The defining feature of Scope 3 is that it covers emissions a business influences but does not directly control. This makes measurement complex, but also crucial: ignoring Scope 3 gives a distorted picture of a company’s climate impact and exposes it to regulatory and reputational risk.

What are the different categories of Scope 3 emissions?

The GHG Protocol sets out 15 categories of Scope 3 emissions. Not all categories apply to every organisation, but companies should assess each one to determine relevance.

Upstream activities (before a product/service reaches you):

- Purchased goods and services – emissions from the production of goods and services bought by the company.

- Capital goods – emissions from the production of long-term assets such as buildings, machinery, or vehicles.

- Fuel- and energy-related activities (not included in Scope 1 or 2) – e.g., extraction and transport of fuels purchased by the company.

- Upstream transportation and distribution – emissions from transporting purchased products.

- Waste generated in operations – emissions from third-party disposal and treatment of waste.

- Business travel – emissions from employee travel for work purposes (e.g., flights, trains, taxis).

- Employee commuting – daily travel between employees’ homes and their workplaces.

- Upstream leased assets – emissions from assets leased by the company (but not owned).

Downstream activities (after a product/service leaves you):

- Downstream transportation and distribution – emissions from delivering products to customers.

- Processing of sold products – emissions from processing intermediate goods sold by the reporting company.

- Use of sold products – emissions generated when a customer uses a product (particularly important in sectors like automotive or energy).

- End-of-life treatment of sold products – emissions from waste disposal and recycling of products once customers are finished with them.

- Downstream leased assets – emissions from assets a company owns and leases to others.

- Franchises – emissions from franchise operations.

- Investments – emissions associated with investments (especially relevant for financial institutions).

For many businesses, purchased goods and services and use of sold products are the largest categories, but each industry will have a unique profile. For example, a consultancy may see employee commuting and business travel dominate, while a manufacturer will focus on purchased goods, logistics, and product lifecycle.

Which UK legislation requires Scope 3 emissions measurement?

While voluntary disclosure frameworks (such as CDP or the Science Based Targets initiative) encourage Scope 3 reporting, in the UK there are now regulatory requirements that make it mandatory for many businesses.

1. Streamlined Energy and Carbon Reporting (SECR)

Introduced in 2019, SECR requires large UK companies (those meeting at least two of: 250+ employees, £36m turnover, £18m balance sheet) to report annual energy use and carbon emissions. While SECR focuses on Scope 1 and 2, businesses are encouraged to include Scope 3 emissions “where material and practical to report.” For many companies, this has been the first step toward fuller Scope 3 disclosure.

Since April 2022, TCFD-aligned reporting has been mandatory for over 1,300 of the largest UK-registered companies and financial institutions. This includes:

- UK companies with >500 employees and £500m turnover.

- LLPs and traded companies meeting similar thresholds.

TCFD requires firms to disclose material climate-related risks and opportunities. While it doesn’t explicitly mandate Scope 3 measurement, understanding full value chain emissions is often necessary to assess climate risks, especially in sectors reliant on supply chains or downstream product use.

3. UK Sustainability Disclosure Requirements (SDR)

The UK is in the process of developing Sustainability Disclosure Requirements, building on TCFD and aligning with the International Sustainability Standards Board (ISSB). These will standardise how companies report environmental impacts, including greenhouse gas emissions. Draft guidance suggests Scope 3 disclosure will become more formalised under SDR, especially for listed and large companies.

4. EU Corporate Sustainability Reporting Directive (CSRD)

Although not UK law, the CSRD will apply to many UK businesses with significant operations in the EU. The CSRD explicitly requires reporting of Scope 1, 2, and 3 emissions in line with the GHG Protocol. UK companies with EU subsidiaries or large EU sales will need to prepare accordingly.

5. Public procurement requirements

Since 2021, the UK government requires suppliers bidding for contracts over £5m per year to commit to achieving Net Zero by 2050 and to publish a Carbon Reduction Plan. This plan must include Scope 3 emissions from five key categories: business travel, employee commuting, waste, upstream transportation and distribution, and downstream transportation and distribution.

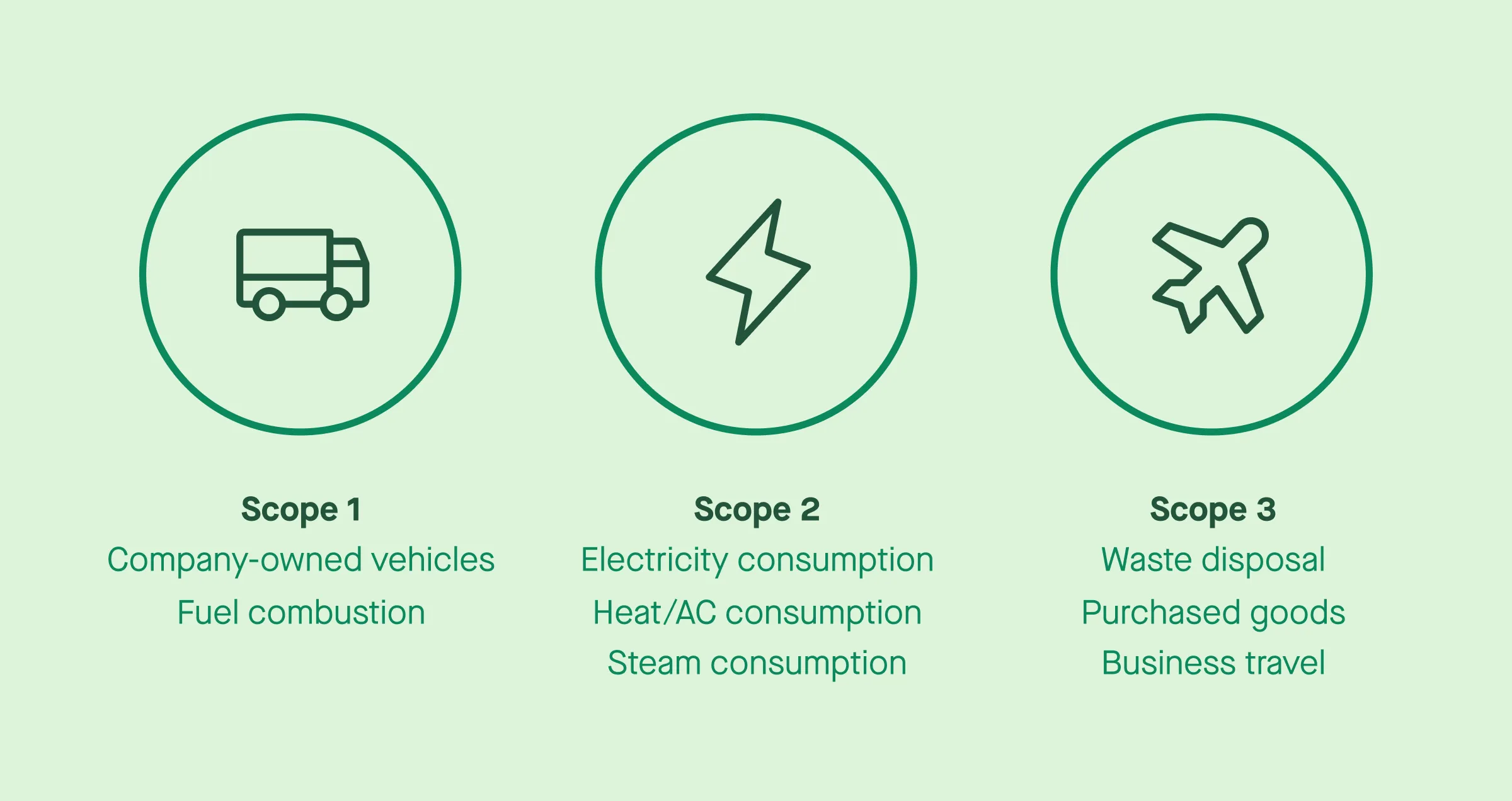

Measuring Scope 3 emissions is complex. Unlike Scope 1 (direct emissions from owned or controlled sources) and Scope 2 (purchased electricity and energy-related activities), Scope 3 covers a reporting company’s entire value chain—indirect emissions from upstream suppliers to downstream customers. ESG data management tools make this challenge more manageable in four key ways:

1. Organising complex data

Tools gather and structure data across suppliers, customers, and other value chain partners, aligning it with the GHG Protocol’s three scopes. This creates a single source of truth for both upstream and downstream activities.

2. Identifying hotspots and savings

By mapping supply chain emissions, companies can spot emission hotspots – such as carbon-intensive purchased goods, business travel, or waste generated. This also highlights cost reduction opportunities linked to energy and resource efficiency.

3. Increasing transparency and engagement

Platforms enable greater transparency and more reliable reporting. They allow businesses to positively engage suppliers and other chain partners, gather primary data, and improve the accuracy of reported greenhouse gas emissions.

4. Turning data into action

Beyond measurement, ESG tools track progress and model reduction activities. This helps companies design evidence-based roadmaps, assess sustainability performance, and demonstrate value to stakeholders.

In summary

Scope 3 emissions are the largest part of most UK businesses’ carbon footprint – and the hardest to measure. With rising disclosure requirements, ESG data tools help companies organise value chain data, engage suppliers, and identify hotspots. The result: more accurate reporting, clearer reduction opportunities, and stronger progress toward net zero.