What is the ISSB? A quick recap

The International Sustainability Standards Board (ISSB) was established by the IFRS Foundation in 2021 during COP26. Following its formation, the ISSB Chair and Vice Chair were appointed, with Sue Lloyd named as Vice Chair, to lead the development of the ISSB’s sustainability standards and oversee its organizational structure.

The IFRS Foundation announced the formation of the ISSB and the appointment of its leadership, and the ISSB published its initial disclosure standards as key milestones in its development.

The ISSB brings together and builds on pre-existing frameworks, such as the Sustainability Accounting Standards Board (SASB), TCFD, and Integrated Reporting, consolidating them into a coherent global baseline. These standards aim to reduce the fragmentation in the sustainability reporting landscape and improve transparency across markets.

What is IFRS S1 and IFRS S2?

The ISSB’s standards are structured around two core disclosure frameworks: IFRS S1 and IFRS S2. These are formally known as IFRS Sustainability Disclosure Standards and are part of the broader landscape of global sustainability disclosure standards.

The purpose of these standards is to provide a consistent and comprehensive approach to sustainability-related disclosures. They are designed to support the needs of investors and the financial markets by ensuring that sustainability information is integrated into financial reporting, enabling informed investment decisions.

When aligning with existing frameworks, the ISSB’s standards are built to be compatible with IFRS accounting standards, ensuring that sustainability disclosures are relevant and comparable within established financial reporting systems.

This standard requires companies to report on material sustainability-related risks and opportunities that could affect their cash flows, access to finance, or cost of capital. IFRS S1 sets out the general requirements for preparing and reporting sustainability-related financial disclosures. IFRS S1 outlines specific disclosure requirements for sustainability information and sustainability-related financial information, ensuring that companies provide transparent and relevant data in line with global standards. It draws heavily from the SASB framework and supports a sector-agnostic, principles-based approach.

Key elements of IFRS S1 include:

- Sustainability-related risks and opportunities

- Governance and risk management processes

- Strategic approach and metrics

- Industry-specific guidance based on materiality

These disclosure requirements are designed to ensure that companies provide comparable information and globally comparable information, supporting investor analysis and decision-making. Companies are also expected to disclose information that could affect the company’s prospects, helping stakeholders understand the potential impact of sustainability factors on future performance.

IFRS S2 is built on the TCFD framework and specifically focuses on climate-related risks and opportunities. It addresses the impact of climate change on business operations and reporting. It mandates detailed disclosures on:

- Governance of climate-related risks

- Strategy and scenario analysis

- Risk management processes

- Metrics and targets, including Scope 1, 2, and 3 emissions

Companies are also required to set and disclose climate related targets and transition plans, ensuring their climate strategies are transparent and aligned with IFRS S2 standards.

The Financial Stability Board played a key role in the development of climate-related disclosure frameworks, such as the TCFD, which informed the creation of IFRS S2.

Together, IFRS S1 and S2 provide a comprehensive view of a company’s sustainability profile—both generally and specifically regarding climate.

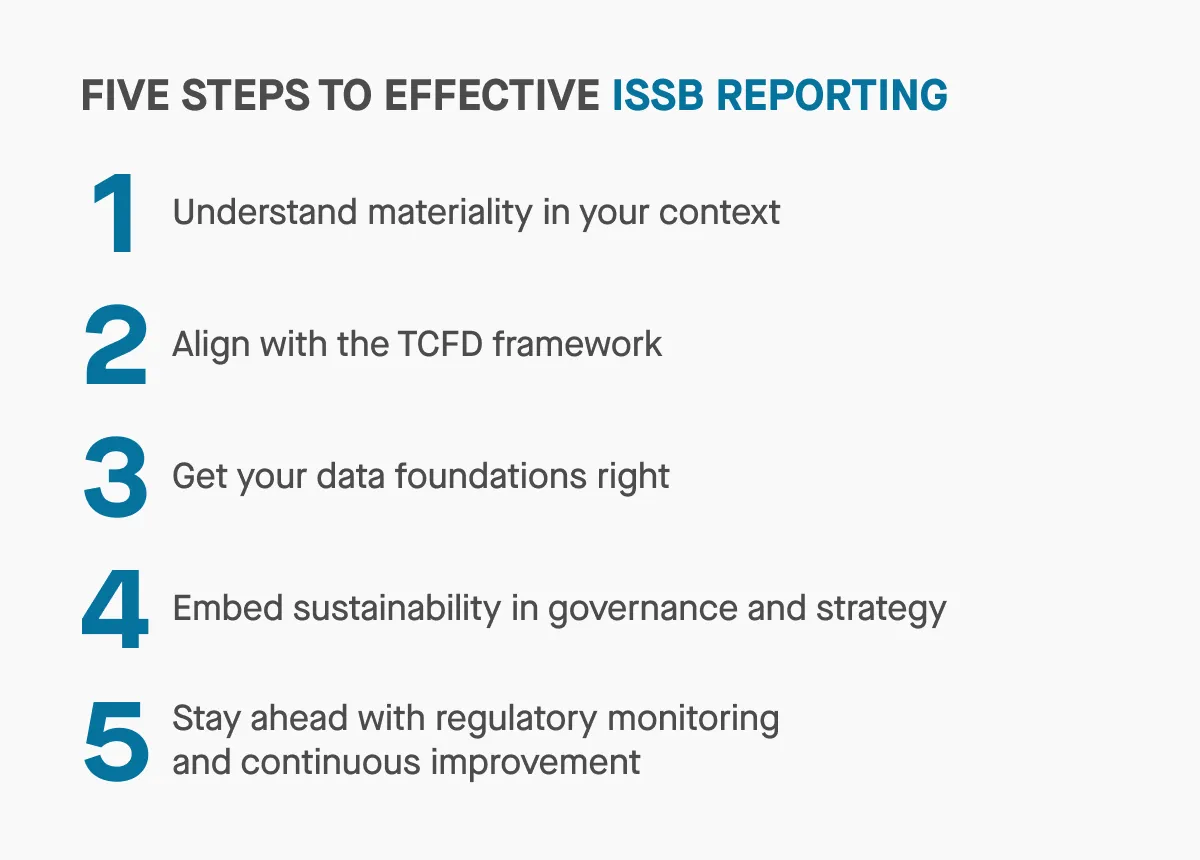

What are the five steps to effective ISSB reporting?

To help your business prepare for and comply with ISSB requirements, we’ve outlined five practical tips that cover everything from internal alignment to data systems. Widespread adoption of ISSB standards is being encouraged by finance ministers, central bank governors, and international organizations, reflecting strong global support for improved sustainability disclosures. Additionally, jurisdiction specific requirements and the involvement of securities commissions are shaping how ISSB standards are implemented across different regions.

1. Understand materiality in your context

The ISSB adopts a single materiality approach—meaning the focus is on how sustainability matters affect enterprise value. Materiality is determined by what could influence investor decisions, ensuring that disclosures provide information relevant for capital allocation. This is distinct from the double materiality approach used in the EU’s CSRD, which also considers the company’s impact on people and the planet. While the ISSB standards primarily focus on investors, they are also designed to meet the information needs of broader stakeholder groups, including regulators and the general public.

To comply with ISSB standards:

- Conduct a materiality assessment specific to your sector and operations.

- Identify risks and opportunities that influence financial performance.

- Engage internal stakeholders, including finance, risk, and sustainability teams.

A well-structured materiality analysis ensures your disclosures are focused, relevant, and aligned with investor expectations.

2. Align with the TCFD framework

Because IFRS S2 closely mirrors the Task Force on Climate-related Financial Disclosures (TCFD) structure, companies already reporting under TCFD have a head start. If not, now is the time to align.

Make sure you:

- Structure disclosures around Governance, Strategy, Risk Management, and Metrics & Targets.

- Assess climate resilience through scenario analysis.

- Report clearly on Scope 1, 2, and 3 emissions, and explain your methodology.

Following the TCFD framework prepares you not only for IFRS S2, but also for wider investor scrutiny and regulatory alignment.

3. Get your data foundations right

ISSB reporting demands accurate, traceable, and auditable data. It’s not enough to publish estimates; companies need to ensure their data is investment-grade.

Focus on:

- Mapping internal data sources across business units and systems.

- Implementing processes for data collection, validation, and review. Digital taxonomies, including IFRS digital taxonomies developed and advised by the IFRS Taxonomy Consultative Group (ITCG), are essential for enabling standardized, high-quality sustainability data collection and reporting, ensuring information is comparable and aligned with IFRS Standards.

- Automating where possible to improve accuracy and reduce reporting burden.

You’ll need both quantitative data (e.g. GHG emissions) and qualitative insights (e.g. governance narratives), so ensure cross-functional collaboration from the start.

4. Embed sustainability in governance and strategy

ISSB reporting is not a side project—it needs to be part of your core business strategy and governance structure.

To meet the standards:

- Demonstrate board-level oversight of sustainability risks and performance.

- Integrate sustainability into business planning and risk management processes.

- Ensure executive remuneration policies and accountability reflect ESG objectives.

This embedded approach not only supports compliance but improves resilience and long-term planning.

5. Stay ahead with regulatory monitoring and continuous improvement

The ISSB standards are designed as a global baseline, but jurisdictions will tailor or add local requirements. For example, the UK, Canada, and Singapore are already working on incorporating ISSB into domestic reporting rules.

To stay on track:

- Monitor evolving regulatory guidance in the markets you operate in. Companies should also monitor exposure drafts and participate in comprehensive reviews of sustainability standards, including SASB Standards, to stay current.

- Schedule regular updates to reporting practices and disclosures.

- Benchmark against peers and global best practices.

Reporting should evolve with your business—and with the changing climate, stakeholder demands, and regulatory landscape.

How can ESG software support ISSB reporting?

Given the volume and complexity of sustainability data, ESG reporting software can be a crucial enabler of ISSB compliance. ESG software helps companies meet sustainability disclosure and sustainability reporting standards by streamlining data management and reporting, ensuring high-quality and comparable information for stakeholders.

Here’s how the right platform helps:

Centralised data management

Sustainability data often lives in spreadsheets or across fragmented systems. ESG software integrates financial, operational, and emissions data into one source of truth. This enables more consistent, scalable reporting across business units and geographies.

Built-in alignment with standards

Leading platforms are built with IFRS S1, IFRS S2, TCFD, and SASB requirements in mind, and also support alignment with the Global Reporting Initiative (GRI) and European Sustainability Reporting Standards (ESRS). Pre-set frameworks help you structure disclosures correctly from the start, reducing manual work and compliance risk.

Real-time insights and benchmarking

Track performance over time and compare against industry benchmarks. Software allows you to visualise progress on targets, such as emissions reduction or climate resilience, and identify areas for improvement.

Audit-ready traceability

With increasing regulatory and investor scrutiny, the ability to track the source and methodology behind every data point is critical. ESG tools support auditability through version control, data lineage, and documentation.

Scenario analysis and forecasting

Advanced platforms support scenario modelling, allowing you to assess climate risk exposure and test your resilience under various future conditions—essential for IFRS S2 compliance.

Final thoughts

ISSB reporting marks a major step toward global consistency and comparability in sustainability disclosures. For companies, it’s an opportunity to demonstrate transparency, build investor trust, and future-proof against regulatory shifts.

By focusing on materiality, aligning with TCFD, strengthening data quality, embedding sustainability in governance, and leveraging ESG software, businesses can meet ISSB standards with confidence—and use them to drive better outcomes.