revenue assumptions affected by climate risk. Begin working with your finance team to identify where such impacts could arise. Transparency in these areas builds trust and ensures your financial statements meet both AASB and broader investor expectations.

Resources will be vital in supporting companies through this transition. Guidance from the AASB and other professional bodies can help address common questions, clarify how to apply the legislation in practice, and provide templates and examples to support consistent application. Whether through internal teams, consultants, or ESG software providers, organisations should ensure they have access to the tools and expertise needed to meet the objectives of AASB S2.

How can ESG software support businesses to report climate related financial disclosures in line with AASB S2?

A reliable ESG reporting platform can significantly streamline your path to compliance. ESG software can:

- Automate data collection and tracking of climate metrics, including emissions

- Ensure consistency across business units and reporting periods

- Enable real-time insights and benchmarking

- Facilitate scenario planning and transition plan modelling

- Provide templates aligned with AASB S2 requirements

- Support audit and assurance processes with robust documentation and traceability

- Track and report on financial instruments

Additionally, a full audit opinion will be necessary for climate disclosures starting from July 2030, emphasizing the role of auditors in ensuring compliance with AASB S2.

In summary

the AASB S2 standard represents a key step in Australia’s rapidly evolving reporting landscape. It sets clear mandatory requirements for climate-related financial disclosures, helping businesses align with global frameworks while addressing local regulatory needs. As proposals and guidance continue to develop, organisations should stay informed and proactive to ensure compliance and transparency in their sustainability reporting.