Turn carbon risk into portfolio strength

Build more resilient and higher-performing portfolios

Transform messy data into trusted insights you can report and act on.

Stay ahead of regulation and shrunk compliance risk with a flexible tool.

Make well-informed decisions: identify hot spots, modelize scenarios, and track your targets.

Sweep’s integrations fit into all your existing workflows, systems, and infrastructure.

Managing financed emissions in 6 steps

Download our guide and discover the 6 essential steps to take back control of your emissions

Sweep powers stronger, more resilient portfolios

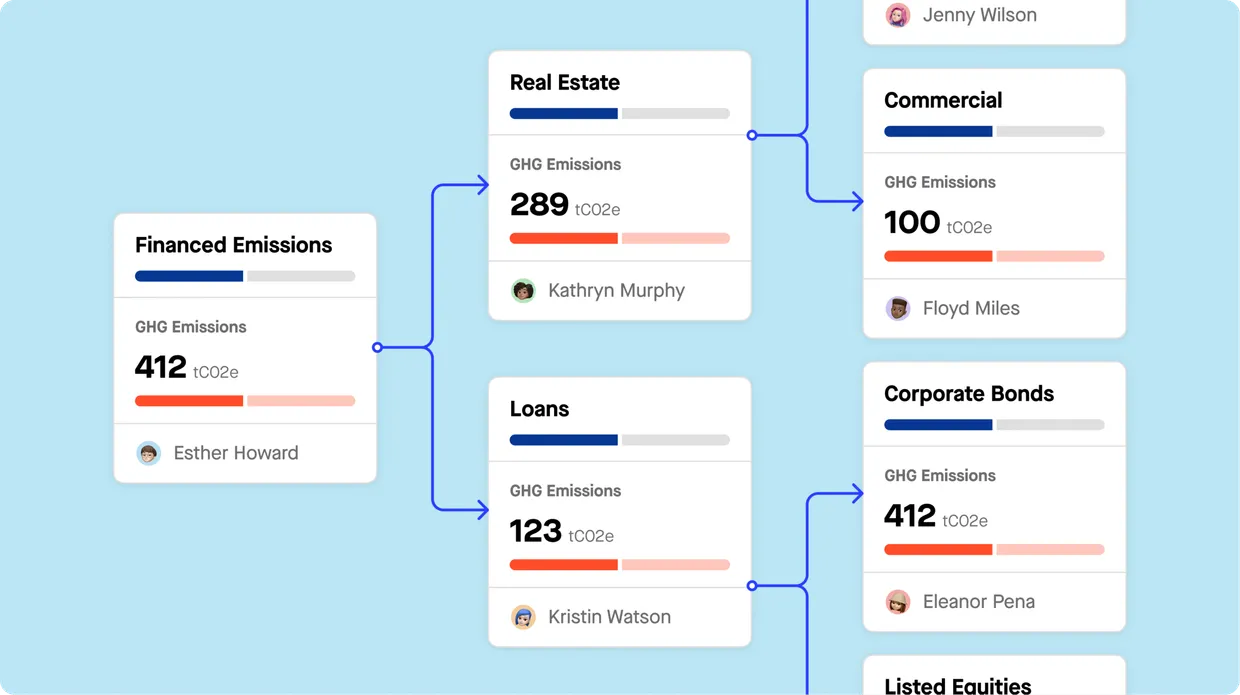

Manage portfolio data in one place

Track, organize, and control your financed emissions data in a single platform.

- Map your entire investment portfolio (funds, companies, and assets) directly in Sweep

- Use sector benchmark data to fill gaps, identify carbon hotspots, and inform risk-adjusted strategies

- Access ready-to-use surveys, templates, and methodologies backed by Sweep’s in-house carbon expertise

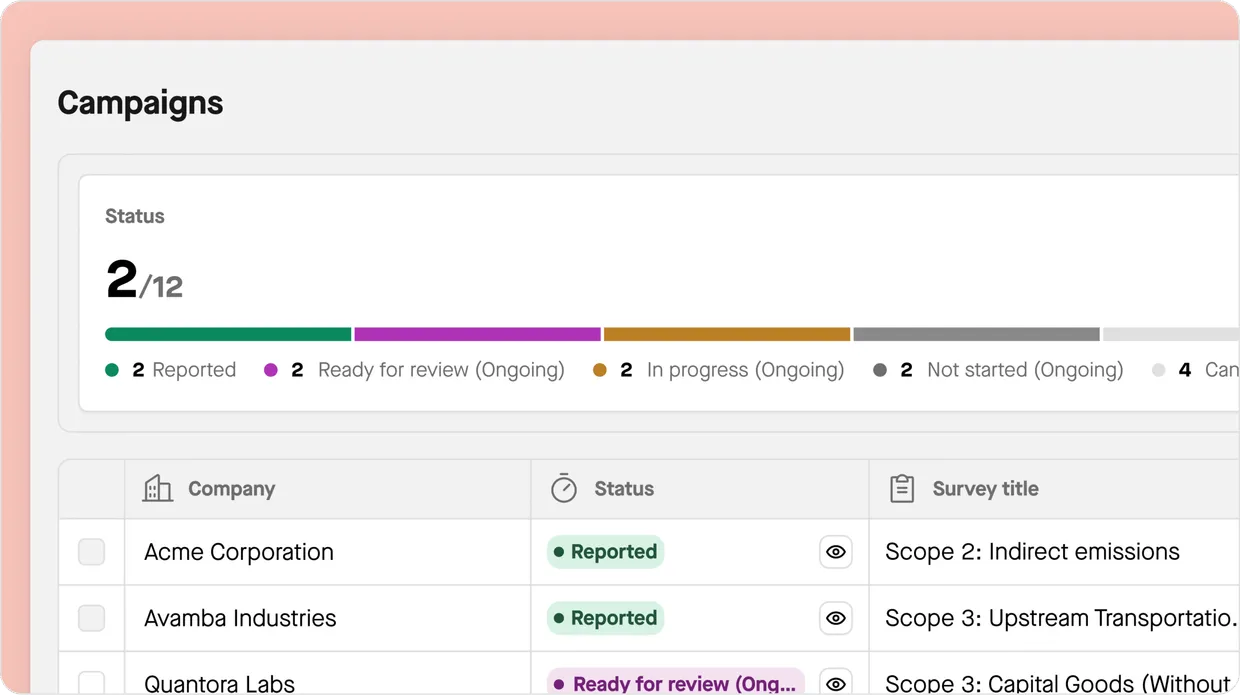

Directly engage your portfolio

Work directly with your investments to get better data and move toward shared goals.

- Invite investees to complete surveys through their own accounts so they can track their performance

- Get real-time visibility into survey campaigns, including response rates, completion progress, and performance insights

- Support and collaborate with your investees to reduce their carbon impact and protect long‑term value

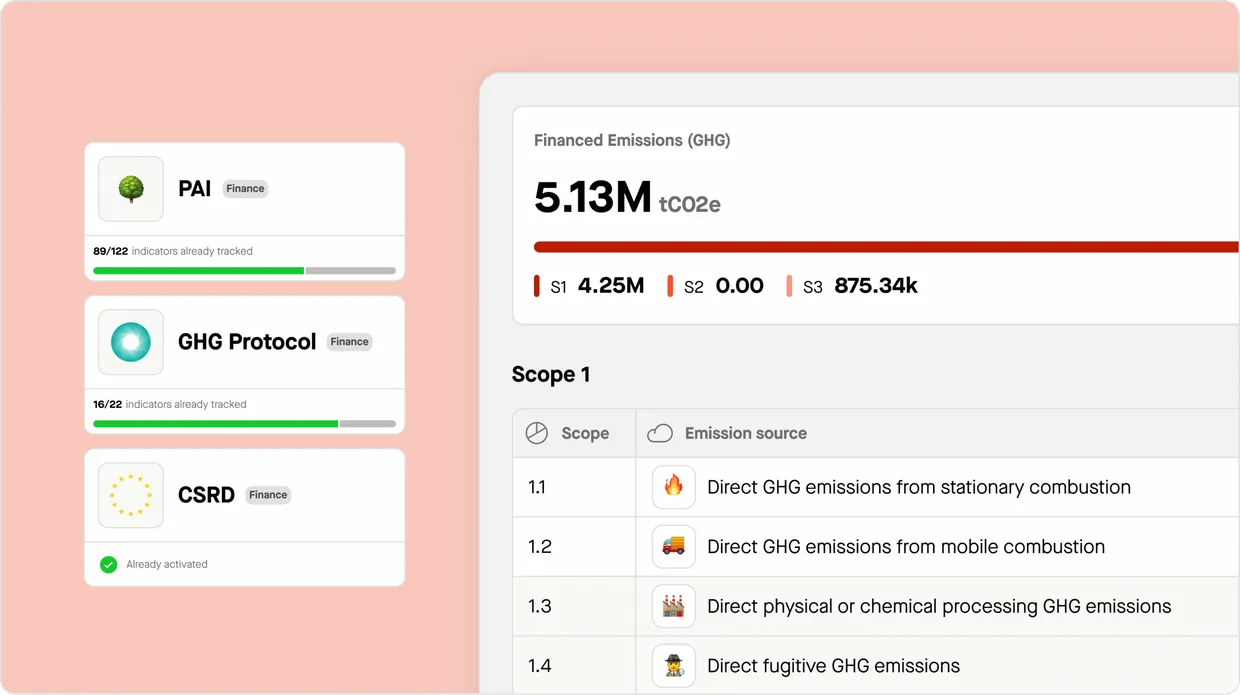

Stay aligned with market standards

Get built‑in support for key market frameworks.

- Aligned with PCAF methodology and GHG Protocol for financed emissions reporting

- Go further with reporting support for CSRD, SFDR, EDCI, and more

- Collect emissions data once and reuse it across multiple standards, saving time, resources, and capital

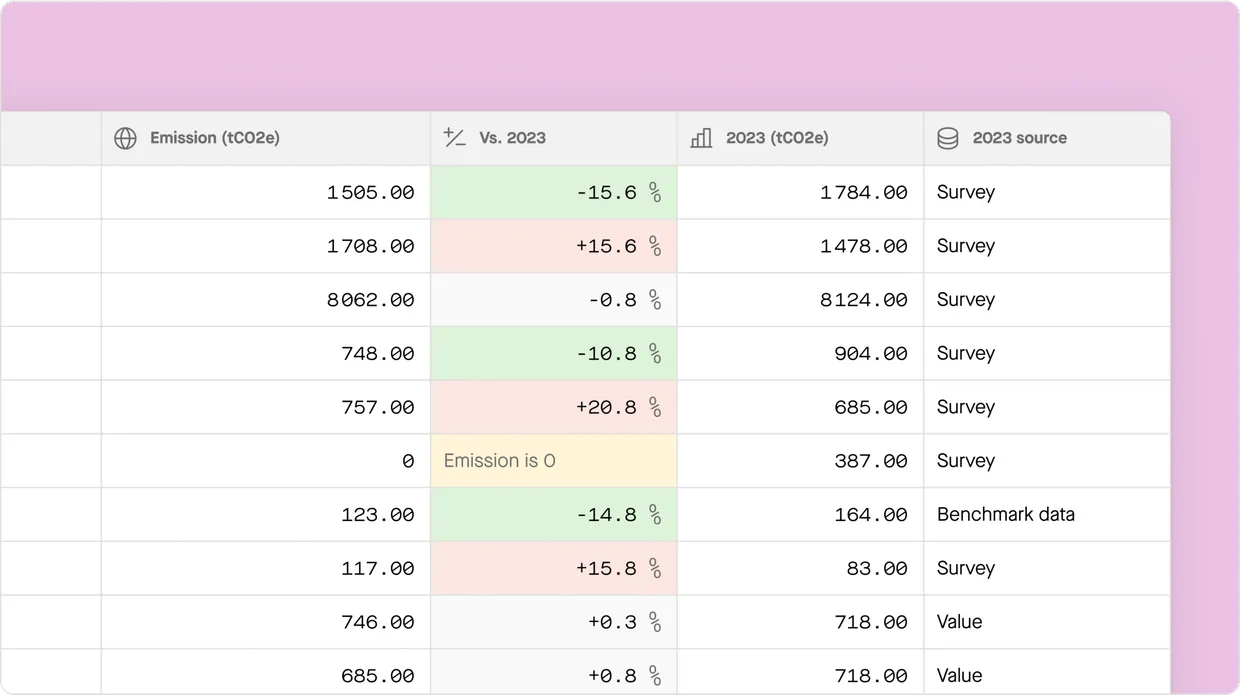

Get clear, actionable data

Obtain single source of truth for your financed emissions data.

- Break down emissions on a granular level, with full traceability and clear sourcing

- Measure investee progress with year-over-year trends and sector-specific benchmarks

- Generate audit‑ready, regulator‑ready reports for internal teams, investors, and financial stakeholders

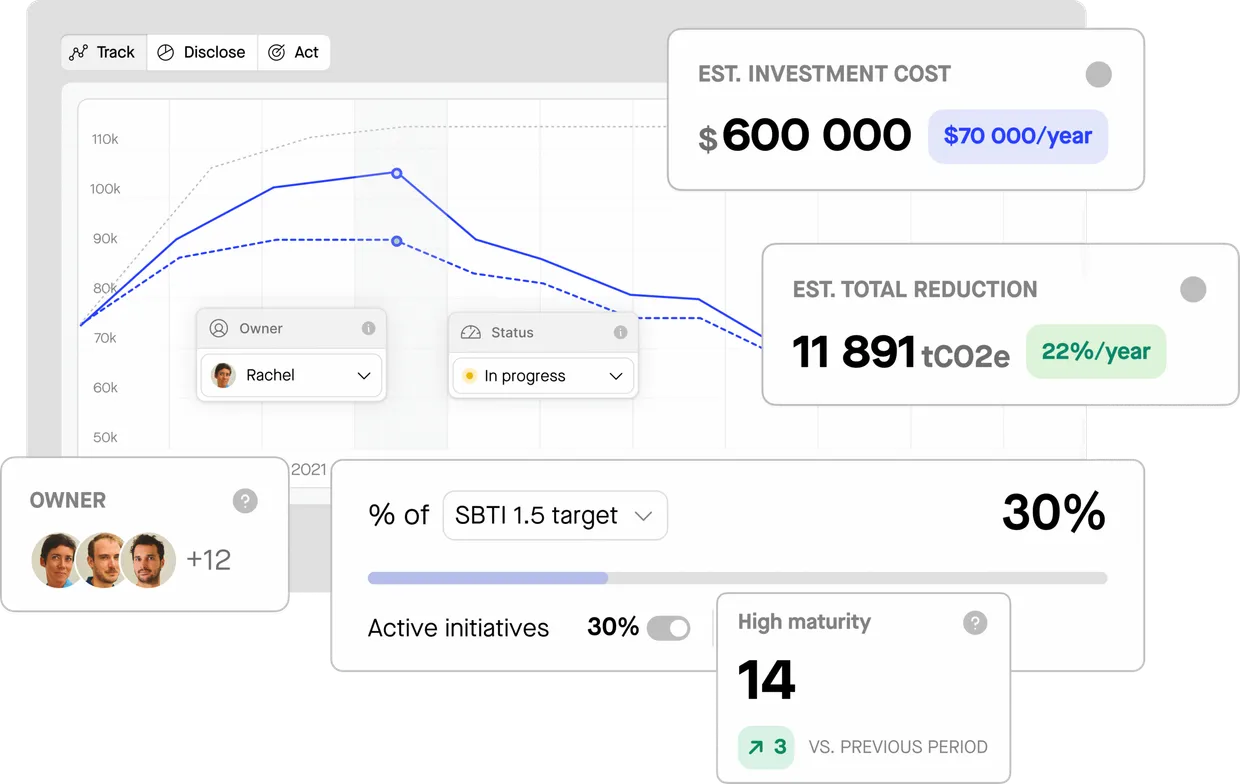

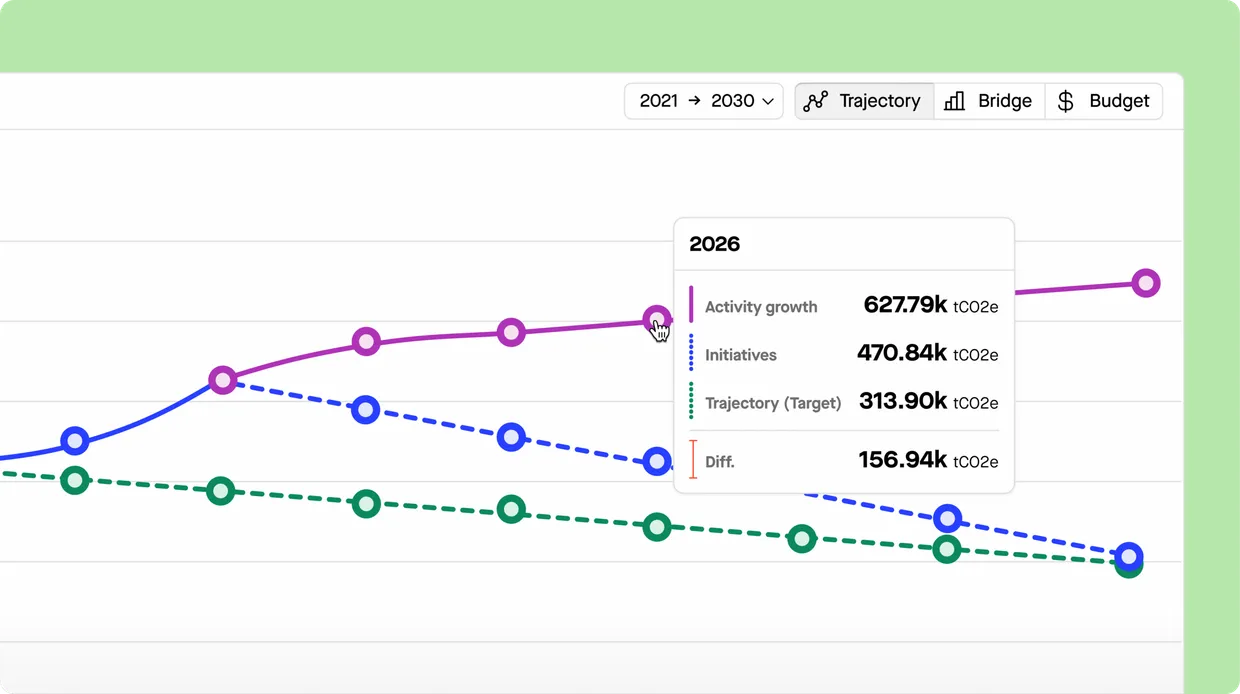

Track progress and manage risk

Stay on course toward your targets and surface emerging risks early.

- Monitor and share portfolio progress in real time with interactive dashboards

- Run scenario analysis, set strategic plans, and identify climate risks early

- Use AI-driven recommendations to guide investment strategy and capital allocation decisions

_ZgacEM.webp)