What is AASB S1?

AASB S1 provides a general-purpose framework for sustainability-related financial disclosures. It is intended to be used alongside financial statements to ensure users of financial reports have a clearer understanding of how environmental, social, and governance issues impact a business’s financial position and strategy.

It draws heavily from the global baseline established by the International Sustainability Standards Board (ISSB), promoting alignment between Australian and international sustainability reporting standards. AASB S1 also supports scenario-based reporting, including climate scenario analysis, to assess exposure to emerging material climate risks.

Who does AASB S1 apply to?

AASB S1 is currently a voluntary standard, but it is intended for wide application across:

- For-profit and not-for-profit organisations

- Listed and unlisted companies

- Financial institutions and superannuation funds

- Public sector and government agencies

As Australia moves toward a more regulated sustainability regime, early adoption of AASB S1 helps organisations prepare for future sustainability reporting obligations and align with investor expectations for transparency and accountability.

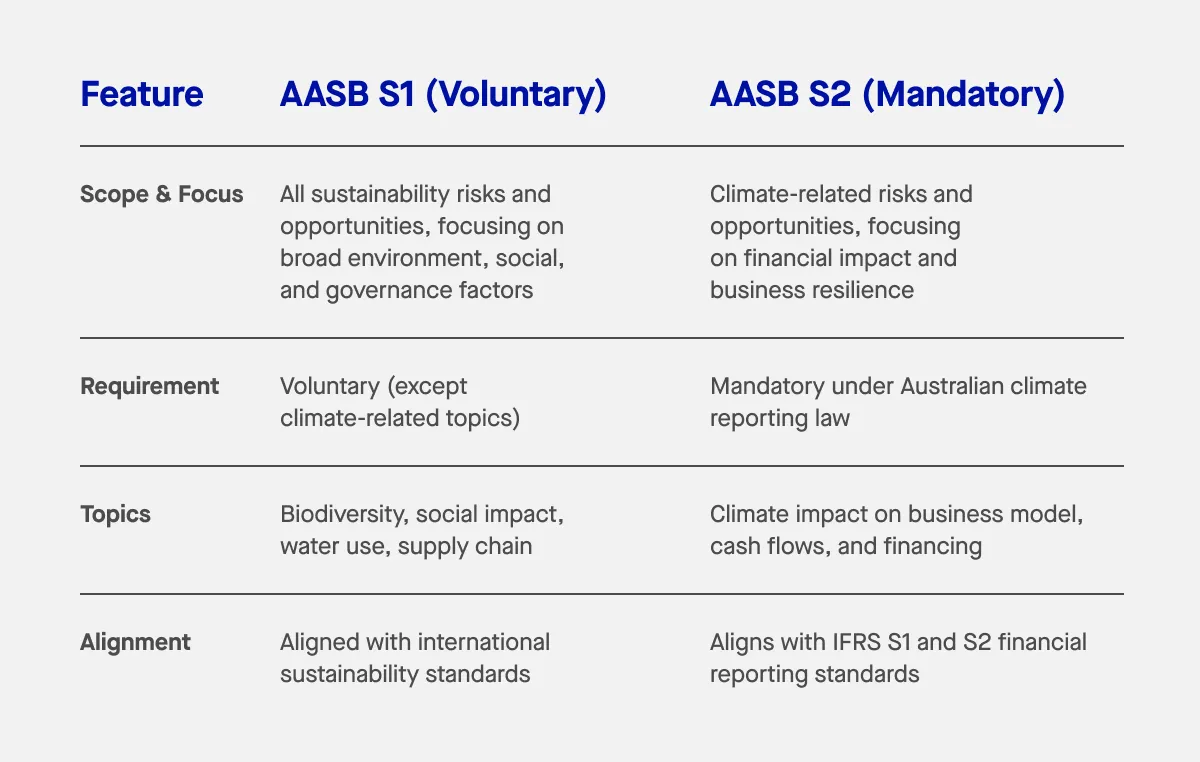

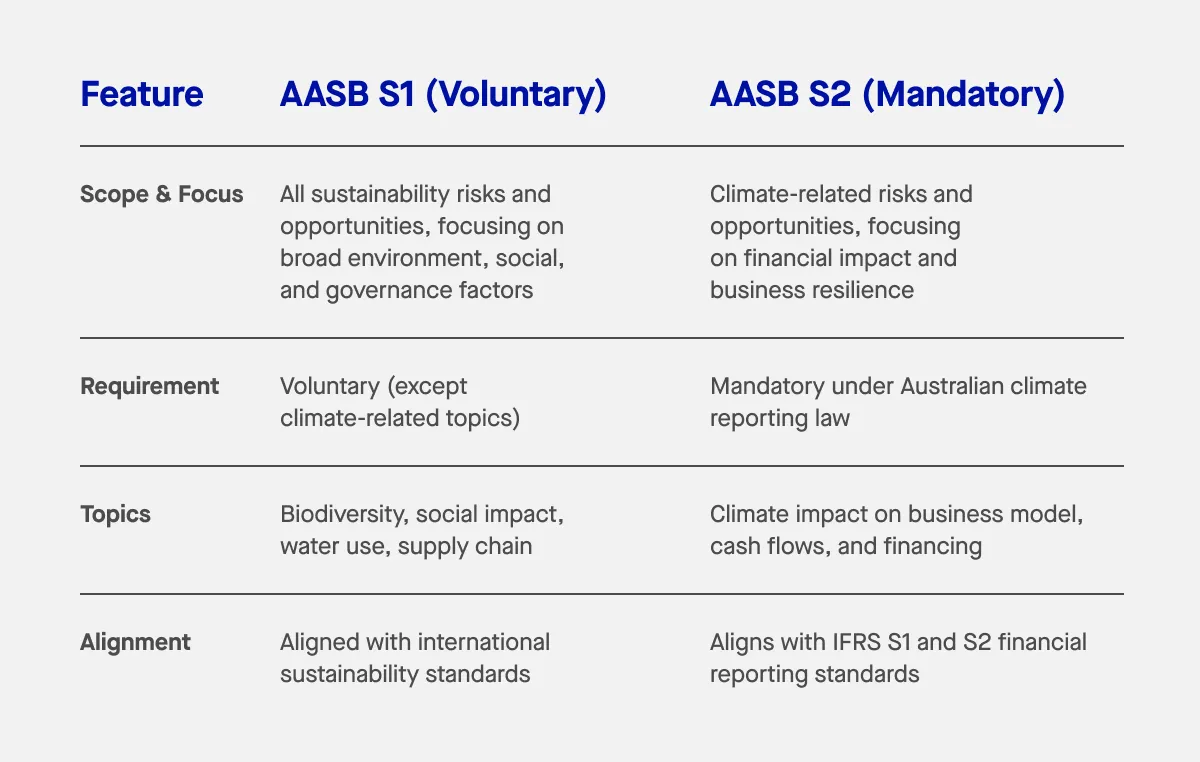

What is the difference between AASB S1 and S2?

AASB S1 is a voluntary standard that establishes general principles for preparing sustainability-related financial disclosures. It outlines how organisations should identify and disclose material climate related risks and opportunities that could affect their financial reporting, including the entity’s prospects, cash flows, or enterprise value. It applies to a wide range of entities, including financial institutions, not-for-profit entities, and businesses of all sizes.

AASB S1 is based on the comprehensive global baseline provided by the International Sustainability Standards Board (ISSB), specifically IFRS S1. It encourages entities to disclose industry-based metrics, adopt strong governance processes, and integrate sustainability matters into their risk management and decision-making frameworks. It is applicable for organisations that want to enhance their transparency and align with investor expectations, even if they are not yet subject to mandatory climate reporting.

In contrast, AASB S2 is a mandatory standard for certain entities and focuses specifically on climate-related financial disclosures. It draws from IFRS S2 and requires companies to disclose how climate-related risks and opportunities affect their strategy, resilience, and financial position. AASB S2 applies to financial years beginning on or after 1 January 2025 (for Group 1 in scope entities) and includes specific requirements such as:

- A climate statement for the year

- Disclosure of Scope 1, Scope 2, and eventually Scope 3 emissions

- Use of climate scenario analysis

- A qualitative and (where relevant) quantitative assessment of the company’s resilience to climate change

- Detailed transition planning

- Connections to related financial statements

While AASB S1 provides the overarching framework for all sustainability disclosures, AASB S2 operationalises climate-specific requirements. Businesses preparing for AASB S2 will likely need to conduct a gap analysis to assess how their current disclosures align with the standard’s requirements, especially if they’ve been reporting under a different framework.

In summary:

- AASB S1 is a voluntary standard for broader sustainability-related financial disclosures

- AASB S2 is a mandatory climate reporting standard for certain entities

- AASB S1 provides the structure; AASB S2 applies it to climate

- Both standards are meant to complement existing financial reporting and ensure users receive a complete picture of sustainability risks and their financial impact

What is the AASB implementation timeline?

The AASB has introduced a phased rollout of sustainability reporting standards, beginning with AASB S2 on climate-related financial disclosures. Mandatory reporting will be introduced in stages:

- Group 1: Annual reporting periods beginning on or after 1 January 2025

- Group 2: Annual reporting periods beginning on or after 1 July 2026

- Group 3: Annual reporting periods beginning on or after 1 July 2027

This timeline aligns with financial year reporting and is designed to ensure compatibility with general purpose financial reports and existing accounting policies. The same reporting entity must apply these standards consistently to build trust and comparability across disclosures.

How does the AASB S1 relate to other international standards?

AASB S1 does not exist in isolation. It is built to align with global sustainability reporting frameworks and reinforce international consistency. Its connections include:

- ISSB: AASB S1 draws directly from the ISSB’s IFRS sustainability disclosure standards (notably IFRS S1), which aim to unify sustainability reporting globally and support investor decision-making.

- GRI: While GRI standards are broader and voluntary, AASB S1 can complement them by adding financial materiality to double materiality reporting practices.

- TCFD: Many of the structural requirements in AASB S1—such as governance, strategy, and risk management—mirror the Task Force on Climate-related Financial Disclosures (TCFD) recommendations, especially for climate-related risks and opportunities.

- CSRD: The EU’s Corporate Sustainability Reporting Directive (CSRD) is more expansive but shares AASB’s commitment to integrating sustainability and financial reporting. AASB S1 prepares Australian companies operating internationally to meet or map to CSRD obligations.

This alignment helps entities reduce duplication, build globally relevant sustainability reports, and ease the transition into sustainability assurance engagements, which are expected to become more common.

Five steps to prepare for AASB S1

Understand your material sustainability issues

The first step is to assess which sustainability-related risks and opportunities are most material to your business. These include environmental concerns, labour practices, supply chain resilience, and governance standards. Businesses must evaluate how these factors could influence their financial performance, investor perception, or legal exposure.

Materiality assessments should be updated regularly to reflect dynamic business environments and stakeholder expectations. They should also consider the implications of material climate risks on business continuity and reputation.

Build internal capacity and cross-functional alignment

Adopting AASB S1 will require collaboration across functions. ESG teams, finance, risk, legal, and operations must coordinate to ensure accurate and relevant disclosures. Risk management processes must incorporate sustainability risks to meet disclosure requirements under AASB S1 and AASB S2.

Leadership buy-in is essential. Appoint sustainability champions within your organisation, develop a reporting strategy, and ensure that your board is actively involved in governance of sustainability reporting.

Establish robust data systems and define reporting boundaries

High-quality reporting depends on credible data. Organisations should define their reporting boundaries, establish emissions tracking (Scopes 1, 2, and 3), and integrate sustainability metrics into financial reporting systems.

Aligning ESG data collection with internal audit protocols helps prepare for future assurance and regulatory scrutiny, including sustainability assurance engagements as part of treasury laws amendment proposals in development.

Align with global sustainability frameworks

To meet stakeholder and regulatory expectations, businesses should benchmark their disclosures against international best practices. These include the IFRS sustainability disclosure standards, GRI, TCFD, and the CSRD.

Aligning early reduces future compliance burdens and makes it easier to adapt to mandatory reporting requirements as sustainability expectations grow globally.

Start disclosing—even if partially

Early disclosures build confidence. Even if your data is not yet complete, publishing partial sustainability reports can help demonstrate transparency, build internal momentum, and identify improvement areas. Start building sustainability into your strategy and business model, and expand over time.

Consistency between financial and non-financial reporting builds trust. AASB S1 encourages disclosures that clearly link sustainability risks to financial outcomes, such as impacts on an entity’s cash flows or capital allocation.

How can ESG software support AASB S1 reporting?

Implementing AASB S1 and preparing for AASB S2 can be complex. ESG reporting software can streamline this process by:

- Automating data collection across departments and subsidiaries

- Standardising metrics aligned with AASB and international frameworks

- Enabling climate scenario analysis to model potential impacts

- Supporting robust risk management processes

- Generating audit-ready reports for boards, investors, and regulators

Software solutions reduce reporting burdens and improve consistency, helping businesses meet current voluntary standards and prepare for upcoming mandatory climate reporting requirements.

Preparing for mandatory sustainability reporting

AASB S1 is more than a reporting guideline—it’s a strategic tool that integrates sustainability into the core of financial performance. It enables businesses to communicate how sustainability-related risks and opportunities affect their operations, long-term value, and investor outlook.

As Australian sustainability reporting evolves toward mandatory frameworks, early adopters of AASB S1 will be best positioned to meet disclosure requirements under AASB S2, align with global standards, and provide meaningful sustainability reports that go beyond compliance.

Preparing now ensures businesses are not reacting to change, but leading it.