The challenges of carbon accounting in 2026

Despite major advances in carbon accounting methodologies, businesses in 2026 still face several persistent and emerging challenges when it comes to managing and reporting greenhouse gas emissions.

Data complexity and quality

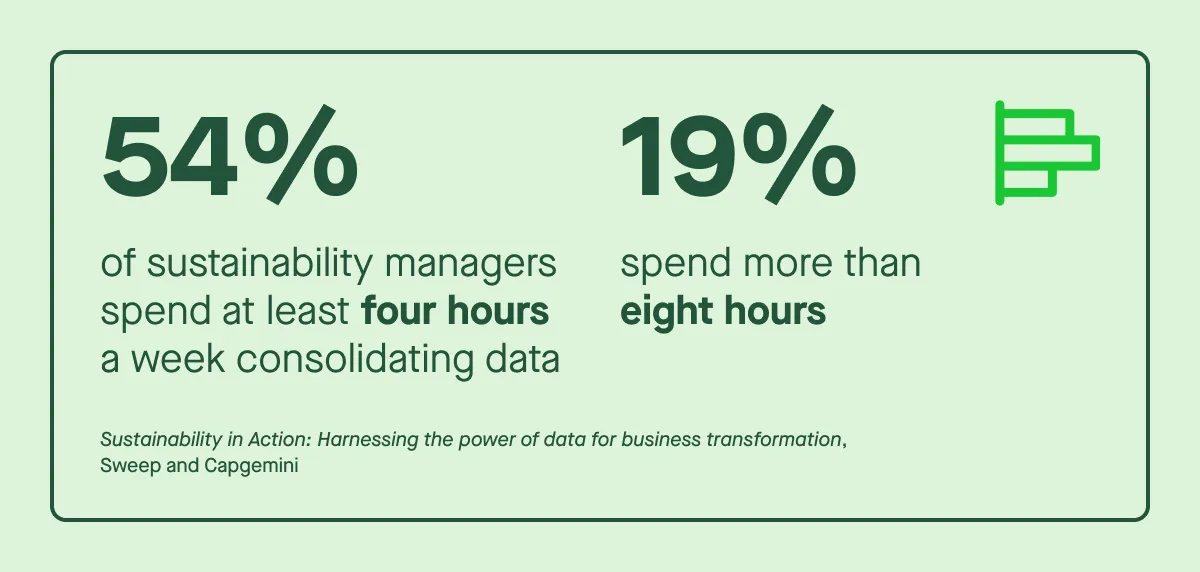

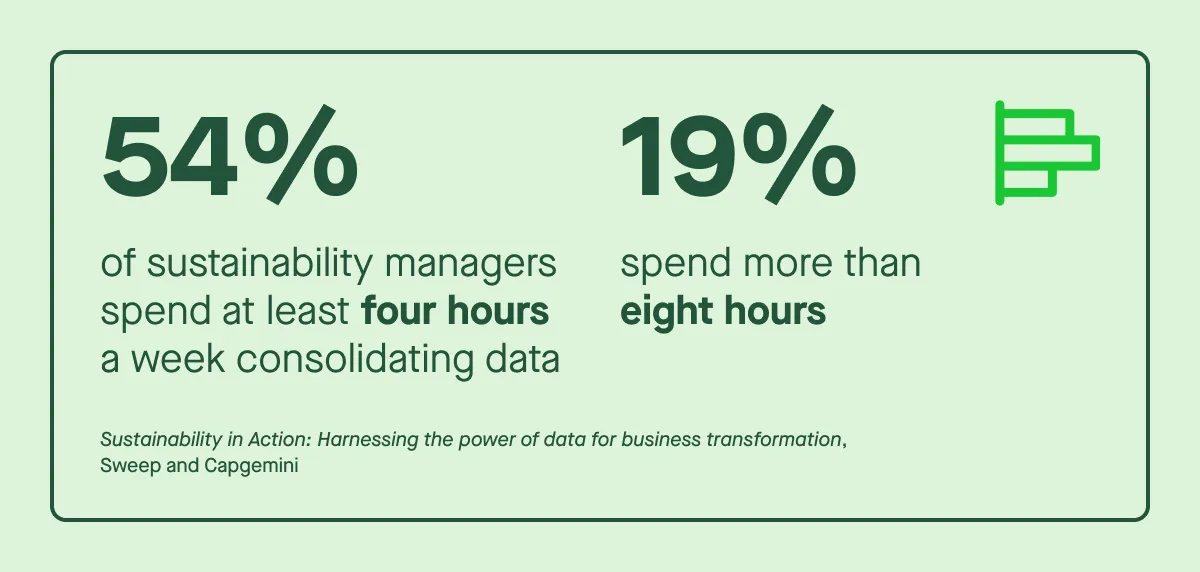

The biggest obstacle remains data quality. Many organizations still rely on manual data collection or outdated systems that fail to capture accurate, granular information on emissions produced across multiple sites, suppliers, and business units. Inconsistent emission factors, incomplete supplier data, and fragmented systems make it difficult to create a reliable annual carbon accounting baseline.

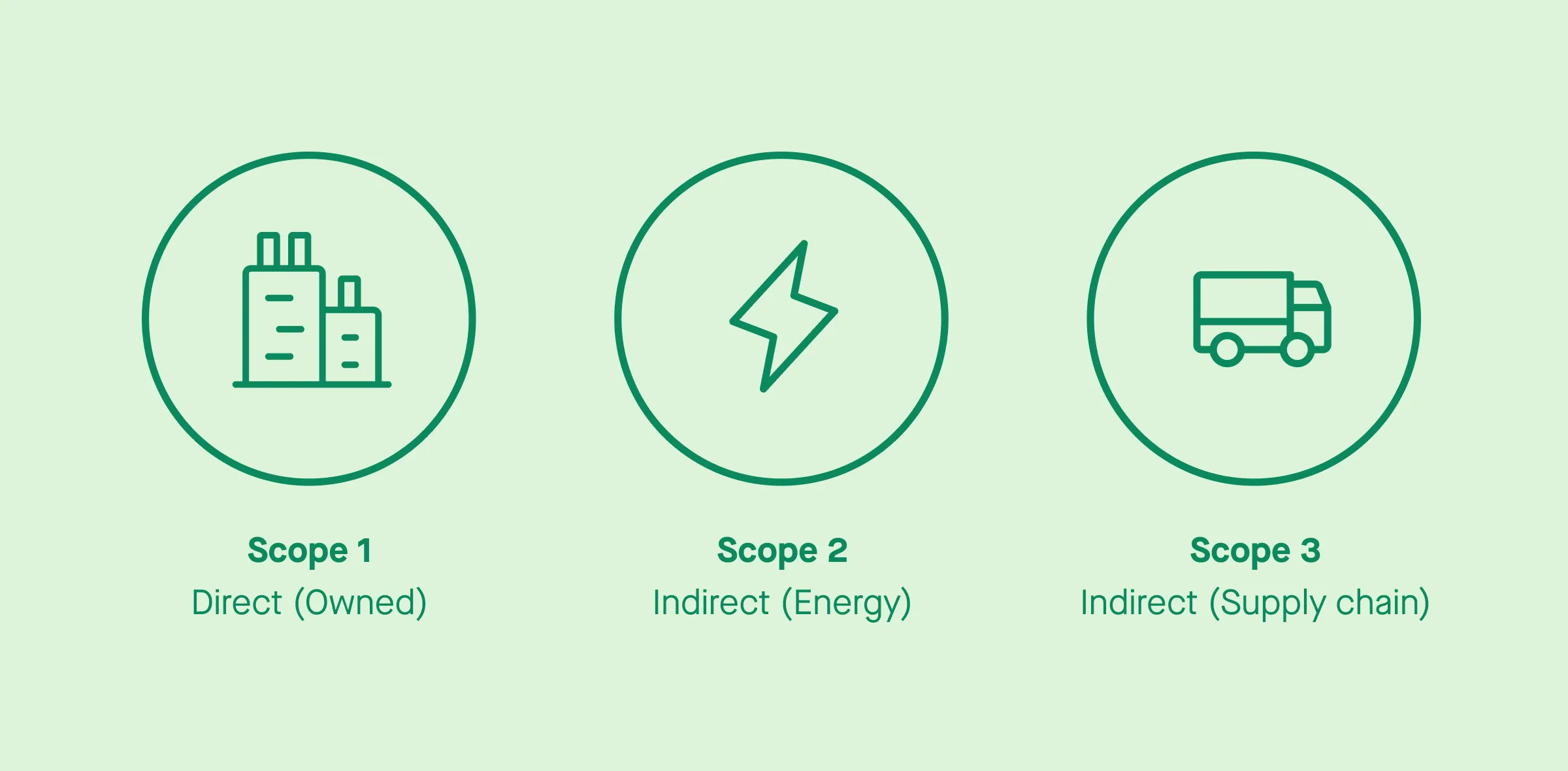

Scope 3 emissions visibility

Capturing indirect emissions across supply chains continues to be one of the hardest parts of the carbon accounting process. Suppliers may use different carbon accounting methods, provide data at irregular intervals, or lack the capacity to measure their own greenhouse gas emissions.

In 2026, many businesses are turning to carbon accounting software that automates data collection and applies standard methodologies aligned with the Greenhouse Gas Protocol to improve consistency and traceability.

Regulatory pressure and fragmentation

As climate related disclosure laws evolve, organizations are juggling multiple and often overlapping frameworks. The challenge is to ensure emissions reporting complies with all relevant standards while avoiding duplication.

From the Corporate Sustainability Reporting Directive in the European Union to California’s new climate disclosure laws in the United States, carbon accounting requires harmonizing diverse requirements into one coherent sustainability strategy.

Financial integration

In 2026, carbon accounting is increasingly intertwined with financial accounting. Investors, regulators, and boards expect emissions data to meet the same level of rigor as financial data. This integration demands new governance structures, advanced analytics, and cross departmental collaboration to ensure accurate carbon accounting and auditable records.

Residual emissions and net zero commitments

Even with strong emissions reduction initiatives, many organizations still face residual emissions that cannot be eliminated immediately. Managing these while maintaining credibility in net zero claims requires transparent carbon accounting methodologies and credible offset verification.

The business benefits of carbon accounting

While the regulatory push for greenhouse gas accounting has grown stronger, the real business case for carbon accounting goes beyond compliance. When done well, it creates measurable value across strategy, operations, and finance.

Risk management and resilience

Accurate carbon accounting enables businesses to identify their most carbon intensive operations, anticipate climate related risks, and take proactive measures. By understanding their carbon footprint, organizations can mitigate exposure to volatile energy costs, supply chain disruptions, and new carbon taxes.

Cost savings and operational efficiency

By tracking energy consumption and emissions factors, companies can pinpoint inefficiencies and reduce waste. Many find that reducing carbon emissions directly leads to lower costs, especially in fuel, electricity, and logistics.

Investor and stakeholder confidence

Transparent carbon reporting builds trust with investors, customers, and employees. Financial institutions increasingly use sustainability data and greenhouse gas emissions inventories to assess corporate performance and resilience.

Innovation and market advantage

Companies that invest in accurate carbon accounting often uncover new business opportunities, from low carbon products to sustainable finance. By managing corporate emissions strategically, businesses position themselves as leaders in the net zero transition, appealing to clients and partners seeking climate conscious suppliers.

Regulatory readiness

With global disclosure standards converging, companies that establish strong carbon accounting systems now will find it easier to comply with emerging regulations and standards in the future.

Key global sustainability disclosure frameworks

In 2026, carbon accounting lies at the heart of a growing network of global sustainability and emissions reporting frameworks. Understanding these is essential for compliance and comparability across markets.

European Union: CSRD and SFDR

The Corporate Sustainability Reporting Directive requires large and listed companies in the European Union, and some non EU companies, to disclose detailed sustainability and greenhouse gas emissions data, including Scope 3 emissions. It integrates with the European Sustainability Reporting Standards to ensure alignment with the Greenhouse Gas Protocol.

The Sustainable Finance Disclosure Regulation focuses on financial institutions and mandates disclosure of climate impact and sustainability data to promote transparency in investment decisions.

United Kingdom: SECR and SRS

The Streamlined Energy and Carbon Reporting framework obligates large UK companies to report on energy consumption, greenhouse gas emissions, and energy efficiency actions.

The Sustainability Reporting Standards, expected to replace SECR, will broaden requirements and align UK reporting with global sustainability standards and the International Sustainability Standards Board.

United States: California climate laws

California has introduced landmark climate disclosure legislation requiring large companies operating in the state to report Scope 1, Scope 2, and Scope 3 emissions. This represents a major step toward mandatory carbon reporting in the United States and aligns with the Environmental Protection Agency and the Securities and Exchange Commission’s proposed rules on climate related risks.

Australia: ASRS

The Australian Sustainability Reporting Standards, introduced in 2025, set mandatory reporting obligations for greenhouse gas emissions, energy use, and climate related financial risks. The standards align closely with guidance from the International Sustainability Standards Board.

Voluntary disclosure frameworks

Alongside mandatory laws, several voluntary frameworks continue to shape best practices for carbon accounting and sustainability disclosure.

The CDP (Carbon Disclosure Project) provides a global platform for companies to disclose carbon emissions, climate strategies, and environmental impact data.

The GRI (Global Reporting Initiative) offers a comprehensive structure for reporting on environmental, social, and governance performance, including greenhouse gas emissions.

The ISSB (International Sustainability Standards Board)’s IFRS S1 and S2 standards are rapidly emerging as the global baseline for sustainability reporting, harmonizing requirements across regions and sectors.

Together these frameworks form the foundation for transparent, comparable, and credible emissions reporting worldwide.

By 2026, carbon accounting software has become indispensable for organizations seeking to manage and report their greenhouse gas emissions efficiently. These platforms automate much of the carbon accounting process, providing real time insights and audit ready reports.

Automating data collection and emissions calculations

Modern carbon accounting platforms integrate with enterprise systems to capture emissions data automatically. They apply standard emission factors to calculate greenhouse gas emissions from fuel combustion, electricity consumption, and logistics. This automation minimizes manual errors and ensures accurate data across direct and indirect emissions.

Mapping Scope 3 emissions and supply chain impact

Because supply chain emissions account for the majority of many companies’ carbon footprints, advanced platforms now enable deep analysis of value chain activities. They help organizations collaborate with suppliers, gather accurate emissions data, and standardize calculations in line with the Greenhouse Gas Protocol.

Integrating financial and sustainability data

As carbon accounting converges with financial accounting, digital tools link sustainability data with cost centers and assets. This helps businesses evaluate the financial impact of emissions, forecast emissions reduction scenarios, and justify investments in decarbonization.

Enhancing data quality and auditability

Platforms ensure consistent carbon accounting methodologies, traceable assumptions, and verifiable datasets that are critical for accurate carbon accounting under global sustainability standards such as CSRD and ISSB.

Supporting net zero strategies

Many tools now include scenario modeling to identify emissions reduction pathways and residual emissions offsets. This allows organizations to build credible, data driven net zero roadmaps that align with regulatory expectations and stakeholder goals.

Delivering actionable insights

Beyond compliance, carbon accounting software provides actionable intelligence that helps businesses understand where to reduce emissions, improve efficiency, and turn climate impact into strategic advantage.

Conclusion: from counting carbon to creating value

In 2026, carbon accounting is no longer a niche sustainability activity, it is the backbone of business strategy in a warming world. As climate change accelerates, companies must move from measuring emissions produced to managing and reducing them systematically across their supply chains.

By adopting robust carbon accounting methodologies, aligning with the Greenhouse Gas Protocol, and leveraging digital tools for emissions tracking, organizations can turn compliance into opportunity.

Done well, carbon accounting enables businesses not only to reduce emissions and costs but to strengthen resilience, attract investment, and contribute meaningfully to sustainable development and the global goal of net zero emissions.

The businesses that embrace accurate carbon accounting today will be the ones defining the low carbon economy of tomorrow.