What is California SB 253?

California SB 253 mandates that organizations must report their full carbon inventories, including scope 3 emissions, which often account for a significant portion of an organization’s climate impact. The law requires large businesses to disclose their greenhouse gas emissions annually, following the Greenhouse Gas Protocol standards. It applies to any partnership, corporation, limited liability company, or other business entity with total annual revenues exceeding $1 billion that does business in California, regardless of where the business entity is formed or headquartered.

On or before January 1, 2025, the California Air Resources Board (CARB) shall develop and adopt regulations requiring reporting entities to disclose their greenhouse gas emissions annually. However, CARB has been given a six-month extension to publish the official disclosure requirements for SB 253, moving the deadline to July 1, 2025.

CARB is responsible for implementing and enforcing both SB 253 and SB 261, including developing implementation rules, assurance standards, and enforcement mechanisms. CARB will also designate an emissions reporting organization responsible for receiving and making publicly available disclosures required by SB 253.

California’s SB 253 aligns with global sustainability reporting frameworks and aims to increase corporate transparency and accountability, moving toward net-zero carbon goals.

Who must comply? Understanding covered entities

SB 253 defines reporting entities as any partnership, corporation, limited liability company, or other business entity with total annual revenue greater than $1 billion that does business in California. This includes:

- Public and private companies with significant California revenue

- Limited liability companies (LLCs) and partnerships

- Entities formed outside California but conducting business operations within the state

Notably, local government entities are exempt from SB 253 requirements. The definition of “doing business in California” is broad and includes selling products or services, maintaining offices, or having employees in the state.

The law is expected to impact approximately 5,400 organizations that do business in California, including both domestic and international entities. If your organization meets the revenue threshold and has any nexus to California, you are likely a covered entity under SB 253. The law does not provide exemptions based on industry sector or headquarters location.

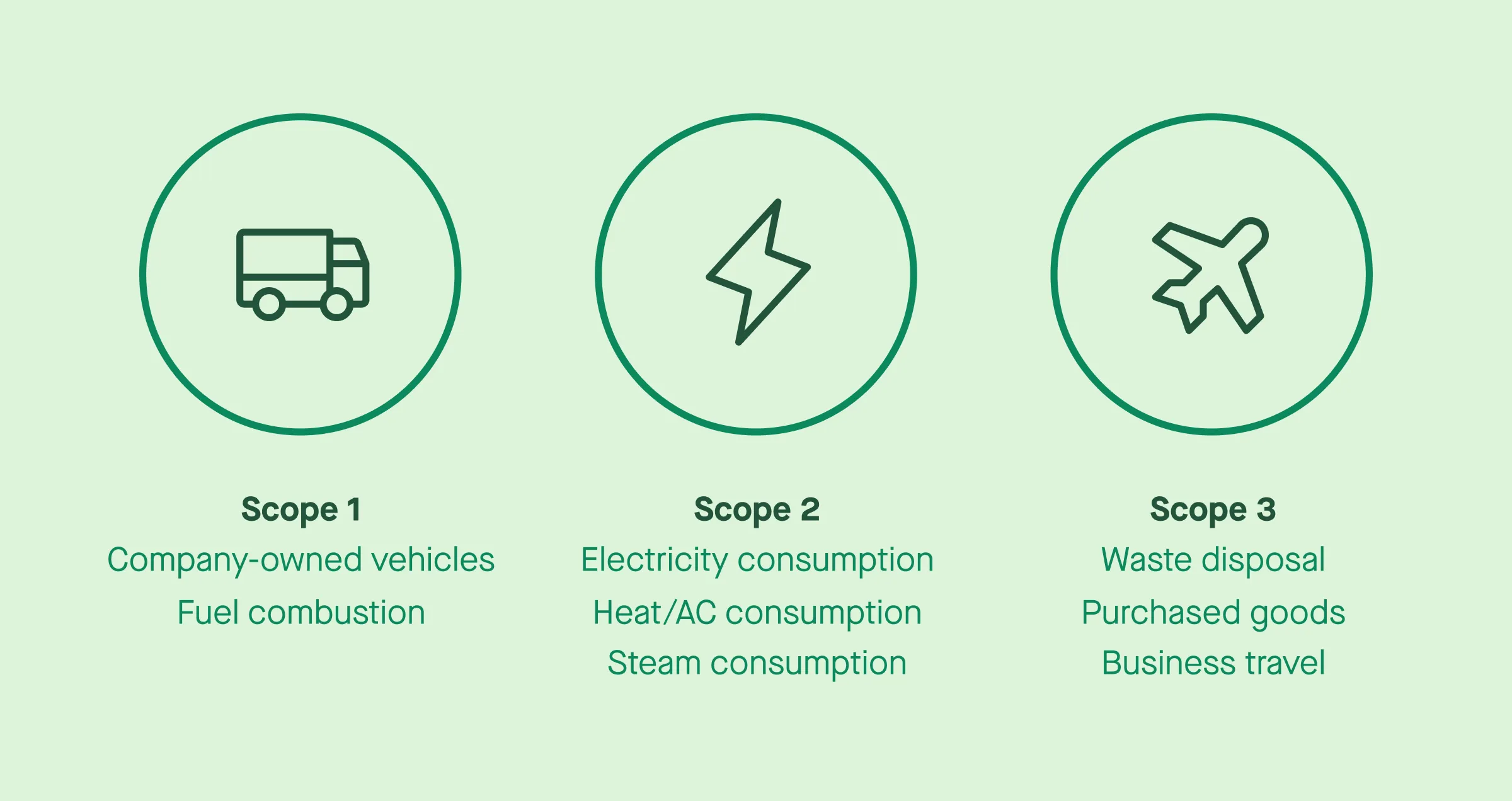

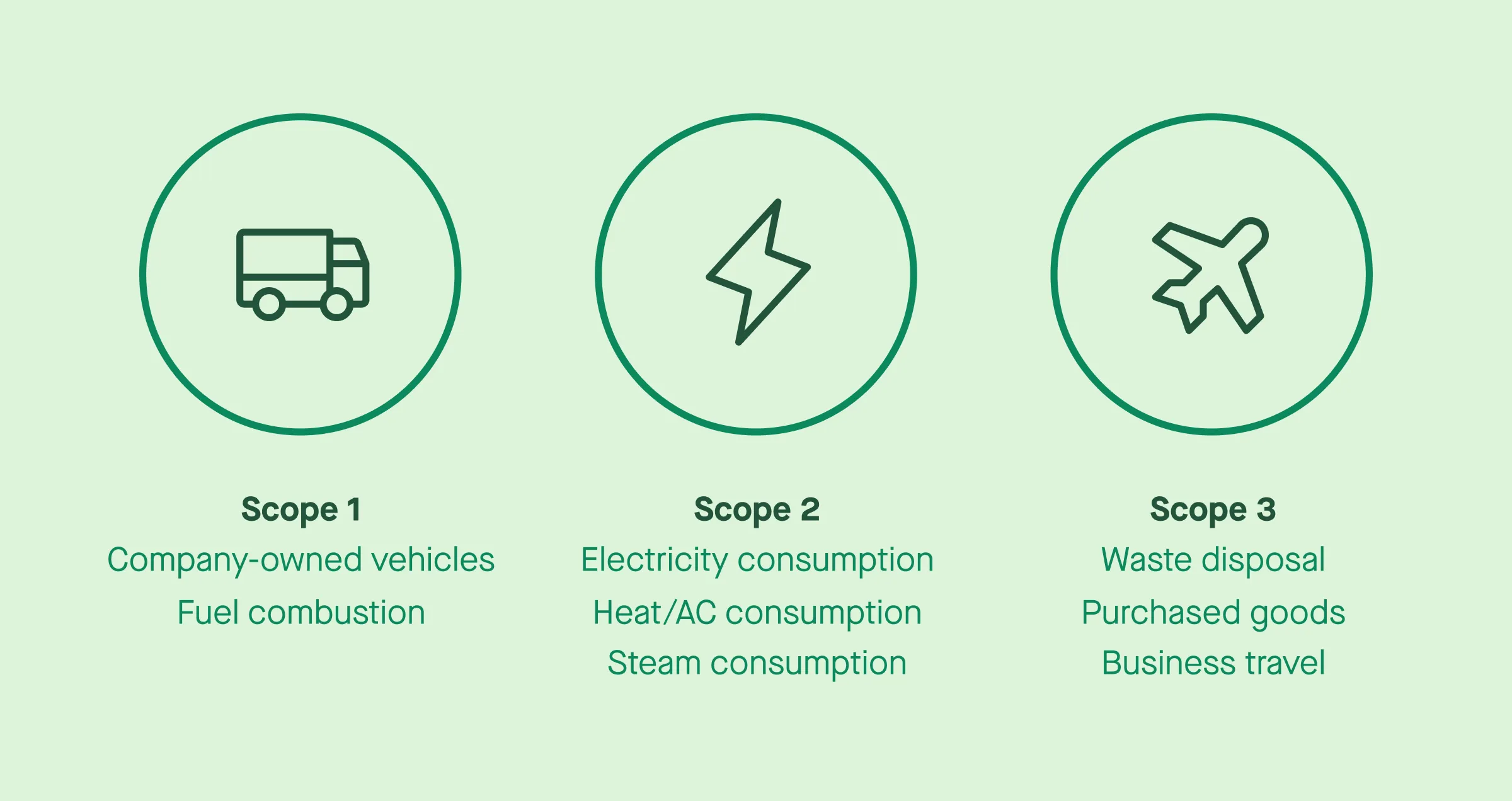

What must be reported? Understanding scope 1, 2, and 3 emissions

SB 253 mandates reporting of three categories of greenhouse gas emissions as defined by the Greenhouse Gas Protocol:

Scope 1: Direct emissions

Scope 1 emissions are all direct greenhouse gas emissions that stem from sources that a reporting entity owns or directly controls. This includes emissions from company vehicles, on-site fuel combustion, industrial processes, or refrigerant leaks.

Scope 2: Indirect emissions from energy

Scope 2 emissions are indirect greenhouse gas emissions from consumed electricity, steam, heating, or cooling purchased or acquired by a reporting entity. These are the emissions created when generating the energy your company purchases.

Scope 3: Value chain emissions

Scope 3 emissions are indirect upstream and downstream greenhouse gas emissions from sources that the reporting entity does not own or directly control. This includes emissions from suppliers, product transportation, employee commuting, business travel, waste disposal, and the use and end-of-life treatment of sold products.

Scope 3 emissions often account for more than 90% of an organization’s climate impact and are notoriously difficult to measure. They require collecting data from suppliers, partners, and customers across complex value chains. The Greenhouse Gas Protocol standards provide detailed guidance on calculating these emissions, but many organizations will need to invest in new data infrastructure and stakeholder engagement processes.

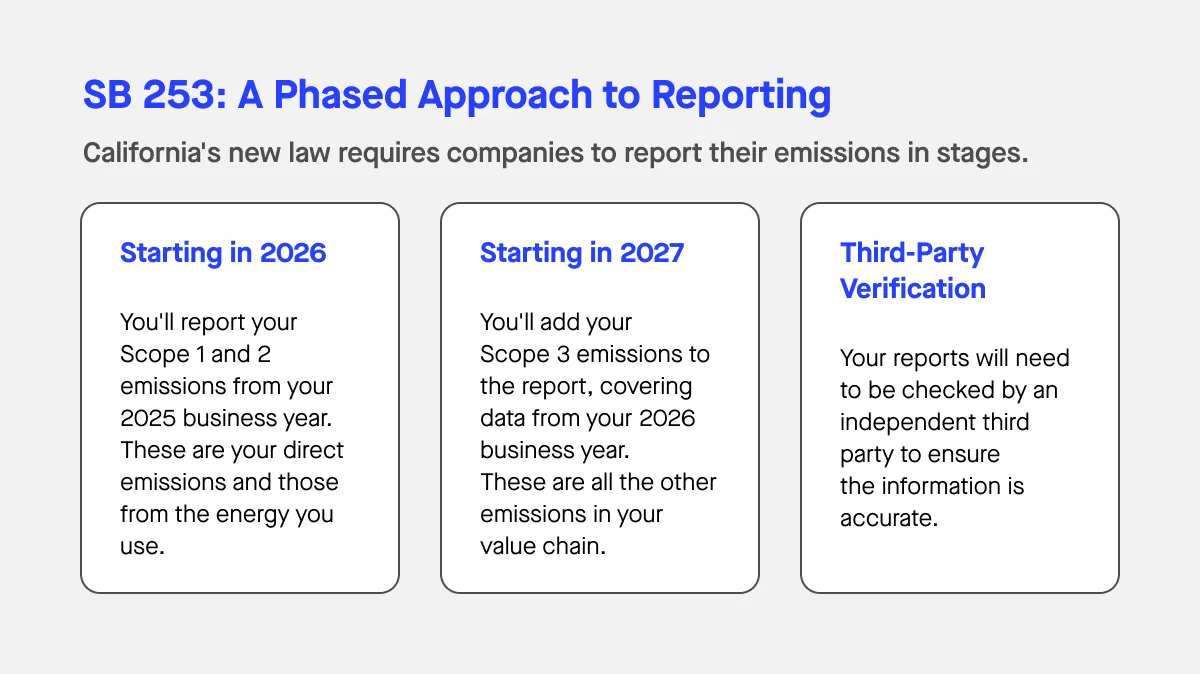

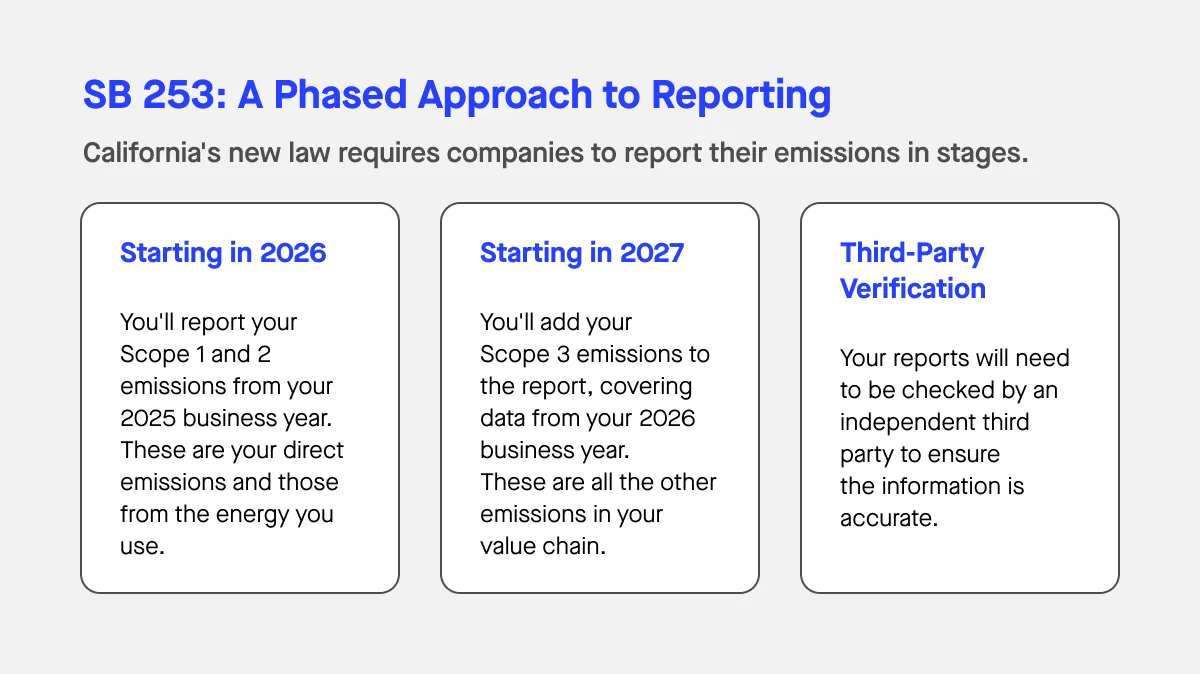

Reporting timelines: When are reports due?

SB 253 follows a phased approach, giving reporting entities time to build capacity for comprehensive emissions reporting.

2026: Initial reports for scope 1 and 2

Organizations must begin reporting Scope 1 and Scope 2 emissions for fiscal year 2025 data in 2026. This is the first reporting cycle and the first year reporting deadline under SB 253. Initial reports covering Scope 1 and Scope 2 emissions for the prior fiscal year must be submitted within 180 days after the end of the fiscal year (or by an alternate reporting date approved by CARB).

CARB will exercise enforcement discretion for the first report due in 2026, allowing reporting entities to submit Scope 1 and Scope 2 emissions based on existing data. Companies are given leniency for good faith efforts during the first reporting cycle, with no penalties planned for 2026 for those demonstrating good faith compliance.

2027: Scope 3 emissions begin

Scope 3 emissions reporting starting in 2027 for fiscal year 2026 data. Organizations must report Scope 3 emissions by 180 days after the end of their fiscal year. Given that Scope 3 emissions often account for more than 90% of an organization’s climate impact, this phase represents the most significant compliance challenge.

The law includes a safe harbor provision for Scope 3 emissions disclosures made with a reasonable basis and disclosed in good faith until 2030. This means companies will not be penalized for unintentional misstatements of Scope 3 data during this period. Penalties assessed on Scope 3 reporting between 2027 and 2030 shall only occur for non-filing.

Future reporting years and evolving requirements

CARB is expected to issue a second rulemaking addressing details about reporting in 2027 and beyond in 2026. This will provide additional clarity on reporting timelines, assurance requirements, and data quality expectations for future reporting years.

Starting in 2030, third party assurance requirements escalate. The assurance engagement for Scope 1 and 2 emissions will move from limited assurance to reasonable assurance, while Scope 3 emissions will require limited assurance from that year forward.

Third party assurance: Verification requirements

One of the defining features of SB 253 is its requirement for independent third-party assurance to verify the accuracy and completeness of emissions disclosures. SB 253 requires third-party assurance for the reported greenhouse gas emissions, while SB 261 (the companion Climate-Related Financial Risk Act) does not require third-party verification.

What is third party assurance?

Third-party assurance means that an independent auditor reviews your reported data and provides an opinion on whether your emissions inventory has been prepared in accordance with the Greenhouse Gas Protocol standards and is free from material misstatement.

Assurance levels

Limited assurance (2026 onwards for Scope 1 and 2; 2030 onwards for Scope 3): The auditor performs limited procedures and provides a conclusion that nothing has come to their attention indicating the data is materially misstated.

Reasonable assurance (2030 onwards for Scope 1 and 2): The auditor performs more extensive procedures and provides a positive opinion that the data is free from material misstatement.

Tracking emissions across operations and securing third-party assurance are significant challenges for organizations under SB 253. Organizations must build robust internal data infrastructure to ensure compliance and transparency with an emissions reporting organization.

Penalties, enforcement, and minimizing compliance burden

California SB 253 includes significant penalties for non-compliance. The enforcement of SB 253 allows CARB to seek monetary penalties for noncompliance, which may include impacts related to debt covenants and contractual obligations. CARB is authorized to adopt regulations that impose administrative penalties for non-filing, late filing, or other compliance failures up to $500,000 per entity per year.

Organizations that fail to submit their required emissions reports may face financial penalties of up to $500,000 per year under SB 253. In contrast, penalties for SB 261 (which addresses climate related financial risk) are capped at $50,000 per year.

However, the law also recognizes the challenges of greenhouse gas emissions reporting, particularly for Scope 3 data. The safe harbor provision until 2030 protects companies making good-faith efforts to report Scope 3 emissions, even if the data contains unintentional errors.

Streamlining reporting efforts

The law requires that emissions reporting is structured to minimize duplication of effort and allows submission of reports prepared to meet other national and international reporting requirements. This means if your organization already reports under frameworks like CDP, TCFD, or the Greenhouse Gas Protocol, you can leverage existing work to streamline reporting under SB 253.

Organizations should align their reporting framework with the Greenhouse Gas Protocol standards while mapping to other disclosure requirements to reduce duplication. This approach helps collect data efficiently across multiple compliance obligations.

How SB 253 compares to SB 261 and other climate disclosure laws

California is not alone in mandating climate disclosure. Understanding how SB 253 fits within the broader reporting framework is essential for multinational organizations.

SB 253 vs SB 261

Both laws were enacted simultaneously but serve different purposes:

SB 253 focuses on the reporting of Scope 1, Scope 2, and Scope 3 greenhouse gas emissions. It requires third-party assurance and applies to entities with annual revenue over $1 billion.

SB 261, the Climate-Related Financial Risk Act, applies to any US corporation or business entity with annual revenue over $500 million that does business in California. SB 261 requires large businesses to prepare and submit a biannual climate-related financial risk report detailing the physical and transition threats they face as a result of climate change.

SB 261 aims to protect consumers and investors from losses due to climate-related disruptions to supply chains, workforces, and infrastructure. It is modeled after existing climate disclosure rules used by the state’s teachers’ retirement fund (CALSTRS) and hundreds of major financial institutions.

The initial round of climate risk disclosure reports under SB 261 was due by January 1, 2026, but the California Air Resources Board (CARB) will not enforce the January 1, 2026 deadline for SB 261 while a Ninth Circuit injunction is pending due to ongoing litigation.

SB 253 and global sustainability frameworks

California’s climate disclosure laws, including SB 261, reflect a global push for increased transparency in carbon accounting and climate-related financial risks. California’s SB 253 is one of the strictest climate disclosure laws in the US and aligns with global sustainability reporting frameworks.

The law aligns with international frameworks including:

The Greenhouse Gas Protocol, which provides the methodological foundation for calculating GHG emissions across all three scopes

TCFD (Task Force on Climate-related Financial Disclosures), which focuses on climate related financial disclosures and risk management

CSRD (Corporate Sustainability Reporting Directive) in Europe, which mandates double materiality assessments

ISSB Standards (International Sustainability Standards Board), which focus on climate related financial disclosures for investors

By aligning with these global frameworks, SB 253 positions California as a leader in corporate climate accountability while making it easier for multinational organizations to leverage existing reporting infrastructure.

Preparing for compliance: Practical steps for 2026

Compliance with SB 253 requires a multi-phase strategy and deep integration of climate-related tracking systems into daily operations. Here’s how to prepare:

Determine if you are a covered entity

Calculate your total annual revenue and assess whether you meet the $1 billion threshold. Review your business activities in California to confirm you are subject to the law. If you operate through multiple legal entities, determine which entities are reporting entities and whether consolidation is required based on financial control or operational control boundaries.

Build robust internal data infrastructure

Organizations must build robust internal data infrastructure to ensure compliance and transparency. This includes establishing systems for collecting data across Scope 1, 2, and 3 categories, identifying control boundaries for reporting, and engaging suppliers and partners to collect Scope 3 emissions data.

Given that Scope 3 emissions often account for more than 90% of an organization’s climate impact and are notoriously difficult to measure, invest early in supplier engagement platforms and value chain mapping tools.

Align with Greenhouse Gas Protocol standards

Reports must follow the Greenhouse Gas Protocol standards. Familiarize yourself with the Corporate Accounting and Reporting Standard and the Corporate Value Chain (Scope 3) Accounting and Reporting Standard. These provide the methodological foundation for calculating and reporting GHG emissions.

Remember that the law requires that emissions reporting is structured to minimize duplication of effort and allows submission of reports prepared to meet other national and international reporting requirements.

Engage third party assurance providers early

Start discussions with independent auditors who specialize in emissions reporting. Independent assurance is required to verify the accuracy and completeness of emissions disclosures. Early engagement will help you understand data quality requirements and identify gaps in your current emissions data collection processes.

Monitor the regulatory process

CARB has been given a six-month extension to publish the official disclosure requirements for SB 253, moving the deadline to July 1, 2025. CARB is expected to issue a second rulemaking addressing details about reporting in 2027 and beyond in 2026.

Stay informed about updates to reporting timelines, assurance standards, and enforcement mechanisms through business groups and industry associations actively engaged in the regulatory process.

Leverage existing reporting to streamline compliance

If you already prepare climate disclosure reports for investors, CDP, or other frameworks, map these to SB 253 requirements. The law explicitly allows submission of reports prepared to meet other national and international reporting requirements, helping you streamline reporting and reduce duplication.

Final thoughts: SB 253 as a strategic opportunity

California SB 253 represents more than a compliance obligation. It’s an opportunity to build transparency, engage your value chains, and demonstrate leadership in corporate climate change accountability.

Yes, the requirements are rigorous. SB 253 mandates that organizations must report their full carbon inventories, including scope 3 emissions, which often account for a significant portion of an organization’s climate impact. Tracking greenhouse gases across complex operations, engaging suppliers for Scope 3 data, and securing third-party assurance all require significant investment.

But organizations that get ahead of these requirements will be better positioned to manage climate risks, identify emission reductions opportunities, and build trust with investors, customers, and regulators. The enforcement of SB 253 allows CARB to seek monetary penalties for noncompliance, which may include impacts related to debt covenants and contractual obligations, so early preparation protects your business from financial and reputational risk.

California’s SB 253 is one of the strictest climate disclosure laws in the US and aligns with global sustainability reporting frameworks. By preparing now, you position your organization for success not just in California, but across the evolving global landscape of sustainability reporting requirements.