What are the latest amendments post-Omnibus announcement?

Omnibus package and ESRS revisions

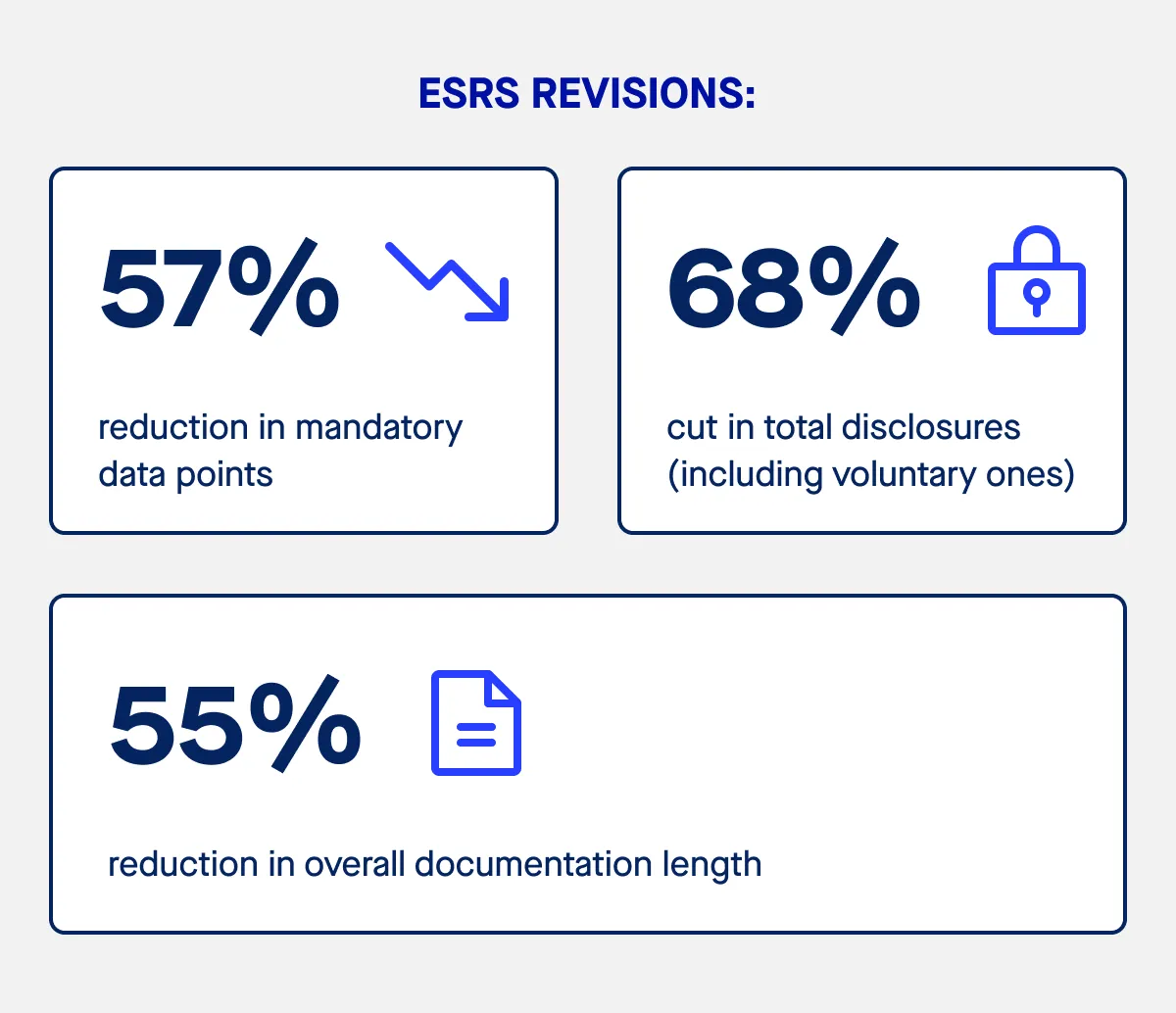

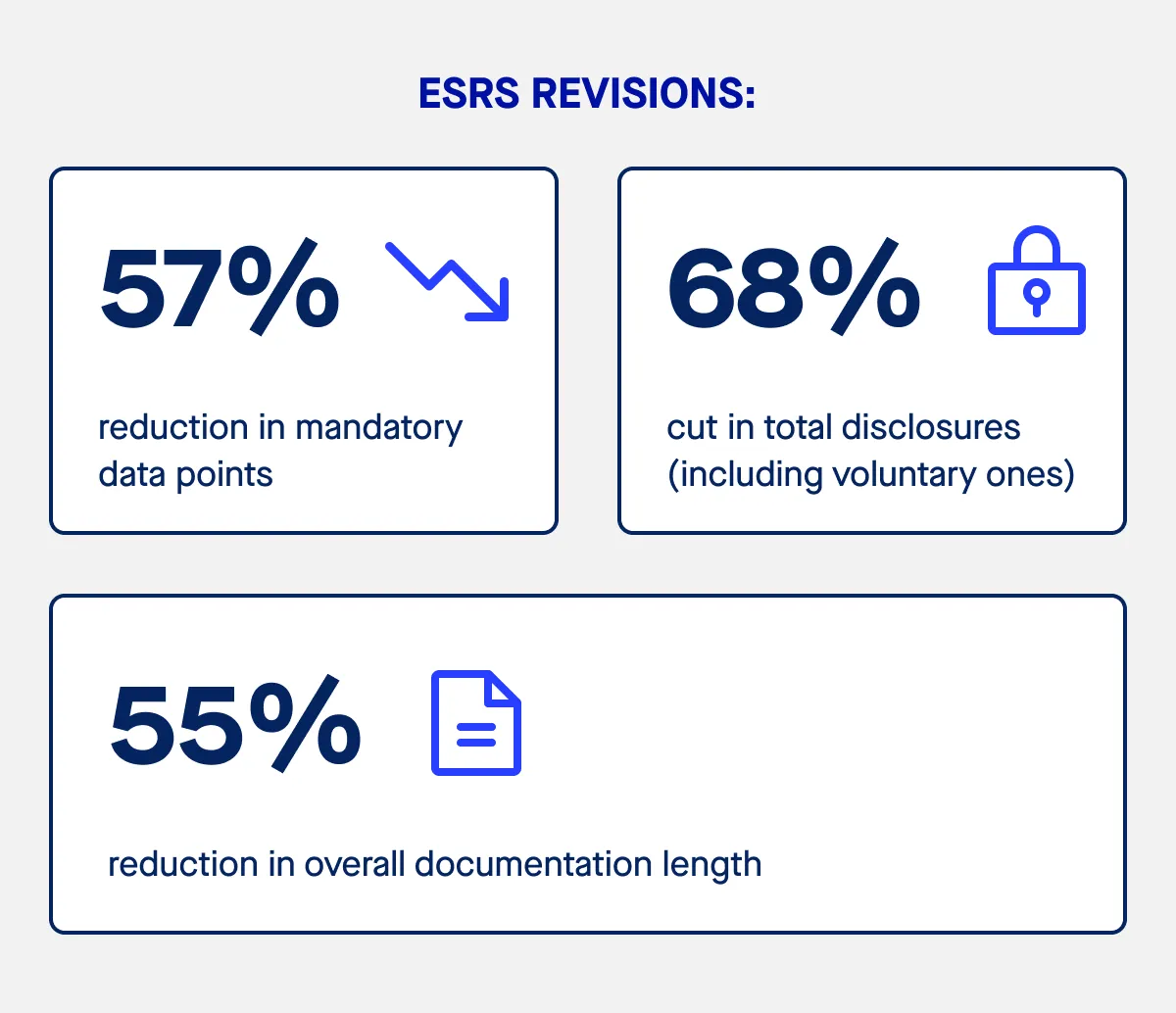

In July 2025, the European Commission adopted a set of proposed amendments under the Omnibus reforms. These changes aim to reduce the reporting burden while preserving the CSRD’s core objectives.

Key changes include:

- A 57% reduction in mandatory data points

- Removal of all voluntary (“may”) disclosures

- 68% cut in total disclosures

- Simplified narrative with option to use appendices for data

- Postponed reasonable assurance requirement (limited assurance continues)

Scope and timeline changes

- Wave 2 and 3 companies now report from 2028–2029 fiscal years

- Very small and medium enterprises (VSMEs) can use voluntary standards

- Adjusted thresholds for CSRD disclosure for some EU subsidiaries of global groups

These reforms are designed to reduce complexity, promote consistent disclosures, and encourage ongoing improvement in sustainability reporting across the EU and beyond.

What US businesses need to know

Do you fall under the scope of the CSRD?

If your US company:

- Generates over €150 million in EU revenue,

- Has an EU subsidiary or branch exceeding €40 million in turnover,

- Or is a parent of EU-listed companies

you may need to comply with the CSRD and submit accurate reporting based on the EU sustainability reporting standards.

What CSRD requirements cover US companies?

For US companies, the CSRD is more than a compliance issue. It affects:

- Investor confidence

- Access to EU-regulated markets

- Ability to secure capital from EU-based market participants

- Positioning in global value chains focused on social responsibility and the circular economy

Moreover, affected communities, customers, regulators, and other stakeholders are now demanding transparency into a company’s social and environmental issues and sustainability risks.

CSRD reporting requirements in a nutshell

Under the directive, companies must:

- Conduct a double materiality assessment

- Disclose how sustainability matters affect financial reporting

- Report on social and environmental impacts across their value chain

- Align with the EU taxonomy regulation and other reporting obligations

How can ESG software help?

Managing complexity at scale

The CSRD introduces a structured but demanding reporting process. For non-EU companies unfamiliar with EU regulations, ESG platforms can:

- Centralise sustainability data across regions and departments

- Track and benchmark sustainability performance

- Generate CSRD-ready reports using digital taxonomy alignment

- Automate and validate non-financial reporting

- Reduce risk of non-compliance and errors

- Integrate with financial reporting systems

- Align with ESRS, GRI, IFRS, and Sustainable Finance Disclosure Regulation frameworks

Final thoughts: Be prepared, Be proactive

As the first companies begin reporting under the CSRD, others—particularly US companies with EU exposure – must act quickly. The European Parliament and European Commission are pressing ahead with sustainability reporting mandates that will shape global standards for years to come.

Businesses that understand and adapt to CSRD reporting requirements today will:

- Future-proof their operations

- Build trust with stakeholders and investors

- Lead in corporate sustainability and transparency

Whether you’re a multinational with an EU subsidiary, a US-based supplier to listed companies, or an expanding brand eyeing the European market—now is the time to assess your CSRD compliance obligations and build a robust, long-term sustainability strategy.