California’s climate disclosure landscape shifted again this month as a federal appeals court paused SB 261 while SB 253 continues to move forward. For companies preparing to report climate related financial risks or greenhouse gas emissions, this split decision adds complexity but does not reduce the urgency to act.

Here is what businesses need to know about why SB 261 was paused, what that means in practice, and how SB 253 is progressing toward its first reporting deadlines.

Why SB 261 has been paused

On November 19 2025, the Ninth Circuit Court of Appeals issued a temporary injunction blocking California from enforcing SB 261. The decision came after an emergency request from the United States Chamber of Commerce and several business groups, who argued that the law forces companies to make subjective climate-related financial disclosures, violating the First Amendment.

SB 261 would require companies with more than 500 million United States dollars in revenue and doing business in California, including corporations, partnerships, limited liability companies, and other business entities, to publish a climate risk disclosure and related financial risk report.

These reports must align with a recognized framework such as the Task Force on Climate related Financial Disclosures or the International Sustainability Standards Board, or an equivalent reporting requirement. The disclosures would cover physical and transition risks, supply chain exposure, and financial risks resulting from climate change.

Note that the court has not overturned the law; it has only paused enforcement while the full case is reviewed in early 2026.

What the injunction does and does not mean

The pause delays, but does not cancel, climate related financial disclosure requirements. SB 261 could be reinstated in early 2026 depending on the appeal outcome.

What the pause means for companies preparing to report

Although the injunction relieves immediate pressure, it does not change the strategic need to address climate risk. Companies should expect that climate related financial risk disclosure will remain a long term requirement, whether under state climate investment frameworks, federal rules, or international standards.

Continue climate risk assessments

Physical and transition threats are growing regardless of regulation. Companies should continue evaluating:

- physical risks, such as heat, wildfire, water stress, storms, and flooding

- transition risks, such as new policies, shifting consumer demand, carbon pricing, or technological change

- supply chain exposure and operational resilience

- financial impacts on assets and investments

Climate related risks increasingly affect credit ratings, insurance availability, audited financial statements, and financial institutions’ lending decisions.

What’s happening with SB 253

Unlike SB 261, SB 253 is not paused. It remains in force and continues to move toward its first reporting deadline.

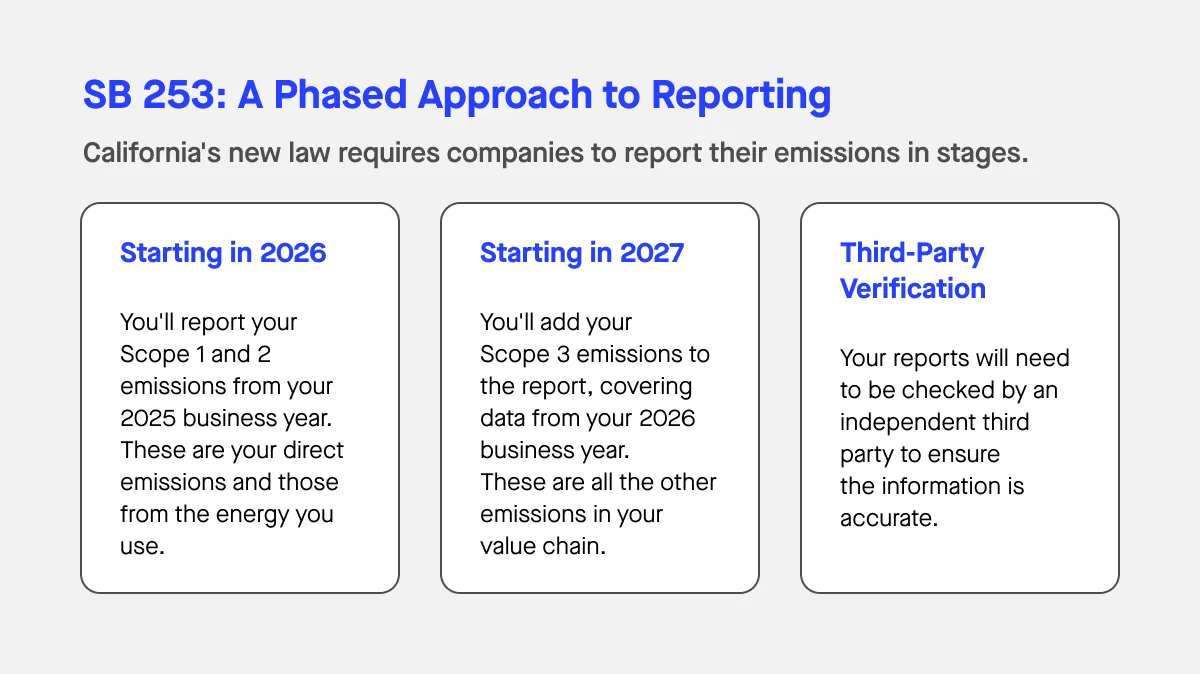

SB 253 requires companies with more than one billion United States dollars in annual revenue doing business in California to report Scope 1 and Scope 2 emissions by June 30, 2026, with Scope 3 value chain emissions following in 2027.

Fees and thresholds under SB 253 may be adjusted periodically based on the California Consumer Price Index.

What the California Air Resources Board is working on

The California Air Resources Board is actively preparing implementation guidance, including methodologies, verification expectations, and administrative penalties imposed for noncompliance. Businesses must prepare for reporting entity obligations even if they were not included on CARB’s preliminary list of more than three thousand covered entities.

SB 253 covers any business entity formed in any jurisdiction, including limited liability companies, foreign corporations, and other business entities, such as partnerships, trusts, or associations, organized under U.S. or foreign law, so long as they exceed the revenue threshold and have business in California. Covered emissions include a covered entity’s greenhouse gases from operations, travel, procurement, waste, supply chains, and more.

Administrative hearings conducted pursuant to the Health and Safety Code will address inadequate submissions and can result in penalties for missing or insufficient reports. CARB will consider the business entity’s revenue, severity of noncompliance, and impact on economically vulnerable communities.

Why SB 253 matters even without SB 261

SB 253 shifts companies from estimated emissions to verifiable, decision grade greenhouse gas reporting. This requires higher quality data, systems that reduce errors, and the assurance needed for emissions to appear alongside audited financial statements.

It also aligns with global regulatory momentum including CSRD, ISSB, and other leading voluntary initiatives. For many companies, SB 253 will require building data systems that can serve multiple frameworks at once.