Australia is entering a new era of corporate transparency with the introduction of mandatory sustainability reporting standards. The Australian Sustainability Reporting Standards (ASRS) set the foundation for how businesses will disclose climate-related risks, strategies, and impacts. These standards, aligned with international frameworks such as IFRS S1 and IFRS S2, are reshaping reporting in Australia for listed and large entities alike.

Australian Sustainability Reporting Standards (ASRS) – What businesses need to know

What are the ASRS?

The Australian Sustainability Reporting Standards (ASRS) form the foundation of Australia’s new climate-related financial disclosure framework. Developed by the Australian Accounting Standards Board (AASB), the ASRS are designed to align Australia’s corporate sustainability reporting with international best practices, and are part of a global movement towards consistent disclosure standards. This positions the ASRS within a broader set of international and regional disclosure standards, particularly those established by the International Sustainability Standards Board (ISSB).

The ASRS currently comprises two standards:

- AASB S1 General Requirements for Disclosure of Sustainability-related Financial Information – a voluntary standard.

- AASB S2 Climate-related Disclosures – a mandatory standard.

How do the ASRS relate to the ISSB?

The ASRS are closely aligned with the international standards issued by the International Sustainability Standards Board (ISSB). Specifically:

- AASB S1 incorporates the general requirements for disclosure found in IFRS S1, enabling Australian entities to report sustainability-related financial information consistently with international expectations.

- AASB S2 is aligned with IFRS S2 on climate-related disclosures and includes selected content from AASB S1 to function as a standalone standard.

Both frameworks establish comprehensive requirements for sustainability disclosures, setting out the standards, regulations, and timelines for verifying sustainability reports and climate disclosures under Australian and international legislation.

One notable difference is that AASB S1 is voluntary, whereas IFRS S1 is intended as a global baseline. Additionally, AASB S2 does not require the use of industry-specific metrics such as those found in the SASB Standards.

By aligning with the ISSB, the ASRS supports comparability and enhances the credibility of reporting in Australia for global investors and regulators.

What has been the timeline for implementation?

Australia’s sustainability reporting framework officially came into effect following the passage of the Treasury Laws Amendment (Financial Market Infrastructure and Other Measures) Act 2024 in September 2024. This legislation mandates sustainability-related disclosures for certain entities under the Corporations Act.

The first ASRS were issued in September 2024, and the mandatory climate-related disclosures apply to financial years beginning on or after 1 January 2025. These new requirements apply to specific reporting periods and will form part of entities’ annual reporting obligations, ensuring compliance with mandatory reporting standards.

Key milestones:

- September 2024: Royal Assent of the Act and release of AASB S1 and AASB S2.

- January 2025: Commencement of the mandatory disclosure requirements, with phased introduction of mandatory reporting for climate and sustainability disclosures based on reporting periods.

- April 2025: ASIC published its regulatory guide, providing clarification on how to apply the standards.

- July 2030: Target date for achieving full reasonable assurance for all climate-related disclosures.

Which businesses are impacted by the ASRS?

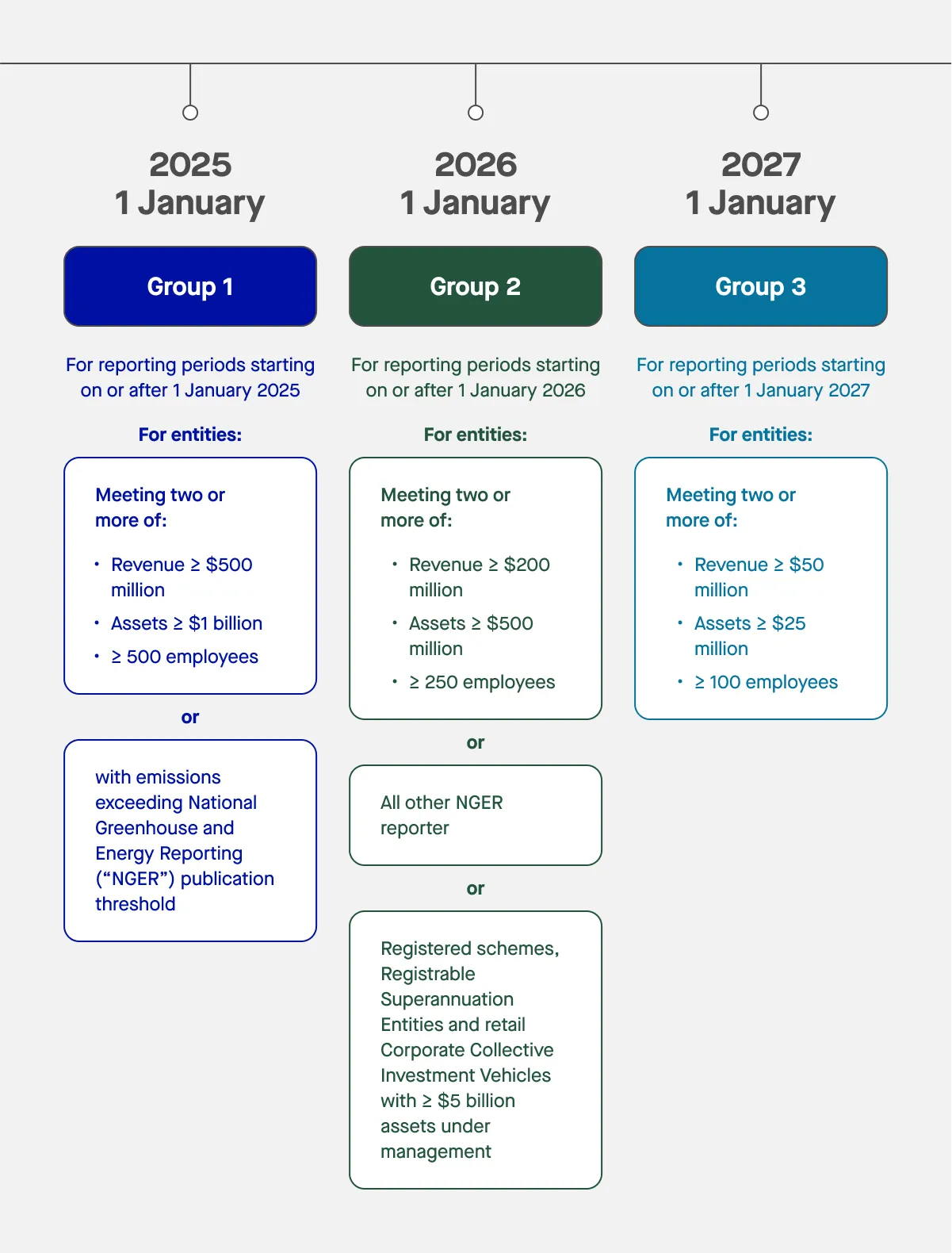

The ASRS applies to entities with reporting obligations under Chapter 2M of the Corporations Act, provided they meet prescribed thresholds relating to size, revenue, assets, or emissions. To manage the rollout of mandatory sustainability reporting, entities are classified into three groups based on their scale and significance:

Group 1: Large entities (reporting from 1 January 2025)

Group 1 entities are the largest organisations and are required to commence sustainability reporting earliest. These include:

- Large listed companies: Publicly traded entities listed on the Australian Securities Exchange (ASX) that meet size and emissions thresholds.

- Asset owners: Superannuation funds, sovereign wealth funds, and other institutional investors managing large portfolios.

- Financial institutions: Major banks, insurance companies, and other regulated financial service providers.

- Other large entities: Organisations meeting specific thresholds set in the legislation relating to consolidated revenue, assets, or number of employees.

Reporting Start Date: Financial years beginning on or after 1 January 2025 (e.g. 31 December 2025 or 30 June 2026 year-ends).

Group 2: Medium-sized entities (reporting from 1 January 2026)

Group 2 includes entities that are smaller than Group 1 but still significant in terms of financial size or climate-related impact.

Reporting Start Date: Financial years beginning on or after 1 January 2026.

Group 3: Smaller entities within scope (reporting from 1 January 2027)

Group 3 captures the smallest of the in-scope entities under the framework. These businesses are provided additional time to prepare for compliance.

Reporting Start Date: Financial years beginning on or after 1 January 2027.

Additional notes:

- The thresholds for inclusion in each group are detailed in the Corporations Act 2001 and accompanying regulations.

- The standards apply to both for-profit and not-for-profit entities.

- Timing of first reporting depends on an entity’s financial year-end (e.g. 31 December or 30 June).

- An entity’s reporting classification directly impacts the scope, timing, and assurance level of its climate-related disclosures.

What do in-scope businesses need to report?

Entities within the scope of AASB S2 must disclose detailed information about their climate-related risks, opportunities, strategies, and financial impacts. Key requirements include:

- Climate-related financial disclosures aligned with four core pillars:

- Governance

- Strategy

- Risk management

- Metrics and targets

- Use of climate scenario analysis involving at least two prescribed scenarios to assess climate risk and resilience.

- Disclosure of Scope 1, Scope 2, and in many cases Scope 3 greenhouse gas emissions.

- Explicit requirement to disclose information on Scope 3 emissions as part of climate reporting, in line with new sustainability standards and legislation.

- Details of transition plans and climate targets.

- Integration of disclosures into the sustainability report, which must be included in the entity’s financial reports and lodged with ASIC.

Entities must identify and disclose both risks and opportunities, as well as related risks and opportunities, in accordance with the standards. Sustainability related risks must also be assessed and disclosed as part of the reporting process.

The assurance requirements will be phased in over time, ultimately requiring reasonable assurance for climate disclosures from 1 July 2030. Sustainability assurance, auditing and assurance, and the Assurance Standards Board (ASB) play a key role in setting and overseeing assurance standards for sustainability disclosures, ensuring compliance with Australian legislation and enhancing the credibility of climate reporting.

How can ESG software help?

As the ASRS brings complexity and new obligations, ESG software can play a vital role in supporting businesses to meet their reporting requirements efficiently and accurately. ESG platforms can assist with:

- Data collection and management: Automating the gathering of emissions, energy usage, and other sustainability data.

- Scenario analysis: Running climate models in line with ASRS expectations.

- Report generation: Producing compliant sustainability reports that align with AASB S2 requirements.

- Audit and assurance readiness: Maintaining traceable, verifiable records for internal and external assurance.

- Stakeholder engagement: Providing dashboards and insights that support communication with investors, regulators, and the public.

The right ESG software solution can significantly reduce the burden on internal teams and improve the accuracy and consistency of disclosures.

Final thoughts

With mandatory sustainability reporting now a legal requirement for many Australian businesses, the introduction of the ASRS marks a major shift in corporate transparency and accountability. Companies that start preparing now will be better positioned to manage the transition, build trust with stakeholders, and demonstrate climate resilience.

Whether you’re a large listed entity or a not-for-profit preparing for phased reporting, understanding the ASRS and embedding ESG capabilities into your reporting processes will be key to long-term success.

For tailored support and guidance on how your organisation can prepare for ASRS compliance, it’s worth consulting with ESG advisors and leveraging purpose-built reporting tools that align with the new standards.

Sweep can help

Sweep is a carbon and ESG management platform that empowers businesses to meet their sustainability goals.

Using our platform, you can:

- Conduct a thorough assessment of your carbon footprint.

- Get a real-time overview of your supply chain and ensure that your suppliers meet your sustainability targets.

- Reach full compliance with the CSRD and other key ESG legislation in a matter of weeks.

- Ensure your sustainability information is reliable by having it verified by a third party before going public.